When it comes to fundraising for your business, attracting potential investors requires more than just a compelling pitch. In order to gain their trust and confidence, you need to present solid financial statements that demonstrate the financial health and viability of your company. In this article, we will explore the essential steps to prepare financial statements that effectively showcase your business’s performance and potential to investors.

1) Understand the Importance of Financial Statements

Financial statements serve as a window into the financial position, performance, and cash flow of your business. Investors heavily rely on these statements to evaluate the profitability and sustainability of their investment. By providing accurate and transparent financial information, you instill confidence in potential investors, increasing your chances of securing the funding you need.

2) Determine the Required Financial Statements

To prepare financial statements for investors, you must understand which statements are necessary. The primary financial statements include the balance sheet, income statement, and cash flow statement. The balance sheet provides a snapshot of your company’s assets, liabilities, and equity at a specific point in time. The income statement presents the revenue, expenses, and net profit or loss over a given period. The cash flow statement tracks the inflow and outflow of cash, offering insights into liquidity and operational activities.

3) Gather Accurate Financial Data

To ensure the accuracy and reliability of your financial statements, it is crucial to gather comprehensive and up-to-date financial data. This includes detailed records of sales, expenses, assets, liabilities, and cash flows. Utilize accounting software or professional services to maintain accurate records and streamline the data collection process. By having reliable financial data, you can generate precise statements that reflect the true financial performance of your business.

4) Prepare and Organize Financial Statements

Once you have gathered the necessary financial data, it’s time to prepare and organize your financial statements. Begin by creating a balance sheet that lists your assets, liabilities, and equity. Ensure that the balance sheet balances by accurately recording and reconciling all financial transactions. Next, develop an income statement that showcases your revenue, expenses, and net profit or loss. Finally, create a cash flow statement that highlights the sources and uses of cash within your business.

5) Review and Analyze Financial Statements

Before presenting your financial statements to potential investors, it’s crucial to review and analyze them thoroughly. Look for any inconsistencies or errors that may impact the accuracy of your statements. Perform financial ratio analysis to assess your company’s liquidity, profitability, and efficiency. This analysis can provide valuable insights into your business’s financial health and help address any weaknesses or areas for improvement.

Why are Financial Statements Important for Shareholders?

Financial statements play a crucial role in enabling potential equity investors or shareholders to make well-informed decisions regarding their investments. Similar to lenders, equity investors assess debt levels and liquidity to gauge the company’s ability to sustain operations. However, equity investors place even greater emphasis on profitability and the potential return on equity when evaluating investment opportunities.

In conclusion, when seeking funding for your business, preparing accurate and comprehensive financial statements is vital. Investors rely on these statements to evaluate the potential of your company and make informed decisions about their investment. By understanding the importance of financial statements, determining the required statements, gathering accurate financial data, and organizing and analyzing your statements, you can effectively showcase your business’s financial performance to potential investors.

