The financial flow of a company is its lifeblood. And at the heart of it all is the timely collection of dues. Improper accounts receivable administration – whether manual or inadequate automation – may further complicate the process by introducing human mistakes, inaccuracies, and delays, resulting in highly clogged collections.

In the era of shifting financial ecosystems, the decision to use automation for accounts receivable must be carefully considered.

Let’s go through the importance of automation in more detail before we get into the best techniques you may use.

Why is Receivable Automation a Great Option for your Business?

Automating accounts receivables is the only way to truly grow your business by increasing collections and minimizing bad debts.

One of the most effective ways to improve your bottom line as a company is to improve cash flow. By increasing cash flow, you will be able to free up more capital for debt repayment, profit sharing and other important business activities. One way that businesses can increase their cash flow is by automating accounts receivable.

Accounts receivable refers to money owing to your company for goods or services provided. Because your order-to-cash cycle is primarily reliant on your AR, it’s critical to maintain essential functions like efficient invoicing, optimal days sales outstanding (DSO), quick resolution of a dispute, and so on. Apart from executing these key responsibilities, the following are the primary reasons why accounts receivable automation is convenient:

-

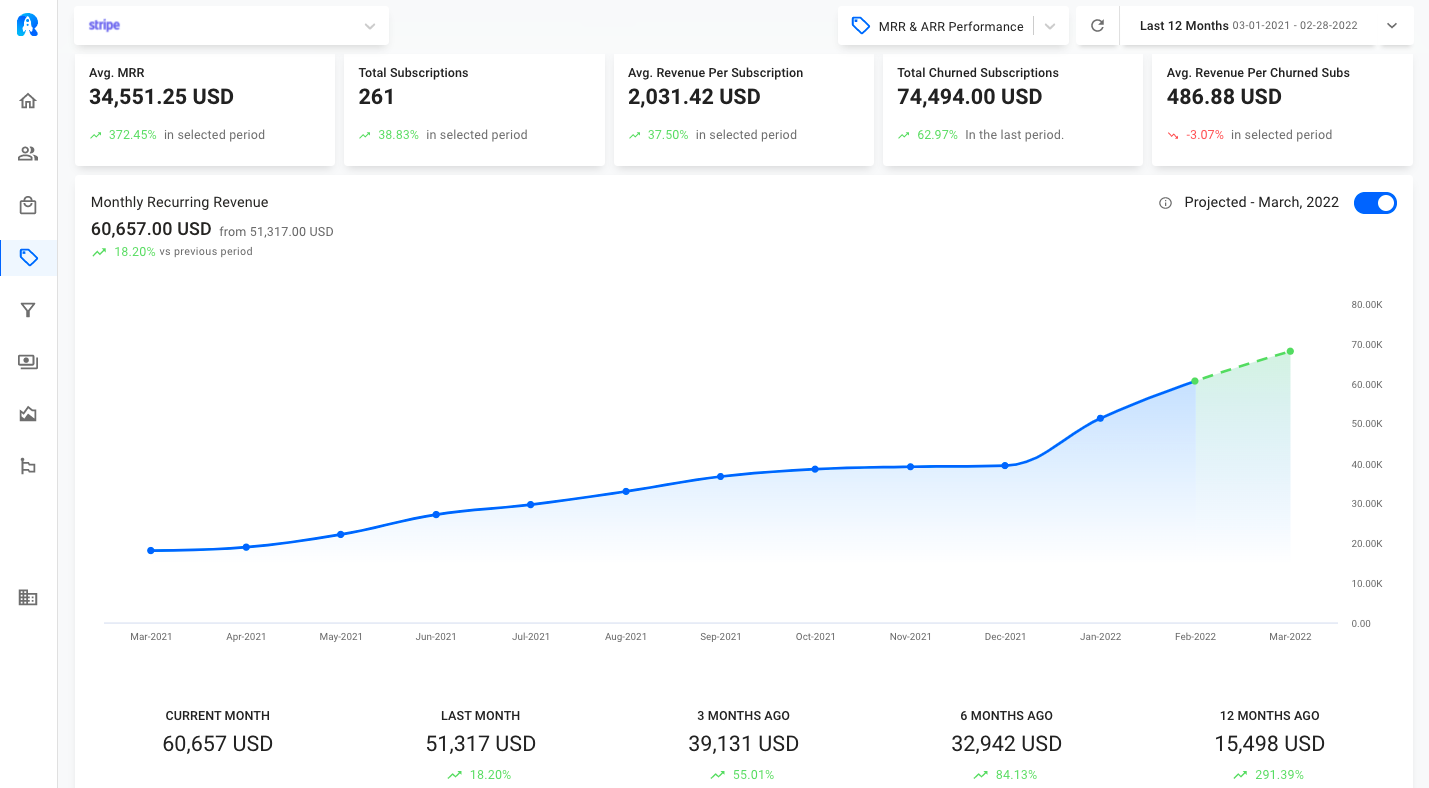

A/R Dashboards

The majority of automation systems include interactive analytics dashboards. They provide precise and useful information on key performance indicators (KPIs) such as days sales outstanding (DSO) and collection effectiveness index (CEI), allowing you to make smart financial decisions.

