When it comes to running a business, it’s important to keep track of your financials. Two key metrics that people often confuse are revenue and profit. While they may seem similar, they are actually quite different. In this article, we’ll take a closer look at what revenue and profit are, how they differ, and why it’s important to understand the distinction.

What is Revenue?

Revenue is the total amount of money a company brings in from sales or other sources of income. It’s the money that flows into the business before any expenses are subtracted. Revenue can come from a variety of sources, such as product sales, services rendered, investments, and more.

For example, let’s say a company sells t-shirts. If they sell 1,000 t-shirts for $20 each, their revenue would be $20,000. This is the total amount of money the company brought in from selling t-shirts.

It’s important to note that revenue does not take into account any expenses or costs associated with running the business. This means that even if a company has high revenue, they may not necessarily be profitable.

What is Profit?

Profit, on the other hand, is the amount of money a company has left over after all expenses have been subtracted from revenue. In other words, it’s the money the company actually gets to keep. Profit is what allows a business to reinvest in itself, pay dividends to shareholders, and grow over time.

Using the same example as before, let’s say the company sold 1,000 t-shirts for $20 each, but it cost them $10 to make each shirt. This means their total expenses for the 1,000 shirts would be $10,000. To calculate profit, we would subtract the total expenses from the total revenue:

Profit = Revenue – Expenses

P = $20,000 – $10,000

Profit = $10,000

In this example, the company’s profit would be $10,000. This is the amount of money they have left over after all expenses have been paid.

Why Understanding the Difference is Important

Understanding the difference between revenue and profit is crucial for running a successful business. While revenue is important, it’s not the only factor to consider. A company could have high revenue, but if their expenses are also high, they may not be profitable.

Profit, on the other hand, is a key indicator of a company’s financial health. It’s what allows a business to continue operating, grow over time, and reward shareholders. If a company is consistently profitable, it’s a good sign that they have a solid business model and are managing their expenses effectively.

In addition, understanding the difference between revenue and profit can help business owners make more informed decisions. For example, if a company has high revenue but low profit, they may need to take a closer look at their expenses and find ways to cut costs. On the other hand, if a company has low revenue but high profit, they may want to focus on increasing sales or exploring new revenue streams.