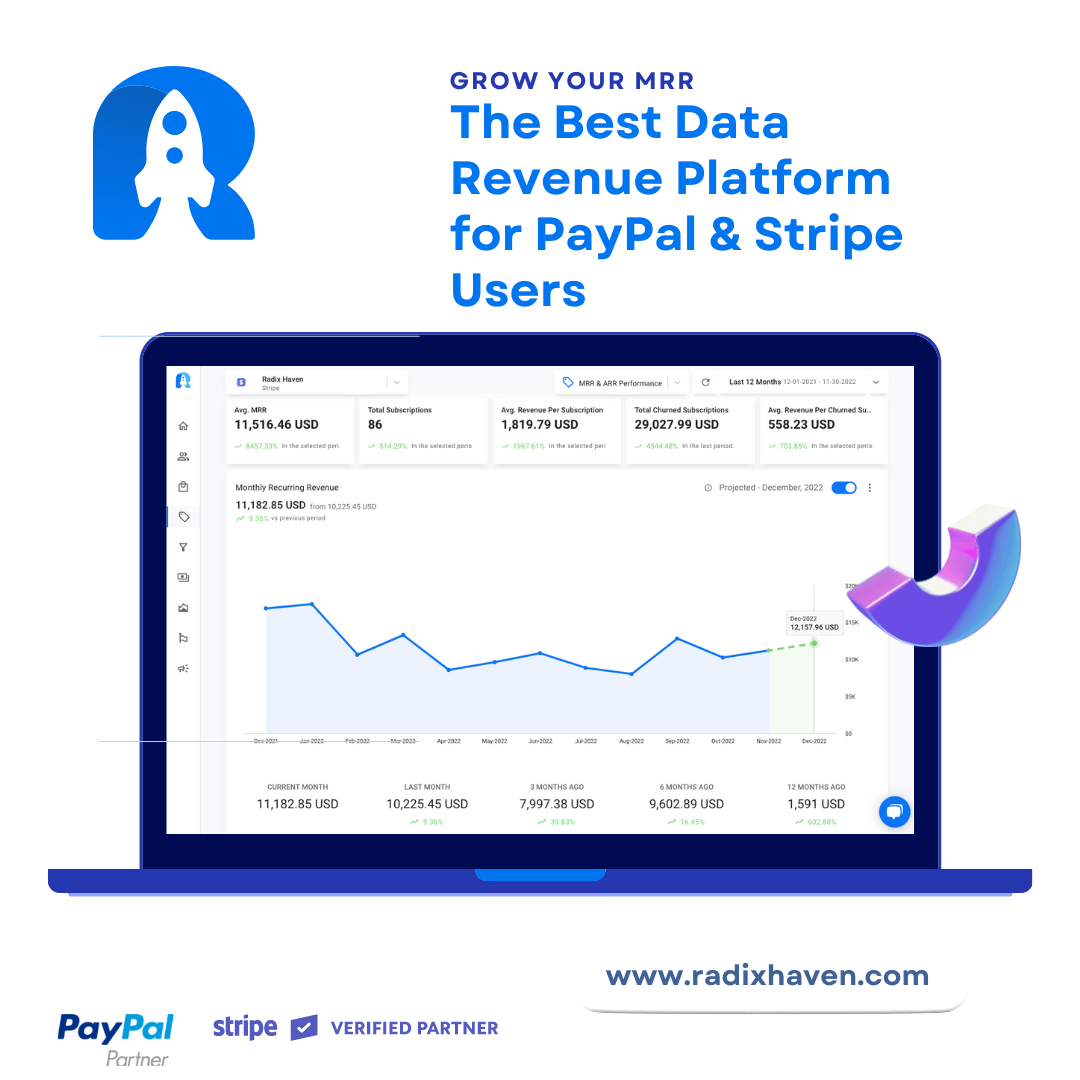

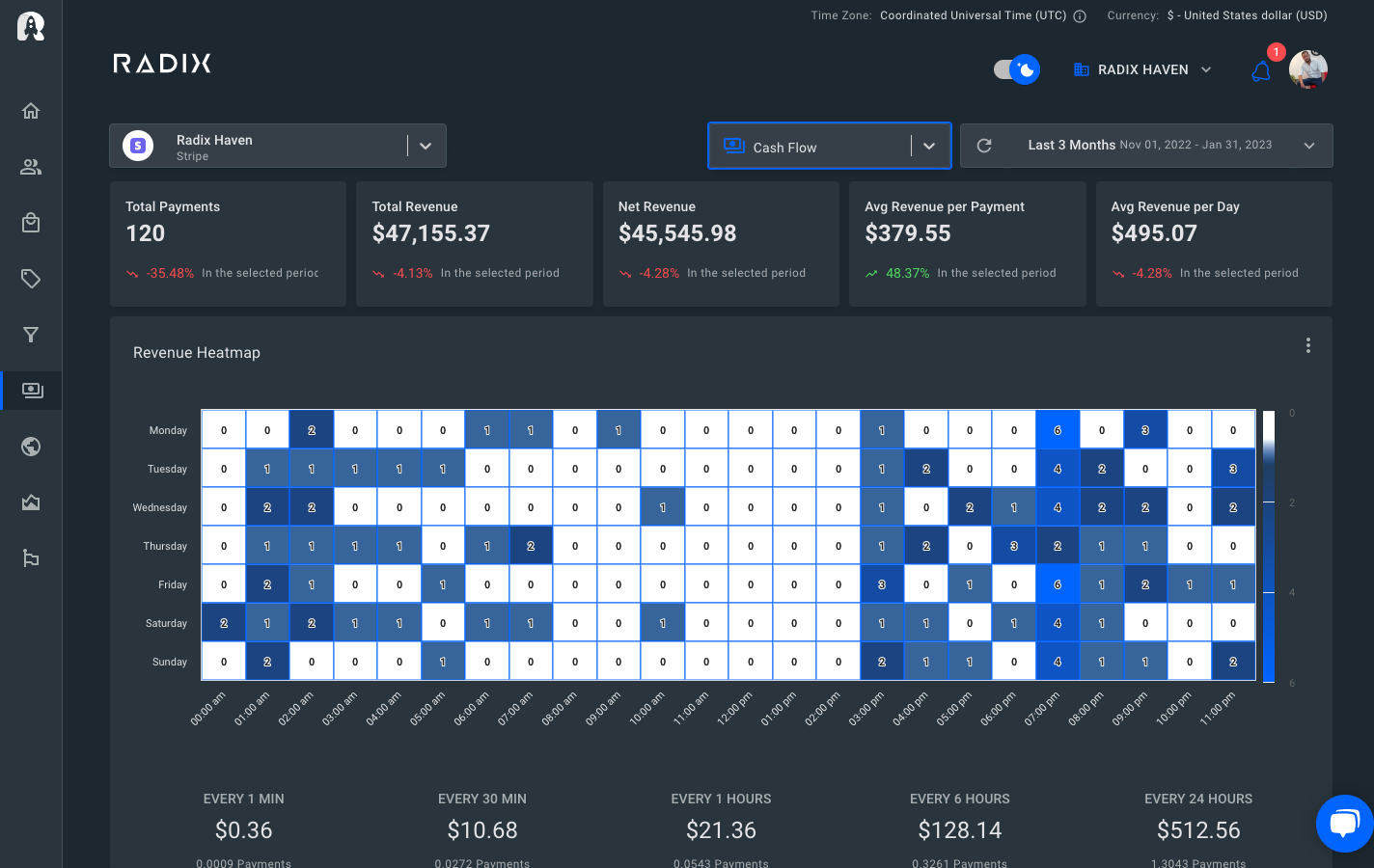

To streamline the process and boost overall key performance indicators (KPIs), CFOs can use Radix. Radix is a powerful revenue metrics tracking tool that can help CFOs prepare accurate financial statements for fundraising. By leveraging Radix, CFOs can ensure precise financial data, enhance financial analysis, and present compelling financial statements that inspire confidence in potential investors.

Incorporating Radix into your financial management practices can significantly improve your fundraising efforts, setting your business on the path to success.