Financial statements are critical documents that help investors understand a company’s financial health and performance. In this short article, we will point out the importance of preparing a PayPal financial statement and provide tips on how to create one that can help secure funding.

Financial Statement Types

There are several types of financial statements that companies need to prepare, including balance sheets, income statements, cash flow statements, and statement of stockholder’s equity. These statements provide a comprehensive view of a company’s financial situation, including its assets, liabilities, revenue, expenses, and cash flow.

Balance Sheet: This statement shows a company’s financial position at a specific point in time. It lists the company’s assets, liabilities, and equity.

Income Statement: This statement shows a company’s revenue, expenses, and net income over a specific period, such as a quarter or a year.

Cash Flow Statement: This statement shows a company’s cash inflows and outflows over a specific period. Therefore, It helps investors understand how a company is generating and using cash.

Statement of Stockholder’s Equity: This statement shows changes in a company’s equity over a specific period, including stock issuances and buybacks.

The Importance of Financial Statement during Fundraising

Financial statements are essential during the fundraising process because they provide investors with a clear picture of a company’s financial health. Investors use financial statements to assess a company’s profitability, stability, and growth potential. In addition, financial statements can help investors determine the amount of money a company needs to raise and the terms of the investment, such as the valuation and equity stake.

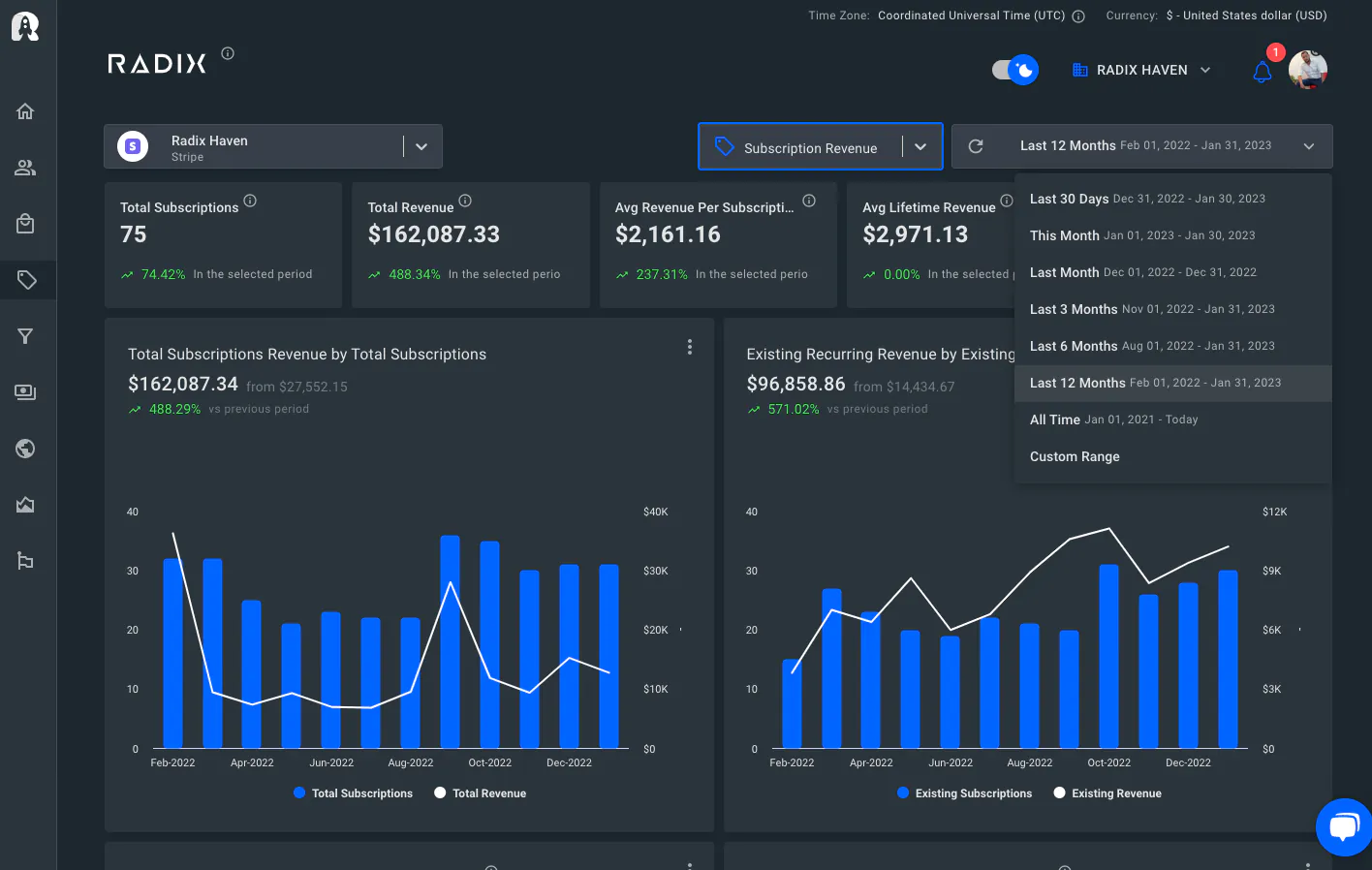

SaaS Financials and Metrics Made Easy with Radix

Radix is a cloud-based financial management tool that makes it easy for SaaS companies to prepare financial statements and analyze metrics. With Radix, you can quickly create balance sheets, income statements, cash flow statements, and statement of stockholder’s equity. The platform also provides real-time financial data and performance metrics, such as churn rate, monthly recurring revenue (MRR), and customer lifetime value (CLV).

Conclusion

In conclusion, preparing a PayPal financial statement is crucial when seeking funding from investors. Financial statements provide investors with a comprehensive view of a company’s financial health and performance. SaaS companies can use Radix to streamline the financial statement preparation process and make it easier to analyze key metrics.