SaaS companies are constantly under pressure to increase their revenues and decrease their costs. In this environment, it’s easy for payments to go wrong. However, there are ways you can avoid SaaS failed payments and keep your business running smoothly:

Understand the reasons for failed payments.

You can avoid failing payments by understanding the reasons behind them. Here are some of the most common reasons:

- Credit card security issues. If your credit card processing is not secure and protected, it may be impossible for customers to complete their transactions online without risking fraud or identity theft.

- Payment processing errors. If your customer’s bank is unable to process a transaction because of an issue with your payment gateway, you’ll need to troubleshoot this problem before issuing refunds or credits back into their account (and potentially losing revenue).

- Your customer’s bank’s policies/customer support services (like Apple Pay). If there are any issues with how Apple Pay works with certain banks—or if there are other problems related to how these services work across different platforms—you’ll want to make sure that everyone involved knows about those limitations so that no one gets stuck trying something out only for it not working properly due its lack of knowledge about such things beforehand!

Customer churn

Churn is a natural part of SaaS. Customers who have not paid for your service or used it for a long time are likely to churn. If you have any customers whose behavior is suspicious, contact them immediately and try to resolve the issue before it gets worse.

Check why payments are failing and how often they’re failing.

- Check your payment processor’s dashboard.

Payment processors offer a variety of tools to help you with your SaaS payments, including:

- API: An API is a way to connect with the payment processor and get information about how often payments are failing and why they’re failing. This can be useful when troubleshooting payment failures, but also for tracking general analytics about how customers interact with your product.

- Documentation: The documentation page for each payment processor should be easily accessible from their website; if not, look for it on the Provider Directory page.

Identify all of your failed payments, including declined and expired cards.

- Identify all of your failed payments, including declined and expired cards.

- Track customer payment history to help determine whether they have an active card and what type of card they have.

- Set up a system that automatically notifies you when a transaction has failed so that you can investigate immediately instead of waiting for the payment to post, which may take days or weeks depending on how far away from the last transaction date it is (and how many transactions were completed before that).

Contact your customers to understand why their payment failed.

You should also contact your customers to understand why their payment failed. Ask them to contact you directly and find out if they have a different card or any other information that can help you resolve the issue.

If the customer did not receive the email and was unable to reach you via phone, ask them to send another message through SMS or email (depending on what kind of communication method you use). If possible, try to resend the payment as soon as possible before your account expires in case there was an error with sending it back again.

Use a pre-dunning approach to help customers before their payment fails.

Another way to help avoid failed payments is by using a pre-dunning approach. Pre-dunning is good for your customer relationships, and it’s also good for you. It helps you avoid failed payments because it allows you to gather more information about each customer before they make their payment, which can then be used in the event of a failed transaction.

This type of pre-approach allows vendors to gain insight into how each client uses SaaS services and what kind of problems they encounter along the way—which are all factors that can contribute toward troubleshooting future issues down the road (and ultimately avoiding those dreaded “failed payment” notifications).

The best way to reduce SaaS failed payments is by understanding the reasons for them.

The best way to reduce SaaS failed payments is by understanding the reasons for them.

- Customer churn: This is probably the most common reason for your SaaS failed payment rate. Customers who begin using your product and then leave without paying can cause you a lot of headaches, especially if they cancel their subscription before the end of their trial period. If you don’t have good retention strategies in place, this could be a major problem that makes it difficult for you to recover from lost revenue in one fell swoop.

- Check why payments are failing and how often they’re failing: As mentioned above, there are many different reasons why a customer may not pay—and knowing which ones will help inform your strategy going forward so that next time around things go more smoothly when someone tries again!

Conclusion

We hope that by following these steps, you’ll be able to reduce your SaaS failed payments. If you have any questions or would like more information on how we can help with your SaaS payment issues, please contact us today!

