Find out if your growth is sustained and meaningful: New MRR and Churned MRR: a blog about churn rate and how to measure it.

Let’s talk about churn. We all see it in software companies or even physical products these days. It is something you might have experienced yourself. Months or quarters go by with your business running as usual until out of nowhere: a client or customer stops using your service.

You probably know how to determine gross margin and net margin for a business. But what about the quick ratio (New MRR and Churned MRR)?

The Quick Ratio compares your new revenue with your churned revenue. This calculation is used commonly in SaaS or eCommerce business models. The reason is obvious: the SaaS business model is all about acquiring and keeping customers. Thus, it is important to maximize revenue per customer, which usually happens by lowering the churn rate but keeping acquisition costs under control. It is a balance that needs to be achieved by almost every fast-growing company and knowing what your ultimate goal is, will help you achieve it faster.

“The Quick Ratio Formula scales down the assets to meet the short duration”

Your business growth will depend heavily on your ability to acquire new customers and retain your actual ones. Remember that Ratio refers to the comparison of two or more numbers that indicates their sizes concerning each other. Therefore, if your Ratio is negative, it is a matter of time for you to close the doors for good.

Positive Ratio (SaaS goal):

2+ new subscriptions to 1 churned subscriptions.

Negative Ratio:

2+ churned subscriptions to 1 new subscription.

NEW MRR and Churned MRR

Monthly Recurrent Revenue is a metric used to measure success for subscription-based businesses. MRR is calculated by multiplying your total subscriptions by the average monthly recurring revenue.

It measures the total amount of money that a company earns from its recurring sources of income. It is calculated by taking the value of your current month’s recurring revenue, adding it to the total value of previous months, and dividing the result by 12. This gives you an average amount raised each month.

New MRR refers to the number of new subscriptions in a given period. These are then translated into monetary terms that will reflect an increase in the company’s profits. Unless there is what we call Churned MRR, which is nothing more than the number of subscriptions canceled and/or downgrades in a given period.

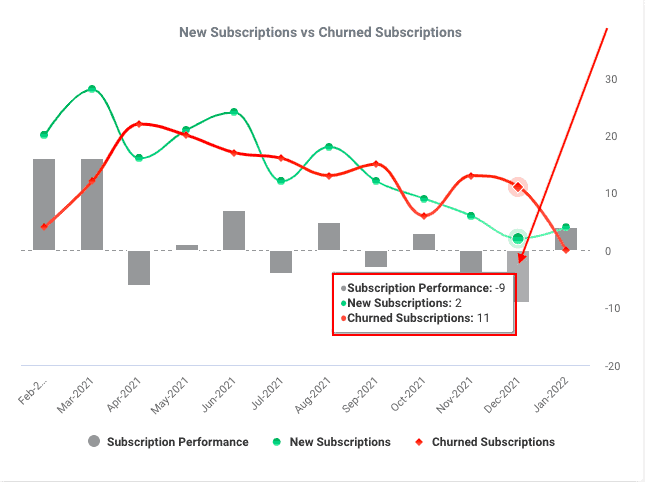

Here is an example of New MRR (New Suscription)

Above, you can see that Subscription Performance is -9 due to the substraction of New Subscriptions and Churned Suscriptions. Then, this result, will be reflected in monetary units, in this case: dollars.

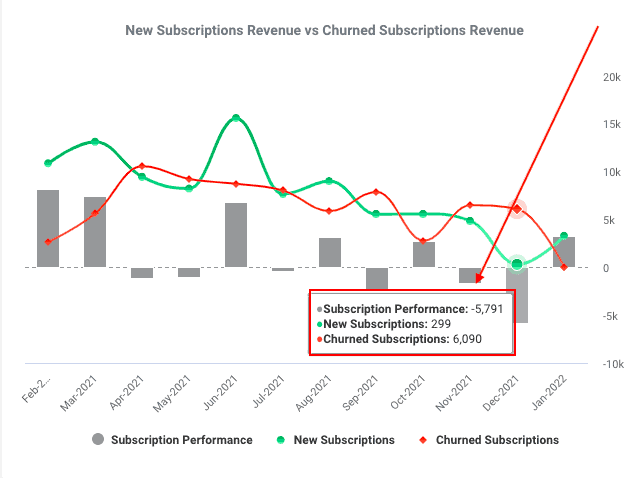

Above, you can see that Subscription Performance is -5,791, therefore it is a Churned MRR. Again, this due to the substraction of New Subscriptions and Churned Suscriptions.

Track New MRR and Churned MRR with Radix

Remember you can analyze and track your subscriptions and get acces to more than 100 KPIs in real-time with Radix. Forecast your revenue and reduce churn. Register here for free!