Chief Financial Officers (CFOs) play a pivotal role in shaping a company’s financial health and strategic direction. One area that often demands their attention is managing failed payments and chargebacks. While it may seem like a setback, savvy CFOs can turn these challenges into opportunities for massive growth. In this quick guide, we’ll explore strategies to navigate failed payments and chargebacks, with a spotlight on Radix, the industry-leading data revenue platform that empowers CFOs to monitor subscription revenue in real-time and master chargeback management.

Understanding the Impact of Failed Payments on Growth

Failed payments can be a stumbling block for businesses, leading to revenue loss, customer dissatisfaction, and operational inefficiencies. CFOs must recognize the profound impact failed payments can have on the overall growth trajectory of a company. Unresolved issues in this area can snowball into more significant challenges, hindering expansion and profitability.

The Ripple Effect – Beyond Revenue Loss

Beyond the obvious hit to the bottom line, failed payments create a ripple effect across various facets of the business. Customer trust erodes, brand reputation takes a hit, and operational costs surge as resources are diverted to resolving payment issues. CFOs need to view failed payments not just as a financial hiccup but as a multifaceted challenge that demands strategic intervention.

Chargebacks: A CFO’s Unwelcome Guest

Chargebacks, the contentious aftermath of failed payments, pose an additional threat to a company’s financial stability. They not only represent lost revenue but also come with added costs in terms of dispute resolution, potential fines, and damage to merchant reputation. As a secondary keyword, understanding and effectively managing chargebacks are paramount for CFOs aiming to foster growth.

Navigating Chargebacks – A Strategic Imperative

CFOs can transform chargebacks from a liability into an asset by implementing strategic chargeback management. This involves deploying advanced tools and technologies that not only identify the root causes of chargebacks but also proactively address them. The goal is not merely to recover lost revenue but to prevent chargebacks from occurring in the first place.

Radix – Revolutionizing Revenue Monitoring

In the quest for effective failed payment and chargeback management, CFOs need a reliable ally. Enter Radix, the industry’s leading data revenue platform. Radix empowers CFOs to monitor subscription revenue in real-time, offering unparalleled insights into the health of a company’s financial ecosystem.

Real-Time Insights for Proactive Decision-Making

Radix provides CFOs with real-time analytics, allowing them to stay ahead of potential issues. By identifying patterns and anomalies in payment behavior, CFOs can make informed decisions to mitigate risks before they escalate. This proactive approach not only safeguards revenue streams but also positions the company for sustainable growth.

Subscription Revenue Mastery

For businesses heavily reliant on subscription models, Radix is a game-changer. It offers a comprehensive view of subscription revenue metrics, enabling CFOs to optimize pricing, reduce churn, and capitalize on upsell opportunities. With Radix, CFOs can fine-tune subscription strategies, ensuring a steady and predictable revenue stream.