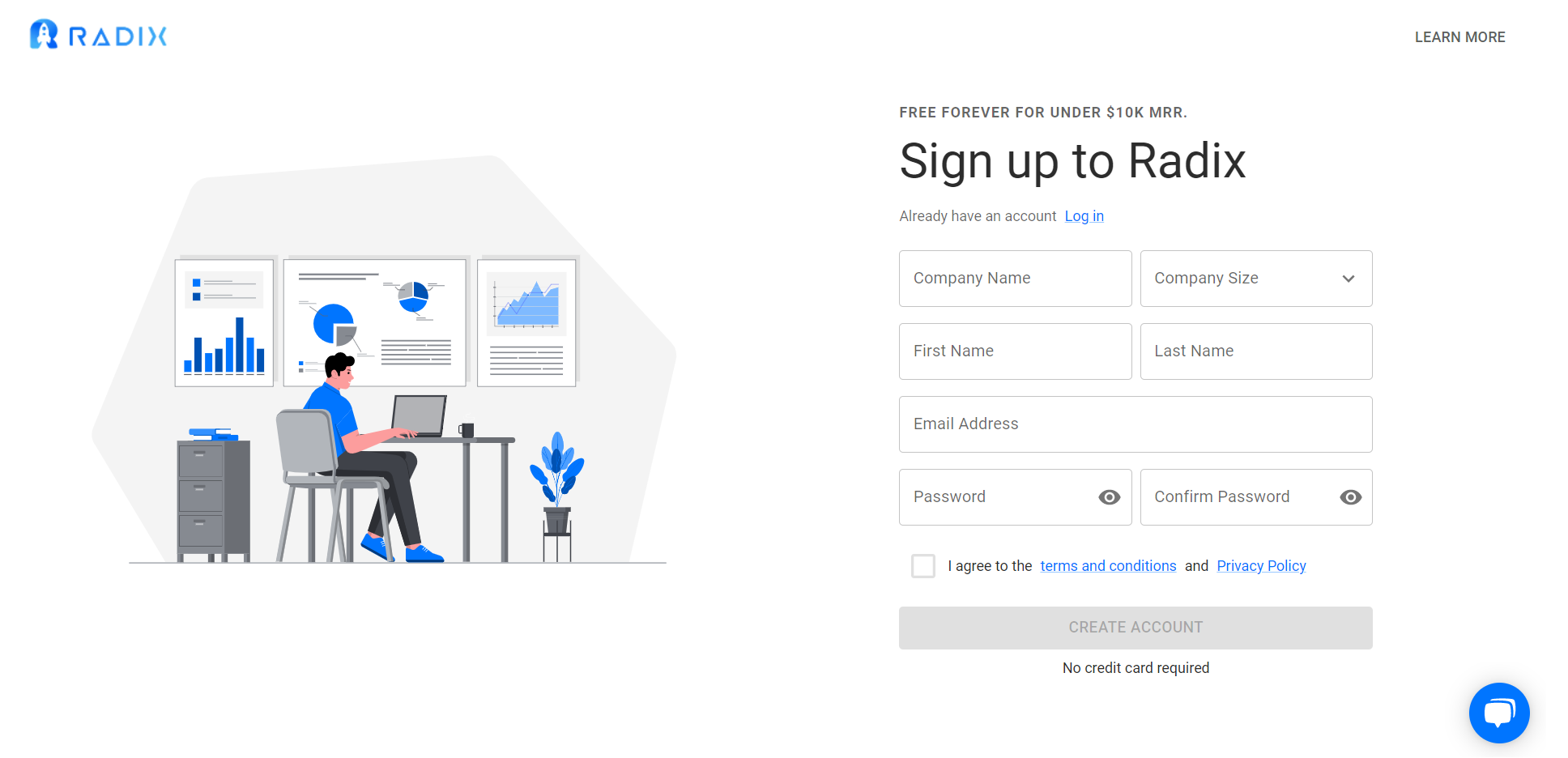

Remeber that with Radix you can track and analyze your SaaS failed payments.