In the world of business, generating consistent cash flow is crucial for growth and sustainability. One strategy that has gained significant traction in recent years is the use of subscription-based business models. Companies that offer products or services on a recurring basis can benefit from a steady stream of revenue that builds over time. This concept is known as “compounding subscription cash flow” and has the potential to transform the way businesses operate.

What is Compounding Subscription Cash Flow?

Compounding subscription cash flow refers to the cumulative effect of recurring revenue over time. In a subscription-based business, customers pay a recurring fee for access to a product or service. As more customers sign up for subscriptions, the revenue generated from those subscriptions compounds and grows over time. This creates a predictable and reliable stream of cash flow that can fuel business growth and provide stability during lean times.

Benefits of Compounding Subscription Cash Flow

There are several benefits to using a subscription-based business model and leveraging the power of compounding subscription cash flow.

1) Predictable Revenue

With a subscription-based model, businesses can forecast future revenue more accurately than with one-time sales. This predictability provides a stable foundation for long-term planning and growth.

2) Customer Loyalty

Subscribers are more likely to be repeat customers because they have already committed to using a product or service on an ongoing basis. This loyalty creates a higher lifetime value for each customer.

3) Cost Savings

Because subscribers are already committed to a product or service, the cost of acquiring new customers is lower. This can result in significant cost savings over time.

4) Flexibility

Also, subscription-based businesses can adjust their offerings or pricing based on customer feedback or market trends, allowing for greater flexibility and agility.

5) Increased Valuation

The steady cash flow generated by subscriptions can lead to a higher valuation for a business, making it more attractive to investors or potential buyers.

How to Optimize Compounding Subscription Cash Flow

While a subscription-based business model has many benefits, it’s not a guaranteed path to success. There are several key strategies that businesses can use to optimize it:

A) Focus On Customer Retention

Keeping subscribers happy is crucial to the long-term success of a subscription-based business. Offering excellent customer service, creating engaging content or product updates, and regularly communicating with subscribers can all help to improve retention rates.

B) Offer Flexible Subscription Options

Providing subscribers with a range of options, such as different subscription levels or payment frequencies, can make a business more accessible to a wider audience.

C) Invest in Marketing

While the cost of acquiring new customers is lower in a subscription-based business, it’s still important to invest in marketing efforts to attract new subscribers. This can include email campaigns, social media advertising, or referral programs.

D)Monitor Metrics

Tracking metrics such as churn rate, customer acquisition cost, and average revenue per user is essential to understanding the health of a subscription-based business. This data can be used to make data-driven decisions about pricing, customer retention strategies, and marketing efforts.

