If you’re running a SaaS (Software as a Service) business, it’s absolutely crucial to have a comprehensive financial model that accurately reflects the state of your company’s financial health. This financial model goes far beyond a simple balance sheet – it’s a dynamic tool that provides you with invaluable insights into your business’s revenue, expenses, profitability, and overall financial performance. Armed with this information, you’ll be better equipped to make well-informed decisions that can drive your SaaS venture towards greater success.

In this quick blog, we’ll delve deeper into the importance of SaaS financial models, xploring the key components that make up such a model and providing tips on how to create and use one effectively.

Understanding the Key Metrics

Before diving into the creation of a financial model, it’s essential to grasp the significance of key performance indicators (KPIs) that underpin your SaaS business. These metrics are the lifeblood of your business’s financial model and include:

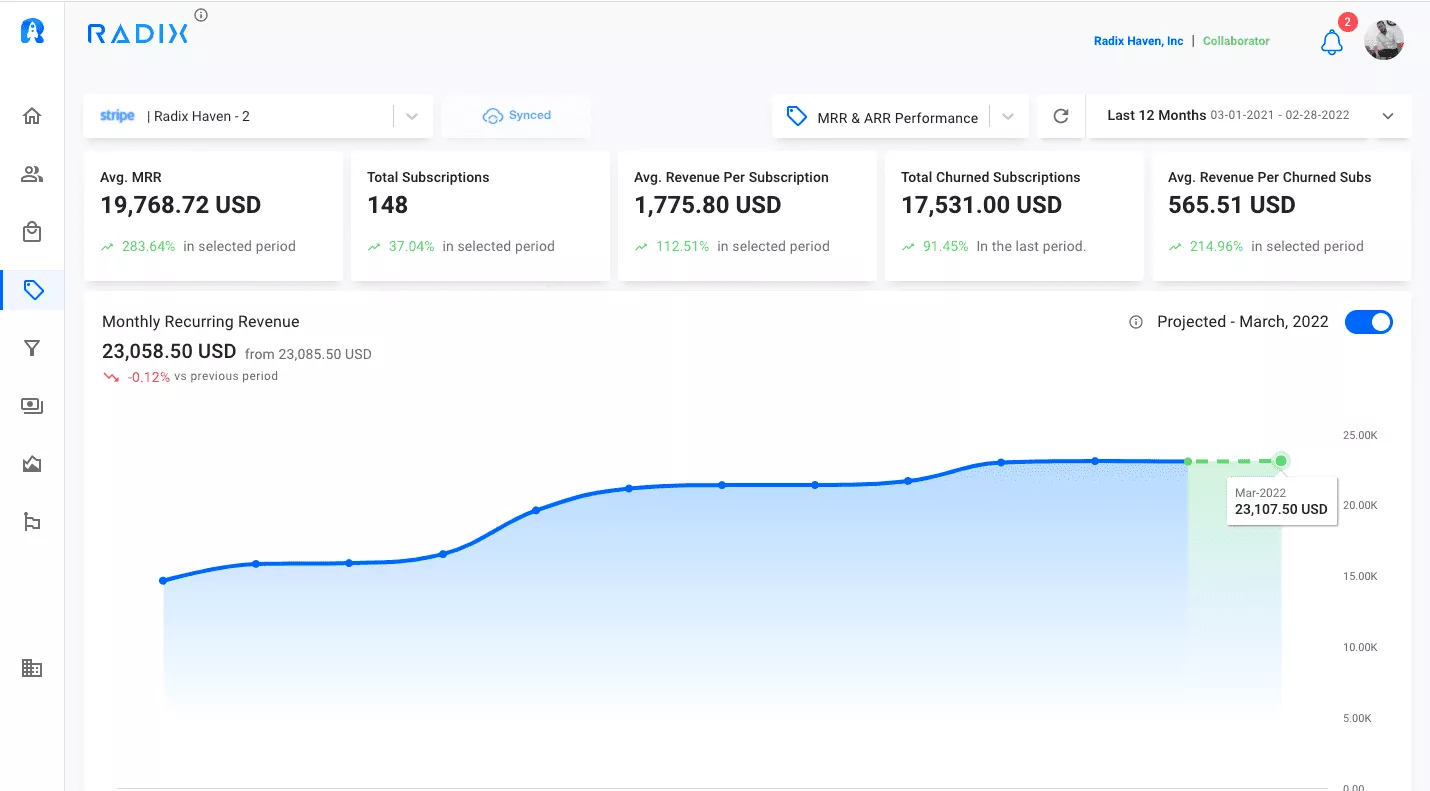

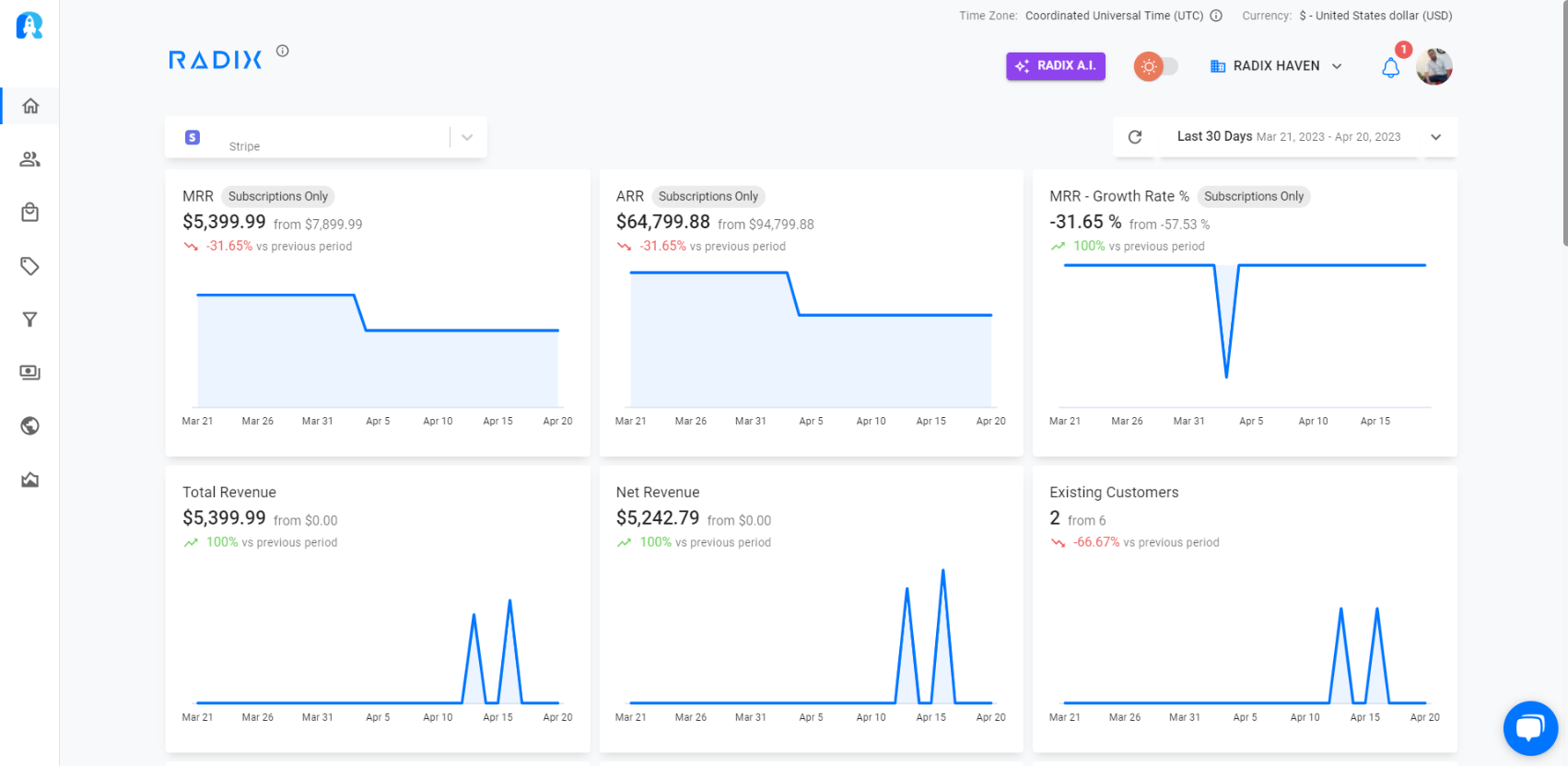

- Monthly Recurring Revenue (MRR): MRR is a fundamental metric in SaaS, representing the monthly revenue generated from your SaaS subscriptions. It’s crucial to track this consistently, as it forms the foundation of your revenue projections.

- Customer Acquisition Cost (CAC): CAC is the cost of acquiring a new customer, encompassing all expenses related to sales and marketing efforts. Keeping CAC in check is vital for maintaining a healthy profit margin.

