Revenue recognition and revenue reconciliation are two terms that are often confused for each other. However, they are very different concepts. This article will explain what they mean and how to perform them properly in order to avoid making any costly mistakes when it comes to your customers’ payments.

Key Differences Between Revenue Reconciliation and Revenue Recognition

Revenue recognition is a one-time event that occurs after a sale has been made. Revenue reconciliation, on the other hand, is an ongoing process that occurs before a sale has been made.

- It is performed at the end of an accounting period (e.g., quarterly or annually) so as to recognize revenue in accordance with generally accepted accounting principles (GAAP). Revenue reconciliation involves determining how much money should be recognized based on whether or not there were any adjustments made during the period(s) being reported on in order to account for any changes over time in what was originally recorded in your books as revenue during those periods.*

What Is Revenue Reconciliation?

Revenue recognition is a process of recording revenue at the time that it’s earned. It’s used to ensure that all transactions are accounted for correctly and allows you to prepare accurate financial statements.

However, there are times when you need to reconcile your transactions with what was originally recorded in your accounting records. This is known as a reconciliation because it allows you to compare them and make sure everything lines up properly.

The main difference between revenue recognition and reconciliation is that revenue recognition occurs only after an event has occurred—revenue has been earned or received by the company—while reconciliation requires comparing two sets of numbers before an event takes place: one set from accounting records (the original) versus another set from actual results generated during operation activities (the current).

How To Perform Accurate Revenue Reconciliation

In order to perform accurate revenue reconciliation, you need to:

- Identify errors in your billing records.

- Correct them by reviewing each customer’s credit card statement and adjusting the amount of sales that were recorded during that period. You can use a spreadsheet or other software as a guide for this process if you’d like.

-Accurate revenue reconciliation is essential to your business. If you want to ensure that you’re charging the correct amount for each transaction, then it’s important that you do so on a regular basis. If not, then there’s a chance that you could be overcharging some customers and undercharging others. This could lead to problems with cash flow down the line if you don’t address these issues as soon as possible.

The Future of Revenue Reconciliation

This process is a critical part of accounting. It’s an ongoing process that helps you make sure that all of your revenue is being recognized correctly and in the right amounts.

Revenue recognition is only one part of the overall revenue reconciliation process, but it’s an important one that has been used for years by many companies who want to ensure they’re reporting accurate information about their sales. In fact, some experts predict that we’ll see more demand for revenue reconciliation as technology continues to improve—and as more companies try out new ways of doing things like virtualizing their operations or moving to digital channels (e-commerce).

Accurate revenue reconciliation can help you identify and correct errors in your billing records.

Revenue recognition is the process of recording revenue in your financial statements, while revenue reconciliation is an accounting process that involves comparing your recorded revenue with the actual amount. A mistake in recording can lead to inaccurate reporting of expenses and assets on your balance sheet, which can result in lower profitability, or even bankruptcy if this error goes unnoticed for too long.

The difference between these two types of accounting procedures lies in their purpose:

- Revenue recognition allows you to account for transactions at some point during or after they occur;

- The second one is used to determine whether there are differences between what was reported as income in a given period (revenue) versus what was actually received (expenses).

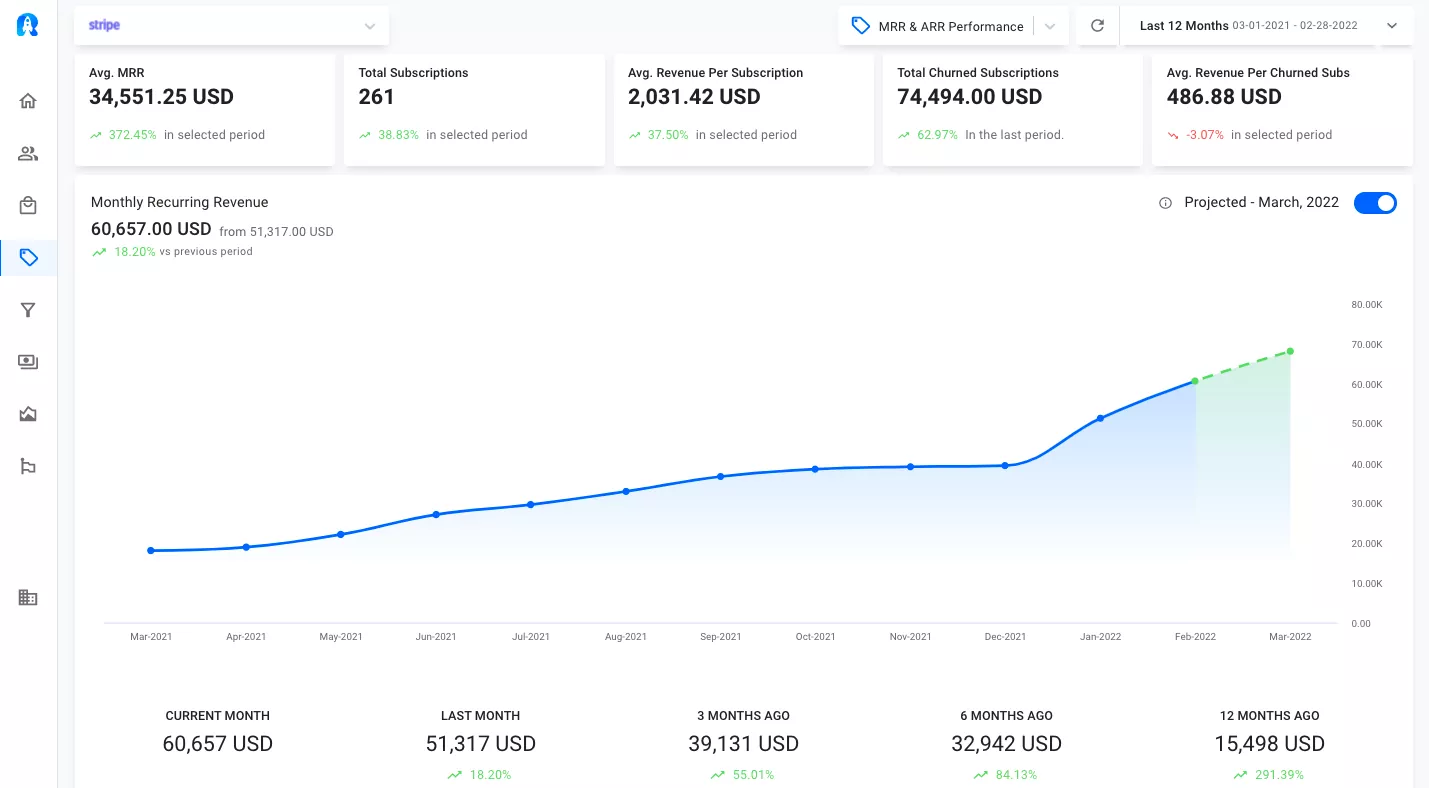

Track your Revenue Accurately with Radix

- Track your MRR movement in real-time.

- Understand your MRR Growth Rate % MoM.

- Forecast your MRR performance.

- Calculate your Annual Recurring Revenue (ARR).

- Increase your MRR consistently.

Conclusion

Although revenue recognition and revenue reconciliation are closely related, they do have some subtle differences. The first one allows you to recognize revenue when it has been earned, while the second one is performed after the fact to account for errors in your records. If you use the right tools and processes, however, both procedures can be easy and efficient.