-

Saving both: time and human effort

The primary role of automation is to provide logic around your accounts receivable process, including which customers to charge, how to bill, when to charge, and for what.

Assume a customer has a one-year contract. The first quarter went well, but the customer requested that certain modifications (such as add-ons, upgrades/downgrades, and so on) be made during the second quarter. As a result, you manually alter the subscription cost. But think if you had hundreds or thousands of customers instead of one — it would be impossible for any business to do this manually.

-

Lower Bad Debt and Predictable Cash Flow

Another significant benefit of automating accounts receivable is having a consistent cash flow for your business. Without automation, your forecast may be entirely off the mark. You can automate Payment alerts, reminders, and emails to guarantee timely collection. Automation will assist you in staying on top of your collections process, guaranteeing regular cash flow, and reducing bad debts.

Account Receivable Automation Best Practices

Here are 6 key tips for automating your AR:

1) Guarantee that operations are holistic

While your initial focus should be on accounts receivable administration, don’t forget that activities such as invoicing and revenue recognition substantially benefit the whole AR process. Avoid the complexities of spreadsheets by automating your revenue workflow from sales order through revenue recognition:

Create a streamlined billing system and automate invoicing logic. Adhering to ASC606 and IFRS15 revenue recognition rules can help you arrive at an accurate valuation.

2) Include your accounting department

While determining whether to use automation software is a high-level choice, your accounting staff should address the issue of which tool to acquire and what features are required. They understand the intricacies of your accounting procedures and, as a result, are the most knowledgeable about the different pain points your business is now experiencing and how to effectively address them.

Also, ask your team to explain and clarify workflows. A typical AR process might comprise several phases related to sales and delivery (communication with the client), bills (invoice issuing), payment collection, and reconciliation. Mapping out a system of your processes allows you to determine what to streamline and automate, as well as what unnecessary tasks you can eliminate to decrease payment friction and simplify billing interaction.

3) Assure that the technology stack is seamlessly integrated

Almost every business has payment gateways and accounting software in place before deciding that the functionality is limited in certain aspects and that they need to upgrade to a more complete billing system to achieve growth.

And, if you decide to use such a tool, the first thing you should ask is, “Will this tool integrate easily into my currently existing tech stack?” If the answer is no, it may wind up being more time-consuming and expensive than you anticipated, and the switch to another tool becomes a pain rather than a problem-solver.

Radix, for example, connects smoothly with platforms such as PayPal and Stripe, enabling you to:

- Track subscriptions

- Analyze customers

- Track overall revenue numbers.

- Set up dashboards and receive detailed reports to make data-driven decisions.

4) Encourage upfront payments

Create payment terms that provide incentives for customers to pay early (or penalties for persistent late payers). If you can afford it, give early or upfront payment discounts; you may even go ahead and provide incentives to customers who pick yearly payment plans. Even big discounts may be better than receiving no money at all in some cases. This agreement will benefit both you and your customers. Keep note of how the discounts affect your bottom line, though.

5) Make absolutely sure disputes are resolved quickly

If sales are important to your enterprise, you need a plan to manage Accounts Receivable (A/R). If you wait until a customer files a dispute, it’s too late. You need preventative measures that will minimize sales loss. An effective A/R management process creates quick dispute resolution, which will lead to better sales retention rates and satisfied customers. You may not think about it day-to-day. But, if you’re like many businesses today, you’re losing thousands of dollars per month because of slow or nonexistent A/R response processes.

6) Receivable Automation: Set up an AR Dashboard

Build dashboards for your AR analytics to make tracking easier. Your dedication and discipline in measuring the proper KPIs and spotting insightful trends will determine the difference between a healthy and a not-so-healthy cash flow.

Radix provides the insights you need to identify and align your organization’s growth strategy. Create your dashboards, display your growth stats, and more. Here are some examples:

Create a Free Account Here!

Conclusion

In this guide, we hope we’ve covered the basics of Accounts Receivable Automation best practices. However, “best practices” itself is an inherently subjective term. In other words, automation will never take the human element out of accounts receivable. Rather, the two are meant to work together to achieve a better end result and a more effective way of handling invoice processing.

Read More:

Improve MRR Performance:10 Tips for Improving Your MRR for Better Business Growth

Churn Analysis in SaaS Business

Forecast & Simulate with Radix For Free (MRR/ARR, Churn, and more)