PayPal is one of the most popular online payment platforms, with over 350 million active users worldwide. As a business owner, setting up a PayPal Business Account can help you streamline your payments and improve your cash flow. In this article, we’ll walk you through the steps to get started with your PayPal Business Account.

Step 1: Sign Up for a PayPal Business Account

To sign up for a PayPal Business Account, go to the PayPal website and click on “Sign Up.” You’ll need to provide your business name, email address, and a password. Once you’ve completed the initial sign-up process, you’ll be asked to provide additional information, such as your business address, phone number, and tax ID number.

Step 2: Link Your Bank Account and/or Credit Card

To start accepting payments, you’ll need to link your PayPal Business Account to your bank account and/or credit card. This allows you to transfer funds from your PayPal account to your bank account or charge payments to your credit card. To link your bank account, you’ll need to provide your bank account number and routing number. To link your credit card, you’ll need to provide your credit card number, expiration date, and security code.

Step 3: Set Up Your Payment Gateway

When it comes to processing payments for your website or online store, your payment gateway is the key component. PayPal provides several payment gateway options, such as PayPal Payments Standard, PayPal Payments Pro, and PayPal Checkout. PayPal Payments Standard is a basic gateway that enables customers to pay using their PayPal account or credit card. On the other hand, PayPal Payments Pro is a more advanced gateway that offers customizable checkout options and integrates with multiple payment methods. Lastly, PayPal Checkout is a simplified checkout process that merges PayPal Payments Standard and PayPal Express Checkout.

Step 4: Customize Your Payment Settings

Once you’ve set up your payment gateway, you can customize your payment settings. This includes setting up shipping and tax rules, setting up discounts and coupons, and creating a custom checkout page. You can also set up automatic invoicing, which sends invoices to your customers automatically when they make a purchase.

Step 5: Start Accepting Payments

Once you’ve completed the above steps, you’re ready to start accepting payments. You can add a PayPal button to your website or online store, or send invoices directly to your customers. PayPal offers a variety of tools to help you manage your payments, including transaction history, reports, and analytics.

Benefits of a PayPal Business Account

There are many benefits to having a PayPal Business Account. Here are some of the key benefits:

-

Increased Payment Options

By accepting payments through PayPal, you’re providing your customers with a variety of payment options. They can pay with their PayPal account, credit card, or even use PayPal Credit to finance their purchases.

-

Improved Cash Flow

By using PayPal, you can receive payments quickly and easily. Funds are typically available in your PayPal account immediately after a transaction is completed. You can then transfer the funds to your bank account or use them to pay for business expenses.

-

Streamlined Invoicing

With PayPal, you can create and send invoices directly to your customers. You can also set up automatic invoicing, which saves you time and ensures that your customers receive their invoices promptly.

-

Customizable Payment Gateway

PayPal offers a variety of payment gateways, including PayPal Payments Standard, PayPal Payments Pro, and PayPal Checkout. These gateways are customizable and can be tailored to meet the needs of your business.

-

Analytics and Reporting

PayPal offers a variety of tools to help you manage your payments, including transaction history, reports, and analytics. These tools can help you track your revenue, analyze customer behavior, and identify areas for improvement.