E) Leverage Technology

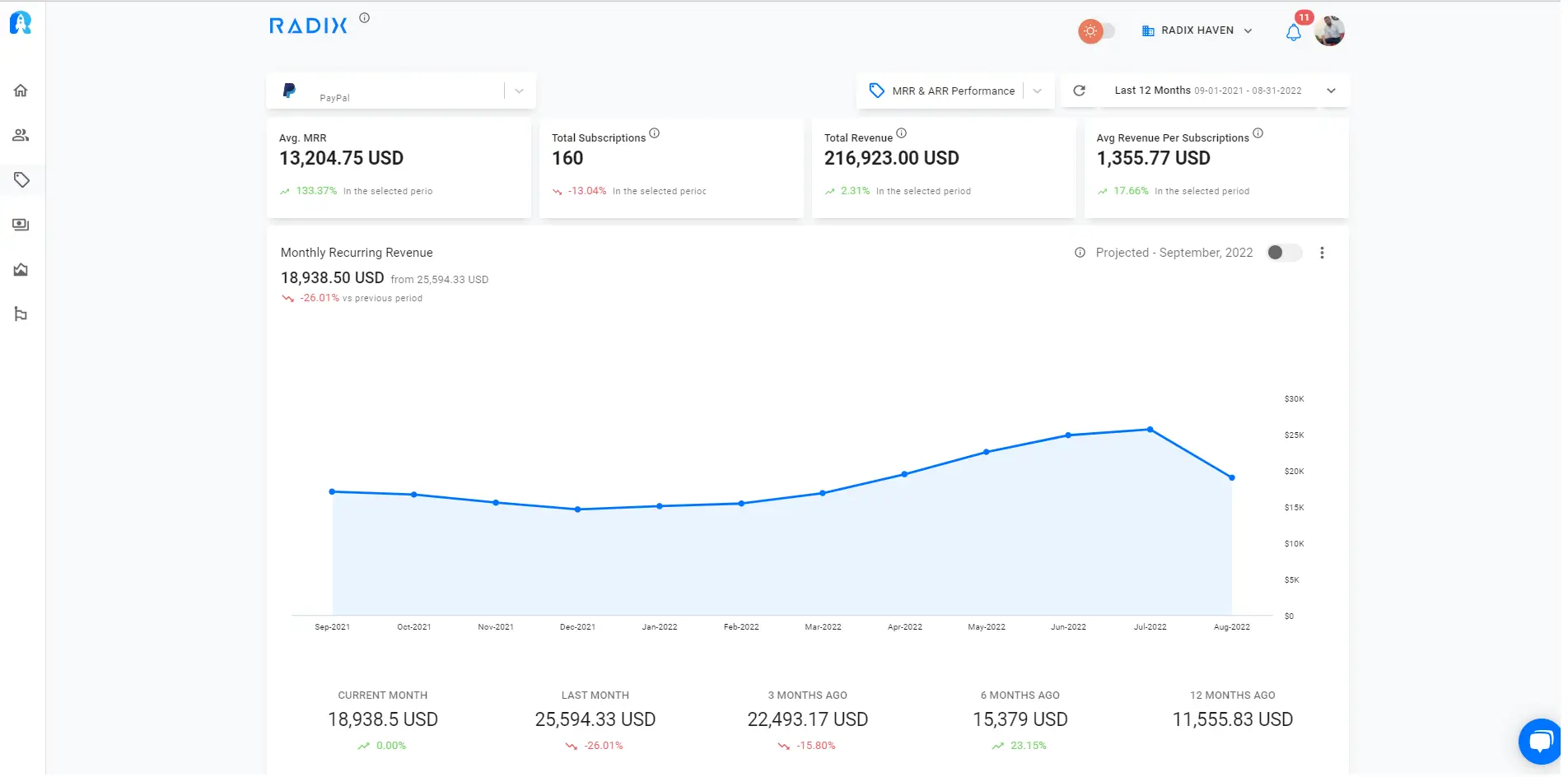

Finally, there are a variety of tools and platforms available that can help businesses manage their subscription-based operations. Platforms such as Radix, for example, offer real-time analytics and insights to help businesses optimize their compounding subscription cash flow.

The Power of Compounding Subscription Cash Flow

Compounding subscription cash flow has the power to transform the way businesses operate. By generating predictable revenue, improving customer loyalty, and providing cost savings, subscription-based models can offer a stable foundation for long-term growth. Therefore, to optimize it, businesses should focus on customer retention, offer flexible subscription options, invest in marketing, monitor metrics, and leverage technology.

Conclusion

In conclusion, the benefits of a subscription-based business model and compounding subscription cash flow cannot be overstated. With the right strategies and tools, businesses can create a steady stream of revenue that grows over time, providing stability and opportunities for long-term growth. Whether you’re running a SaaS company, a digital media outlet, or any other business that can benefit from recurring revenue, it’s worth considering the advantages of a subscription-based model.

In addition, for businesses looking to optimize their compounding subscription cash flow, utilizing technology can be a game-changer. Platforms like Radix provide real-time analytics and insights that can help businesses track and analyze their subscription-based operations in real-time. With the ability to monitor metrics such as churn rate, customer acquisition cost, and average revenue per user, businesses can make data-driven decisions that improve customer retention, reduce costs, and attract new subscribers.