When it comes to assessing the success of a business, tracking revenue retention metrics is crucial. Gross vs Retention Rates. Understanding the differences between these metrics and how they impact your business can help you make informed decisions to drive growth. In this article, we will explore the significance of gross vs net retention rates and their implications for your company’s success.

What is Gross Retention Rate?

Gross retention rate refers to the percentage of customers who continue using a product or service within a given period, typically measured on a monthly or annual basis. It is a straightforward metric that provides a basic understanding of customer retention. To calculate the gross retention rate, subtract the number of customers lost during a specific period from the total number of customers at the beginning of that period. Then, divide the result by the total number of customers at the start of the period and multiply by 100.

Gross Retention Rate = [(CE – CN) / CS] * 100

Where:

CE = Number of customers at the end of a period

CN = Number of new customers acquired during that period

CS = Number of customers at the start of a period

The Importance of Net Retention Rates:

Net retention rates offer a more accurate reflection of revenue growth potential. By factoring in the additional revenue from upselling and expansion, it helps identify how effectively you are capitalizing on your existing customer base. A high net retention rate indicates that your business is not only retaining customers but also maximizing revenue opportunities within the customer lifecycle. This metric is particularly valuable for businesses with subscription-based models or recurring revenue streams.

Net Retention Rate = [(CE – CN – CR) / CS] * 100

Where:

CR = Revenue from lost customers during the periodCE = Number of customers at the end of a period

CN = Number of new customers acquired during that period

CS = Number of customers at the start of a period

Gross vs Net Retention Rates: Understanding the Differences:

The fundamental difference between gross and net retention rates lies in the scope of analysis. While gross retention rates focus solely on customer retention, net retention rates consider revenue growth derived from existing customers. Gross retention rates provide a baseline understanding of customer loyalty, whereas net retention rates capture the full picture by factoring in revenue expansion opportunities.

Why You Need to Track Both Metrics:

Tracking both gross and net retention rates is essential to gaining a comprehensive understanding of your business’s performance. While a high gross retention rate signifies a strong customer base, a declining net retention rate may indicate missed revenue opportunities. By monitoring both metrics, you can identify trends, compare performance over time, and determine the effectiveness of your customer retention and revenue expansion strategies.

To accurately track and monitor gross and net retention rates, consider implementing the following tips:

- Consistent Data Collection: Ensure that customer data is consistently and accurately collected. Use a centralized system to store customer information and track their lifecycle, including acquisition, engagement, and churn.

- Define Cohorts: Group customers based on their acquisition dates to analyze retention rates for specific cohorts over time. This allows for a more granular understanding of customer behavior and the effectiveness of retention strategies.

- Monitor Churned Customers: Keep a close eye on customers who have churned and track their reasons for leaving. This information can provide valuable insights into areas for improvement and guide customer retention efforts.

- Customer Surveys: Conduct regular surveys to gauge customer satisfaction, identify pain points, and gather feedback on your product or service. This qualitative data can help fine-tune your retention strategies and address any issues that might lead to churn.

- Analyze Customer Behavior: Leverage customer analytics to gain deeper insights into customer behavior, preferences, and patterns. Identify high-value customers, analyze their engagement, and tailor retention efforts to their needs.

