One number sticks out as the most important indicator of a business’s performance among the complex web of financial statements: net income. It’s the final outcome of all sales, costs, profits, and losses; the bottom line. Gaining insight into a company’s financial performance and health through the net income formula is like unlocking the secrets of the Bible of corporate finance.

Unveiling the Net Income Formula

What is Net Income?

Net income, also known as the “bottom line,” is the profit a company generates after deducting all expenses from its total revenue. It’s the culmination of the income statement, reflecting the company’s ability to generate profits from its core operations.

The Net Income Formula

The net income formula is elegantly simple yet profoundly insightful:

Net Income=Total Revenue−Total Expenses

Breaking it down further:

Total Revenue

Total revenue represents all the money a company earns from its primary business activities. It includes sales revenue, service revenue, interest income, and any other sources of income directly related to the core operations.

Total Expenses

Total expenses encompass all costs incurred in generating revenue and running the business. This includes the cost of goods sold (COGS), operating expenses, interest expenses, taxes, and any other miscellaneous expenses.

Decoding Net Income: Why It Matters

The Significance of Net Income

Net income serves as a barometer of a company’s profitability and financial performance. It provides crucial insights into whether a company is making or losing money and how efficiently it’s operating. Investors, analysts, and stakeholders often scrutinize net income to assess the company’s viability and growth prospects.

Analyzing Net Income Trends

Examining net income trends over time can reveal valuable patterns and signals. Consistently increasing net income indicates healthy growth and profitability, while declining or negative net income may raise red flags about the company’s financial stability and operational efficiency.

The Role of Net Income in Financial Analysis

Financial Ratios and Net Income

Net income serves as a cornerstone for calculating various financial ratios that offer deeper insights into a company’s financial performance. Ratios like the net profit margin, return on equity (ROE), and earnings per share (EPS) all rely on net income as a key component.

Making Informed Decisions

Armed with a clear understanding of net income, investors and stakeholders can make informed decisions about investing, lending, or partnering with a company. A healthy net income indicates robust financial health and enhances confidence in the company’s ability to generate returns.

The PayPal Case Study: Net Income in Action

Let’s take a closer look at PayPal, a global leader in online payments, to illustrate the significance of the net income formula in real-world scenarios.

PayPal’s Net Income Performance

PayPal’s net income has been a key metric for assessing its financial strength and growth trajectory. By analyzing PayPal’s net income over the years, investors and analysts can gauge the company’s profitability and competitive position in the market.