- Lifetime Value (LTV): LTV represents the estimated value a customer will bring to your business over their entire lifetime as a subscriber. It’s a measure of long-term customer relationships and revenue potential.

- Churn: Churn, or customer churn rate, is the rate at which customers cancel their subscriptions. Minimizing churn is critical for ensuring a steady stream of MRR and profitability.

- Gross Margins: Gross margins reflect the difference between your revenue and the cost of goods sold (COGS). These margins are essential for understanding the financial efficiency of your operations.

Creating a SaaS Financial Model

Now that you have a solid grasp of these key metrics, it’s time to roll up your sleeves and create a financial model that accurately reflects your unique business needs. Your financial model should encompass the following essential components:

- Revenue Projections: Begin by projecting your monthly recurring revenue based on the number of customers and their subscription levels. This forms the backbone of your financial model, giving you a clear view of your income potential.

- Expenses: Include all of your expenses, such as salaries, marketing expenses, cloud infrastructure costs, customer support, and other overhead expenses. Accurate expense tracking is pivotal to understanding your cost structure.

- Cash Flow: Calculate your monthly cash flow by subtracting your total expenses from your revenue projections. A positive cash flow is vital to sustaining your operations and growing your business.

- Profit and Loss Statement: Finally, calculate your profit and loss statement, which includes your gross margin, operating expenses, and net income. This statement provides a snapshot of your overall financial performance.

