In today’s competitive Software as a Service (SaaS) landscape, businesses face the constant challenge of retaining customers and minimizing churn. Churn analytics has emerged as a powerful tool that enables agile finance, providing valuable insights that can help businesses increase their SaaS revenue. In this article, we will explore three key insights offered by churn analytics and how they can be leveraged effectively.

Insight 1: Identifying Churn Patterns and Early Warning Signs

Churn analytics allows businesses to analyze customer data to identify patterns and early warning signs of churn. By examining factors such as usage patterns, customer behavior, and engagement metrics, businesses gain a deeper understanding of the factors that contribute to customer attrition. These insights empower businesses to take proactive measures to prevent churn by addressing customer pain points, improving product features, or providing targeted customer support.

Insight 2: Segmentation and Personalization for Retention

Churn analytics enables businesses to segment their customer base based on various criteria such as demographics, usage patterns, or customer lifetime value. By creating targeted segments, businesses can personalize their offerings and tailor their communication to address the specific needs and preferences of different customer groups. This personalized approach enhances customer satisfaction, increases engagement, and ultimately reduces churn.

Insight 3: Predictive Analytics for Proactive Retention Strategies

One of the most valuable aspects of churn analytics is its ability to provide predictive insights. By leveraging machine learning algorithms and advanced data analysis techniques, businesses can forecast which customers are at a higher risk of churn in the future. Armed with this information, CFOs and finance teams can devise proactive retention strategies, such as personalized offers, upselling, or targeted promotions, to mitigate the risk and increase customer retention rates.

Conclusion

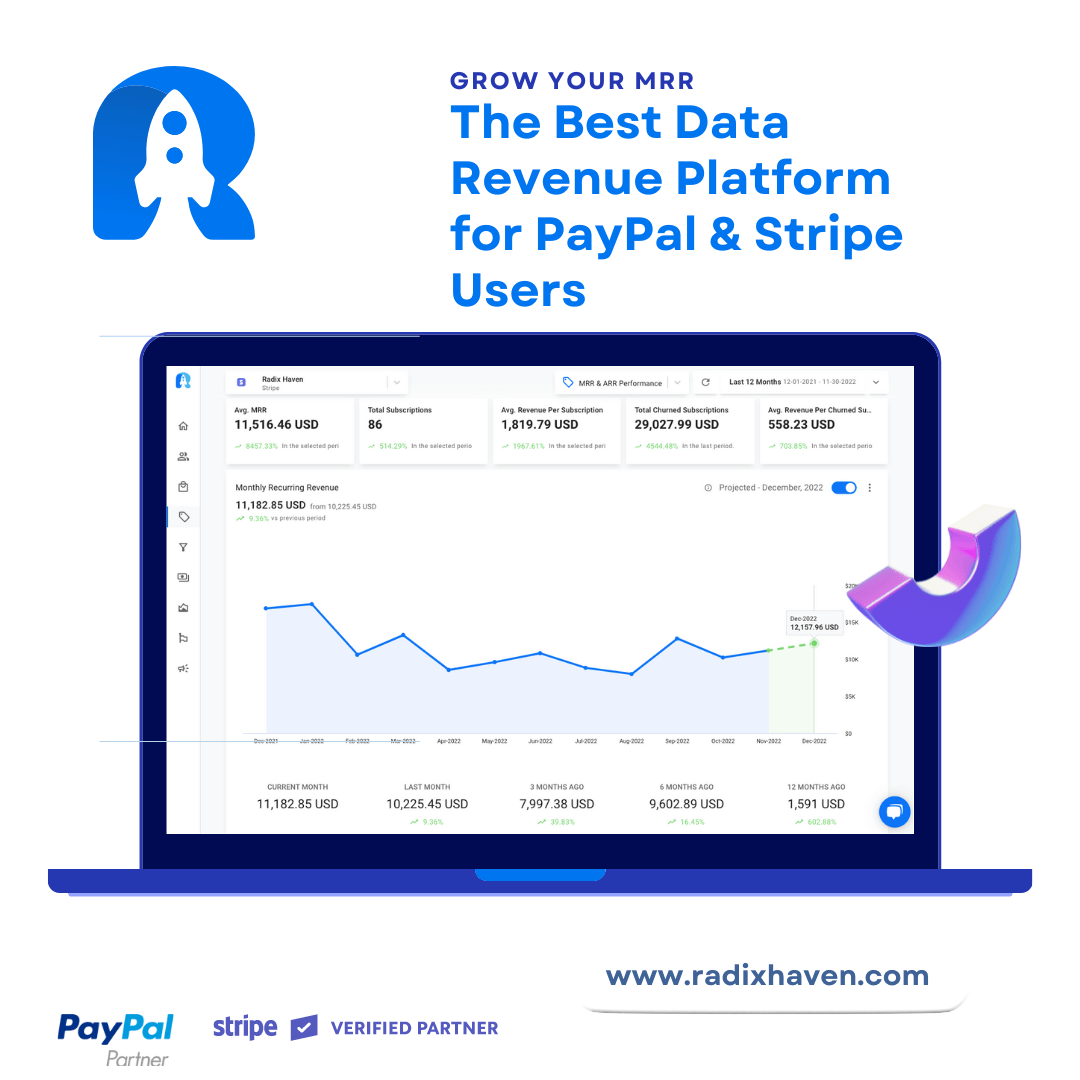

Churn analytics is a game-changer for businesses aiming to increase SaaS revenue and ensure long-term success. By leveraging churn analytics insights, CFOs and finance teams can make data-driven decisions that enable agile finance and boost customer retention. To make the most of churn analytics, it is essential for CFOs to utilize robust tools like Radix, which enables them to track key metrics, monitor customer behavior, and identify churn patterns effectively.

In today’s highly competitive SaaS landscape, reducing churn is paramount. With Radix, CFOs can gain a holistic view of their SaaS business, allowing them to identify trends, make informed decisions, and optimize their strategies. By focusing on churn analytics and utilizing Radix, businesses can enhance customer satisfaction, improve retention rates, and drive substantial revenue growth.

To conclude, embracing churn analytics and employing cutting-edge tools like Radix is crucial for CFOs and finance teams looking to stay ahead in the dynamic SaaS industry. By harnessing the power of data and insights, businesses can unlock new avenues for revenue growth, reduce customer churn, and pave the way for a prosperous future.