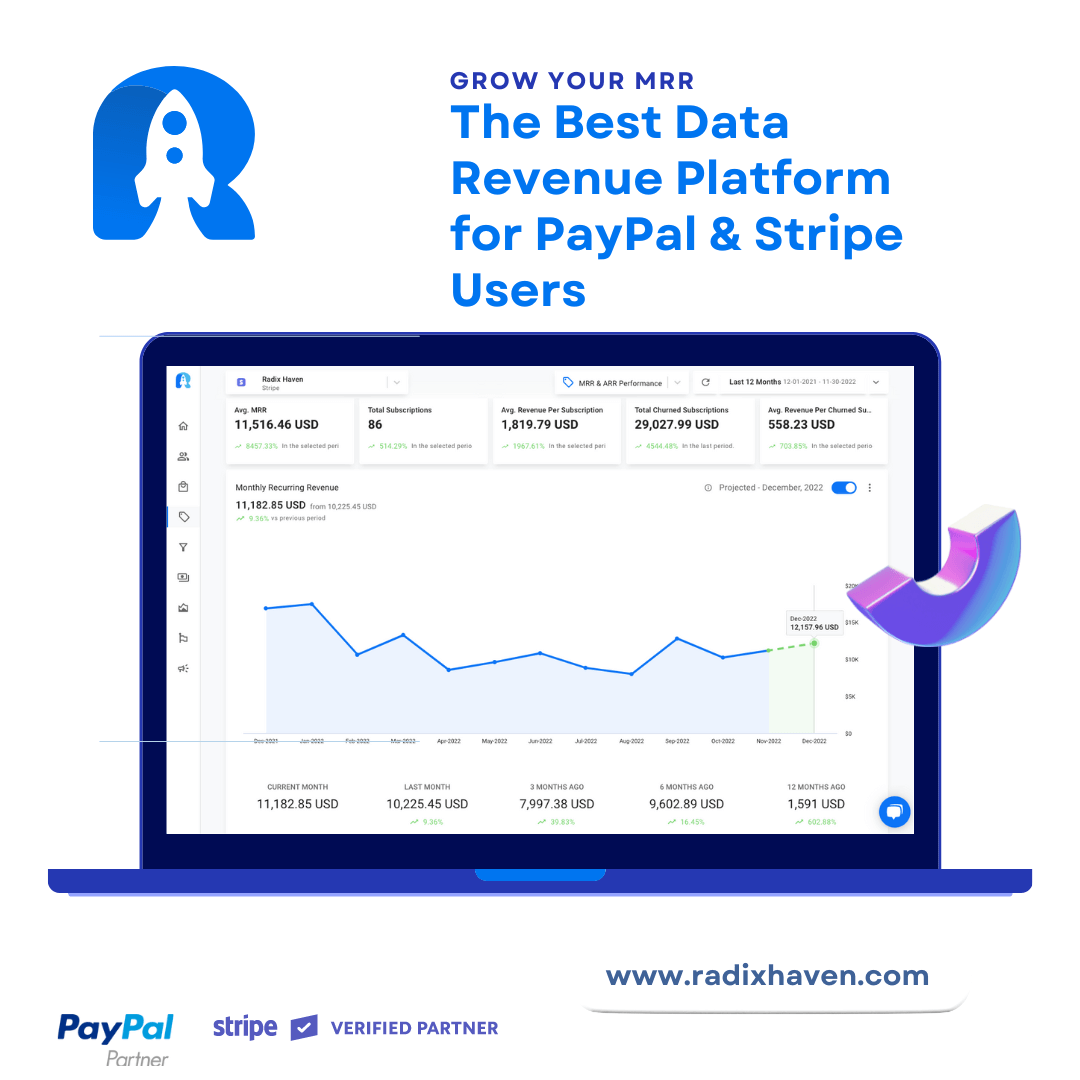

Boosting KPIs with Radix Analytics

While manually tracking and analyzing retention metrics can be time-consuming and prone to errors, using a comprehensive analytics tool like Radix can streamline the process and provide powerful insights to boost overall KPIs. Radix offers advanced features such as automated data collection, real-time reporting, and customizable dashboards. Its intuitive interface enables businesses to visualize retention rates, identify trends, and make data-driven decisions promptly.

To Sum Up…

In today’s competitive business landscape, understanding and optimizing revenue retention metrics is crucial for sustainable growth. Gross and net retention rates provide valuable insights into customer loyalty, revenue expansion, and areas for improvement. By accurately tracking these metrics and leveraging a robust analytics tool like Radix, businesses can make informed decisions, optimize customer retention strategies, and ultimately enhance their overall key performance indicators. Invest in tracking and analyzing these metrics to ensure long-term success and profitability in today’s dynamic market environment.

Boost your business’s revenue retention metrics with Radix today and propel your success forward!