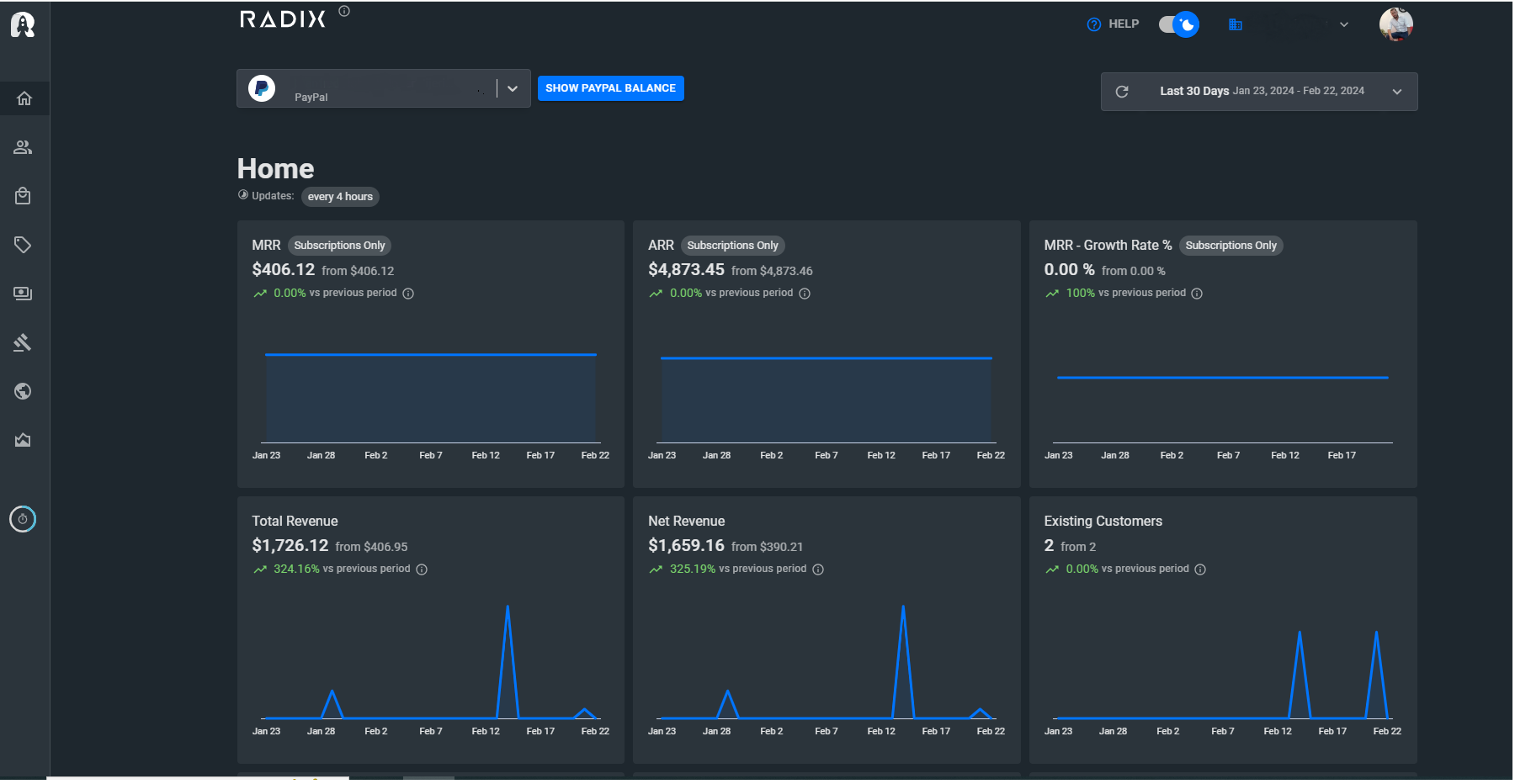

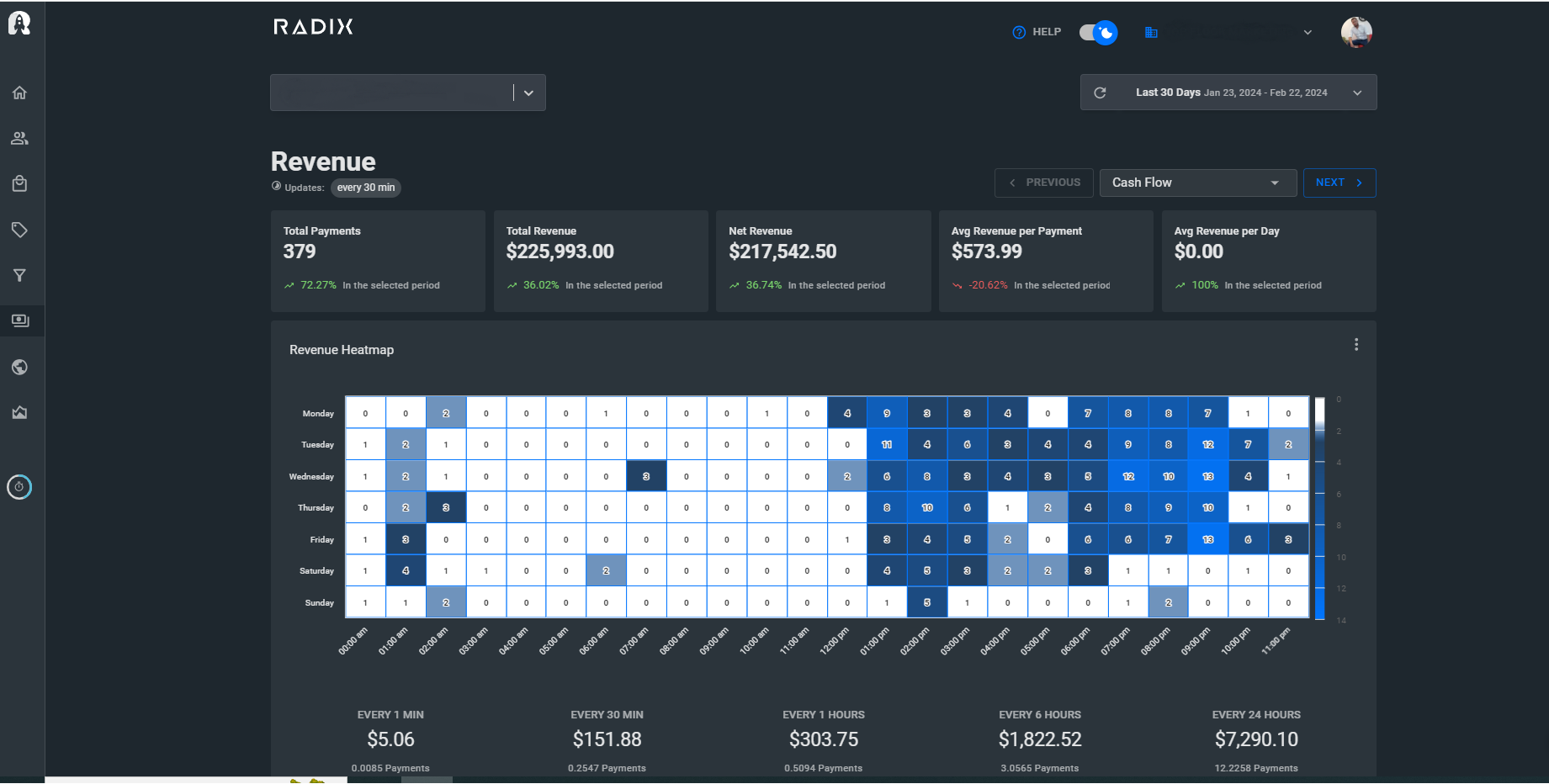

Leveraging Data for Insights

In today’s data-driven world, companies like PayPal rely on advanced analytics platforms to gain deeper insights into their financial performance. Radix, a leading data revenue platform, empowers companies to monitor subscription revenue in real-time, track revenue metrics, and optimize sales strategies for maximum profitability.

The Radix Advantage

Radix stands out as the go-to solution for companies seeking unparalleled visibility into their financial data. By leveraging Radix’s robust features and analytics capabilities, companies like PayPal can unlock actionable insights that drive growth, enhance profitability, and ensure long-term success.

Conclusion: Mastering the Net Income Formula

In the intricate web of financial metrics, the net income formula shines as a beacon of clarity and insight. Understanding this fundamental concept equips investors, analysts, and stakeholders with the tools they need to navigate the complexities of corporate finance.

As companies strive to thrive in an ever-evolving business landscape, harnessing the power of data becomes paramount. Platforms like Radix offer a competitive edge by providing real-time visibility into key financial metrics, empowering companies to make data-driven decisions that propel them toward success.

In the realm of finance, knowledge is power—and mastering the net income formula is the first step toward unlocking a world of financial opportunities and insights.

Sign Up to Track Net Income in Real-Time