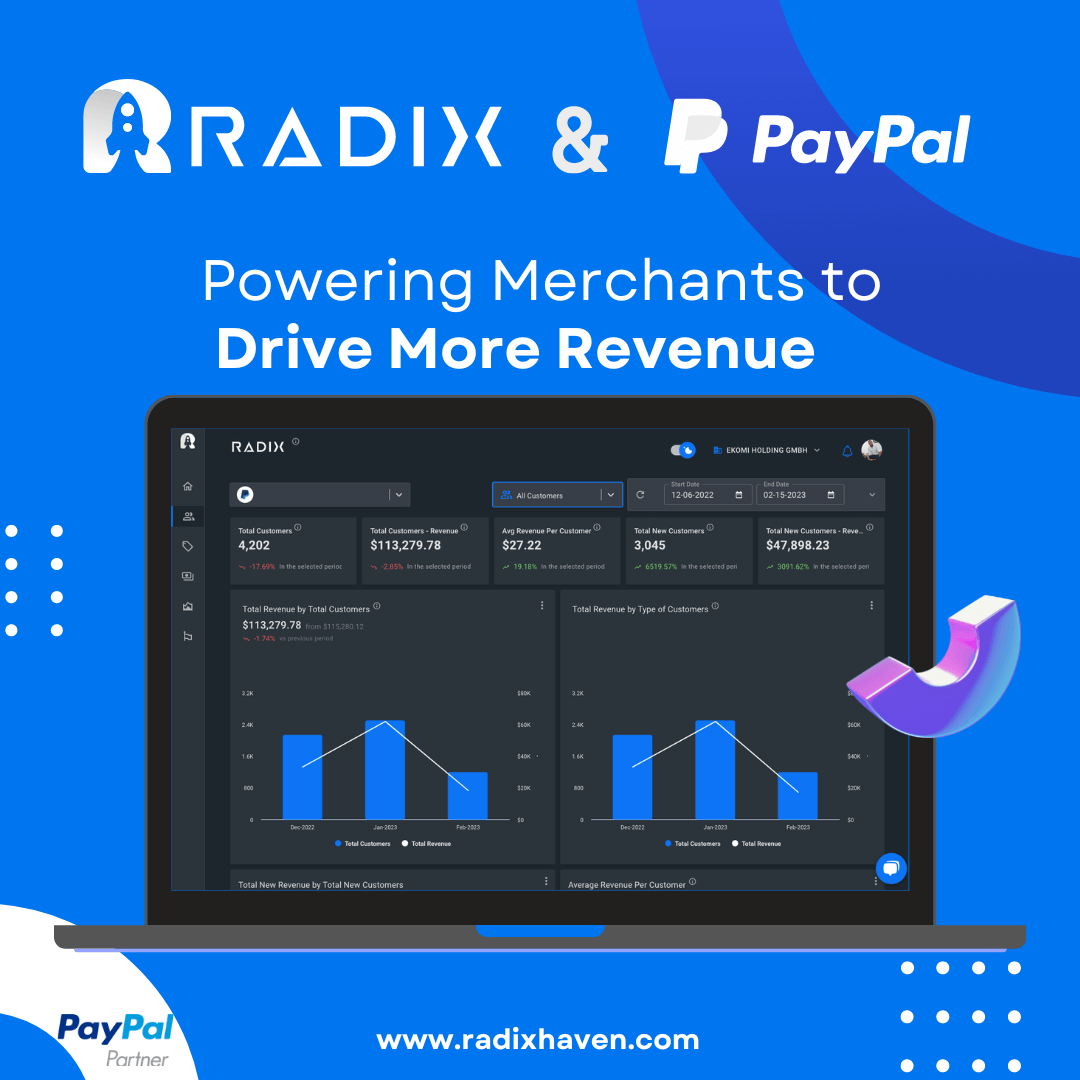

Using Radix: The Tool You Need to Track and Analyze Your PayPal Business Account Metrics

While PayPal offers many tools to help you manage your payments, tracking and analyzing your revenue metrics can be a daunting task. That’s where Radix comes in. Radix is a powerful analytics tool that helps you track, analyze, and grow your PayPal revenue metrics.

With Radix, you can easily track your revenue metrics, such as sales, refunds, and chargebacks. You can also analyze customer behavior, such as purchase frequency, average order value, and customer lifetime value. Radix provides you with actionable insights that can help you optimize your payment process, improve your customer experience, and boost your overall KPIs.

Radix also offers a variety of features that can help you grow your business. For example, you can set up email campaigns to promote your products or offer discounts to your customers. You can also track your advertising campaigns and see which campaigns are driving the most traffic and revenue.

Conclusion: Use Radix to Boost Your PayPal Business Account Performance

Setting up a PayPal Business Account is a great way to streamline your payments and improve your cash flow. However, to truly optimize your payment process and grow your business, you need to track and analyze your revenue metrics. Radix is the tool you need to do just that.

With Radix, you can easily track and analyze your revenue metrics, as well as optimize your payment process and grow your business. So, if you want to boost your overall KPIs and take your PayPal Business Account to the next level, sign up for Radix today.