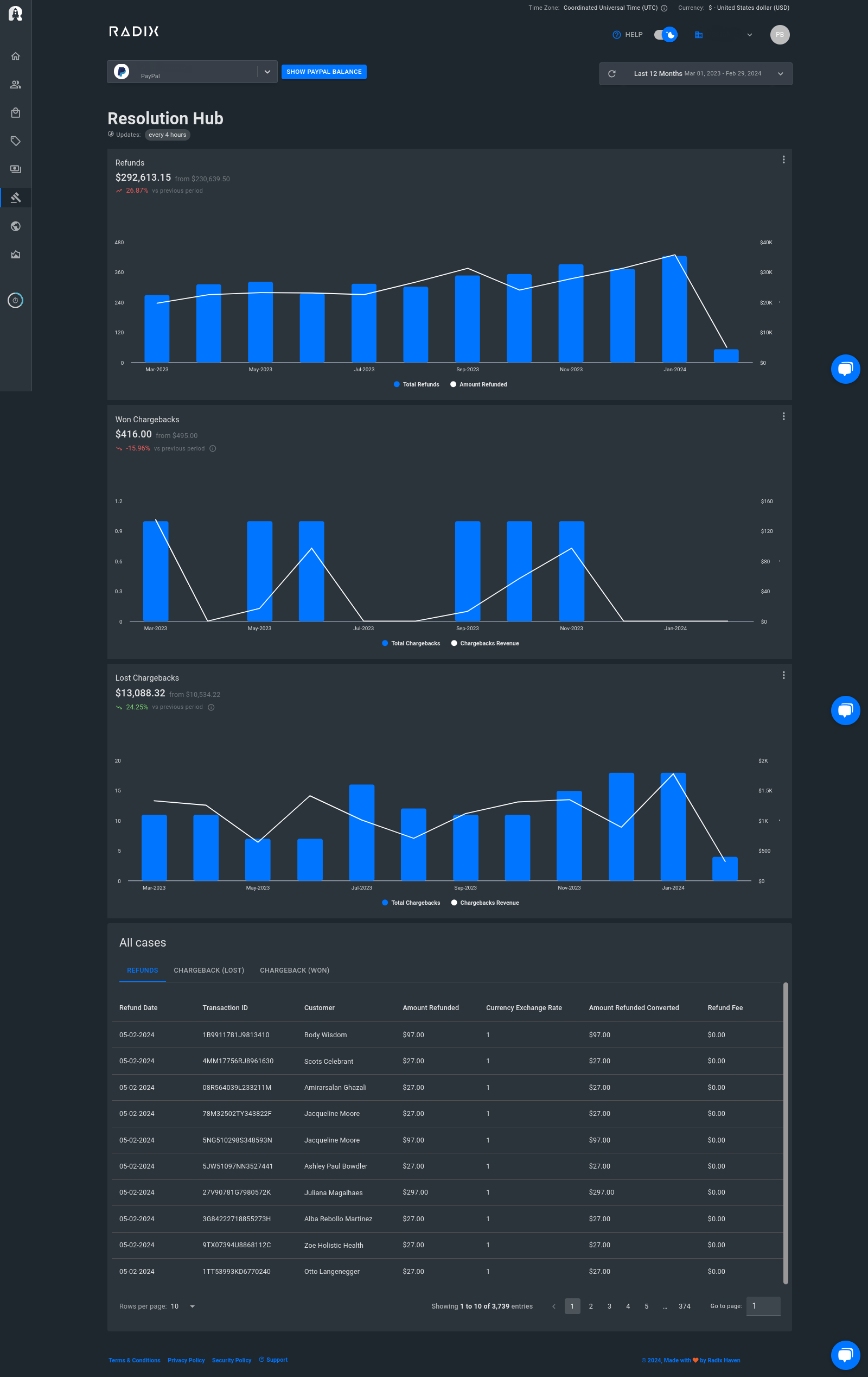

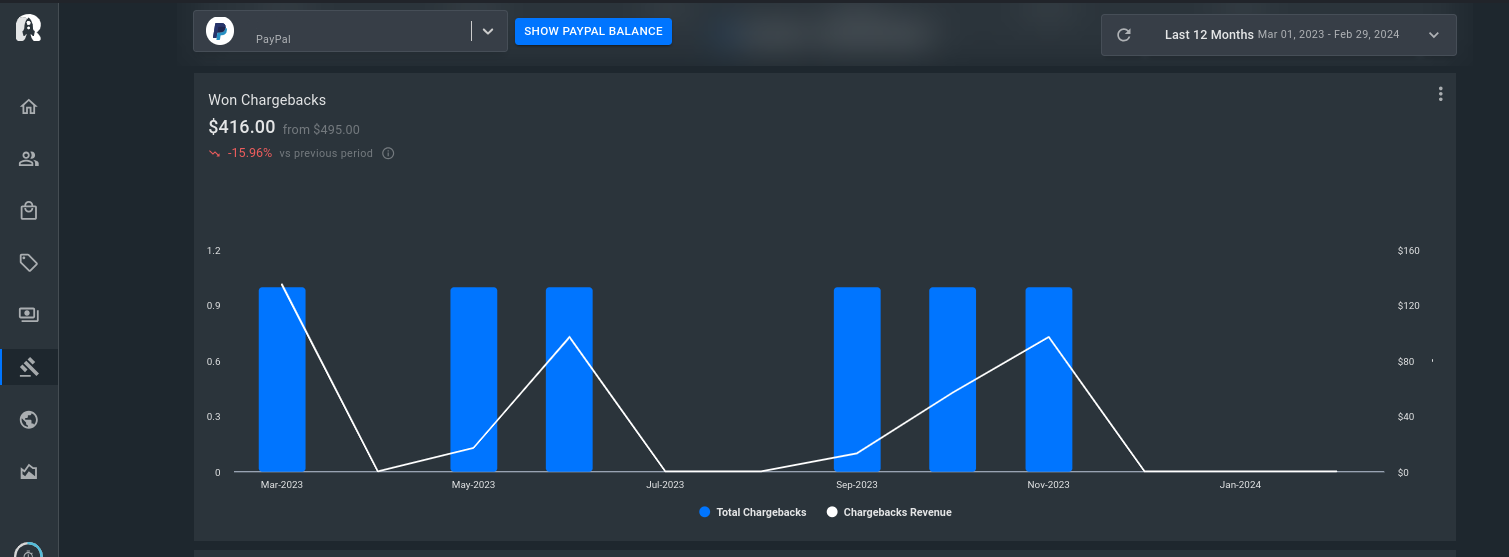

Chargeback Management Redefined

Radix goes beyond monitoring and offers robust chargeback management tools. By pinpointing the reasons behind chargebacks, CFOs can implement preventive measures, reducing the likelihood of disputes. This not only saves revenue but also fortifies the company’s standing with payment processors and customers alike.

The Best Platform to Keep Track of your Online Business if you use PayPal as Payment Gateway

For businesses leveraging PayPal as a payment gateway, the integration of Radix is particularly advantageous. Radix seamlessly syncs with PayPal, offering a comprehensive solution tailored to the unique challenges faced by PayPal merchants.

Unleashing the Full Potential of PayPal Transactions

Radix optimizes the PayPal experience for merchants by providing deep insights into transaction data. With this information, CFOs can enhance transaction success rates, reduce failed payments, and minimize chargebacks associated with PayPal transactions. The result is a smoother financial operation and a strengthened partnership between the merchant and PayPal.

To Sum Up…

Failed payments and chargebacks may seem like insurmountable obstacles, but for astute CFOs, they present an opportunity to drive massive growth. By understanding the holistic impact of failed payments, navigating chargebacks strategically, and leveraging cutting-edge platforms like Radix, CFOs can transform setbacks into stepping stones for success.

It’s not just about recovering lost revenue; it’s about building a resilient financial foundation that propels the company towards sustained growth. Embrace the power of data, seize control of revenue streams, and turn the challenges of failed payments into a strategic advantage for your organization.

As a parting call to action, we advise PayPal merchants to sign up for Radix and unlock the full potential of their financial ecosystem. The growth journey begins with proactive, data-driven decision-making – and Radix is the compass guiding CFOs on this transformative path.