SaaS businesses operate in a fast-paced, constantly evolving environment. Therefore, it’s essential to track the right metrics to evaluate the performance of the business. Customer Lifetime Value (LTV) is one such metric that is crucial for SaaS companies. In this article, we’ll delve into what LTV is, why it’s important, and how to calculate it.

What is Customer Lifetime Value (LTV)?

Customer Lifetime Value is a metric that represents the total amount of revenue a customer generates for your business over the duration of their relationship with your company. It’s a crucial metric because it helps you determine the value of your customers to your business. Additionally, it helps you identify which customers are most valuable to your company and allocate resources accordingly.

Why is LTV important for SaaS businesses?

LTV is a crucial metric for SaaS businesses because it helps you understand the lifetime value of your customers. By knowing how much revenue a customer will generate over time, you can better understand how much you should spend to acquire that customer. Additionally, LTV helps you understand which customers are most valuable to your business. By knowing this, you can focus your efforts on retaining those customers and acquiring more customers like them.

How to calculate LTV?

Calculating LTV can be tricky, but it’s an essential metric for SaaS businesses. There are several ways to calculate LTV, but the most common formula is:

LTV = ARPU x (1 / Churn Rate)

Where ARPU is the average revenue per user per month and Churn Rate is the percentage of customers who leave each month.

Let’s break this down further. ARPU is calculated by taking the total revenue generated by your SaaS business in a month and dividing it by the number of active users. For example, if your business generated $50,000 in revenue in a month and had 1,000 active users, your ARPU would be $50.

Churn Rate is the percentage of customers who leave your business each month. To calculate this, you need to know how many customers you had at the beginning of the month, how many customers you lost during the month, and how many customers you had at the end of the month. The formula for calculating Churn Rate is:

Churn Rate = (Customers at the beginning of the month – Customers at the end of the month) / Customers at the beginning of the month

For example, if you had 1,000 customers at the beginning of the month, lost 50 customers during the month, and ended the month with 950 customers, your Churn Rate would be 5%.

Using the formula above, if your ARPU is $50 and your Churn Rate is 5%, your LTV would be:

LTV = $50 x (1 / 0.05) = $1,000

This means that on average, a customer will generate $1,000 in revenue over their lifetime with your business.

How to improve Customer Lifetime Value?

Improving LTV is critical for SaaS businesses, as it means that you’re generating more revenue from your customers over their lifetime. There are several ways to improve LTV:

- Focus on customer retention: Customer retention is crucial for improving LTV. By retaining your customers, you’re ensuring that they continue to generate revenue for your business over time.

- Improve product offering: Improving your product offering can help increase customer satisfaction, which can lead to increased LTV. By offering new features and functionalities, you can attract new customers and retain existing ones.

- Increase pricing: Increasing pricing can help increase LTV, but it’s crucial to do this strategically. You don’t want to increase pricing to a point where customers are no longer willing to pay for your product. Therefore, it’s essential to evaluate your pricing strategy carefully and make incremental price increases.

- Cross-selling and upselling: Cross-selling and upselling can help increase LTV by encouraging customers to purchase additional products or services from your business. This is especially effective if the additional products or services complement the customer’s existing purchases.

- Reduce churn: Reducing churn is crucial for improving LTV. By minimizing the number of customers who leave your business each month, you’re ensuring that you’re generating revenue from your customers over their lifetime.