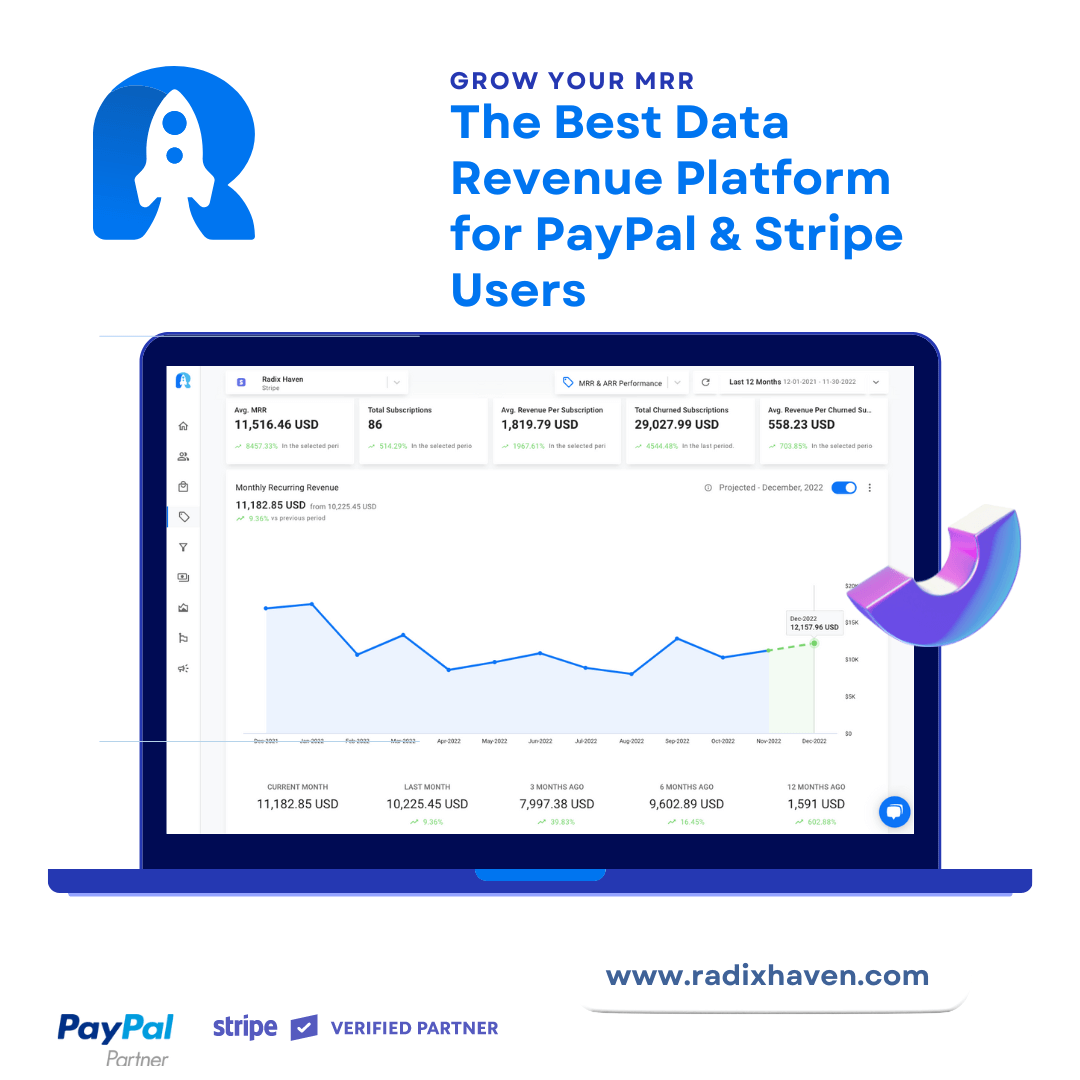

Using Radix to Collect and Visualize Revenue Data

One of the most important aspects of understanding revenue and profit is being able to track and analyze your financial data. This is where Radix comes in. Radix is a powerful tool that allows you to collect, analyze, and visualize all of your revenue data in one place.

With Radix, you can track your revenue and expenses in real-time, so you always know where your business stands financially. You can also create custom reports and dashboards to get a more in-depth view of your financial data and identify areas for improvement.

In addition, Radix makes it easy to share your financial data with others, such as investors, board members, or accountants. This can help build trust and transparency, and ensure that everyone is on the same page when it comes to your business’s finances.

One of the key benefits of using Radix is the ability to visualize your revenue data in a variety of ways. This can help you identify trends, spot anomalies, and make more informed decisions about the direction of your business. For example, you could create a chart that shows your revenue over time, broken down by product or service. This could help you identify which products or services are most profitable, and where you may need to focus your efforts.

Another benefit of using Radix is the ability to track your expenses and identify areas where you may be overspending. By analyzing your expense data alongside your revenue data, you can get a more accurate picture of your profitability and identify areas where you may be able to cut costs.

Conclusion

In conclusion, understanding the difference between revenue and profit is crucial for running a successful business. Revenue is the total amount of money a company brings in, while profit is the amount of money left over after expenses are subtracted. While revenue is important, it’s not the only factor to consider when evaluating a company’s financial health. Profit is a key indicator of a company’s ability to grow, reward shareholders, and sustain itself over time.

To track and analyze your revenue data effectively, it’s important to use a tool like Radix. Radix allows you to collect, analyze, and visualize all of your financial data in one place, making it easier to identify trends, spot anomalies, and make more informed decisions about the direction of your business. So, if you want to take your revenue tracking and analysis to the next level, give Radix a try today.