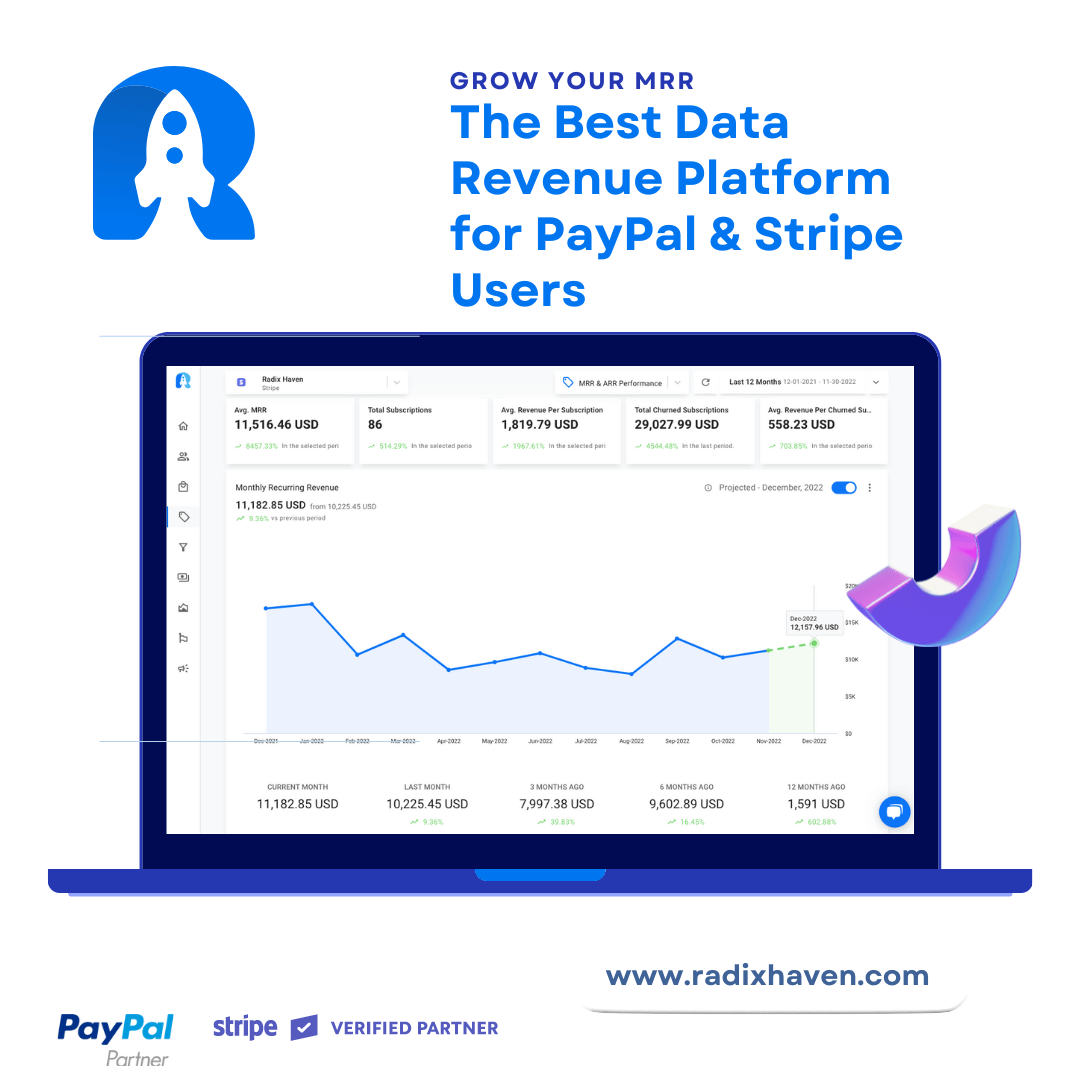

Why use Radix to reduce churn and boost overall KPIs?

Radix is a customer success platform that can help SaaS businesses reduce churn and boost overall KPIs. Radix uses machine learning algorithms to identify at-risk customers and provides actionable insights to help businesses retain those customers. Additionally, Radix provides a comprehensive view of customer data, allowing businesses to make informed decisions to improve customer satisfaction and increase LTV.

In conclusion, Customer Lifetime Value (LTV) is a crucial metric for SaaS businesses as it helps businesses understand the lifetime value of their customers. By knowing how much revenue a customer will generate over time, businesses can better understand how much they should spend to acquire that customer. Additionally, LTV helps businesses understand which customers are most valuable to their business, allowing them to focus their efforts on retaining those customers and acquiring more customers like them.

Improving LTV is critical for SaaS businesses as it means that they’re generating more revenue from their customers over their lifetime. There are several ways to improve LTV, including focusing on customer retention, improving the product offering, increasing pricing, cross-selling and upselling, and reducing churn.

Using Radix can help SaaS businesses reduce churn and boost overall KPIs. Radix uses machine learning algorithms to identify at-risk customers and provides actionable insights to help businesses retain those customers. Additionally, Radix provides a comprehensive view of customer data, allowing businesses to make informed decisions to improve customer satisfaction and increase LTV.