Using Your SaaS Financial Model

Having developed a financial model tailored to your SaaS business, it’s equally important to use it effectively to drive decision-making and ensure your company’s financial stability. Here are some tips to make the most of your SaaS financial model:

- Track Your Metrics: Continuously use your financial model to track your key metrics, including MRR, CAC, LTV, churn, and gross margins. Regular monitoring is essential for identifying trends and potential issues.

- Make Informed Decisions: Utilize your financial model to make well-informed decisions about your business, such as when to hire new employees, invest in marketing campaigns, or adjust your pricing strategy based on customer behavior and profitability trends.

- Monitor Your Cash Flow: Your SaaS financial model should help you keep a close eye on your cash flow. Maintaining a healthy cash flow ensures that you have enough liquidity to cover expenses and seize growth opportunities.

- Iterate and Improve: Don’t treat your financial model as a static document. Regularly review and update it to reflect changes in your business landscape, whether that’s due to new product launches, shifts in customer behavior, or fluctuations in market conditions.

Conclusion

In conclusion, creating and using a SaaS financial model is an absolute necessity for any SaaS business that aims to accurately gauge and enhance its financial health. By understanding your key metrics, crafting a financial model that aligns with your unique business dynamics, and leveraging it effectively, you can make data-driven decisions that position your business for long-term success.

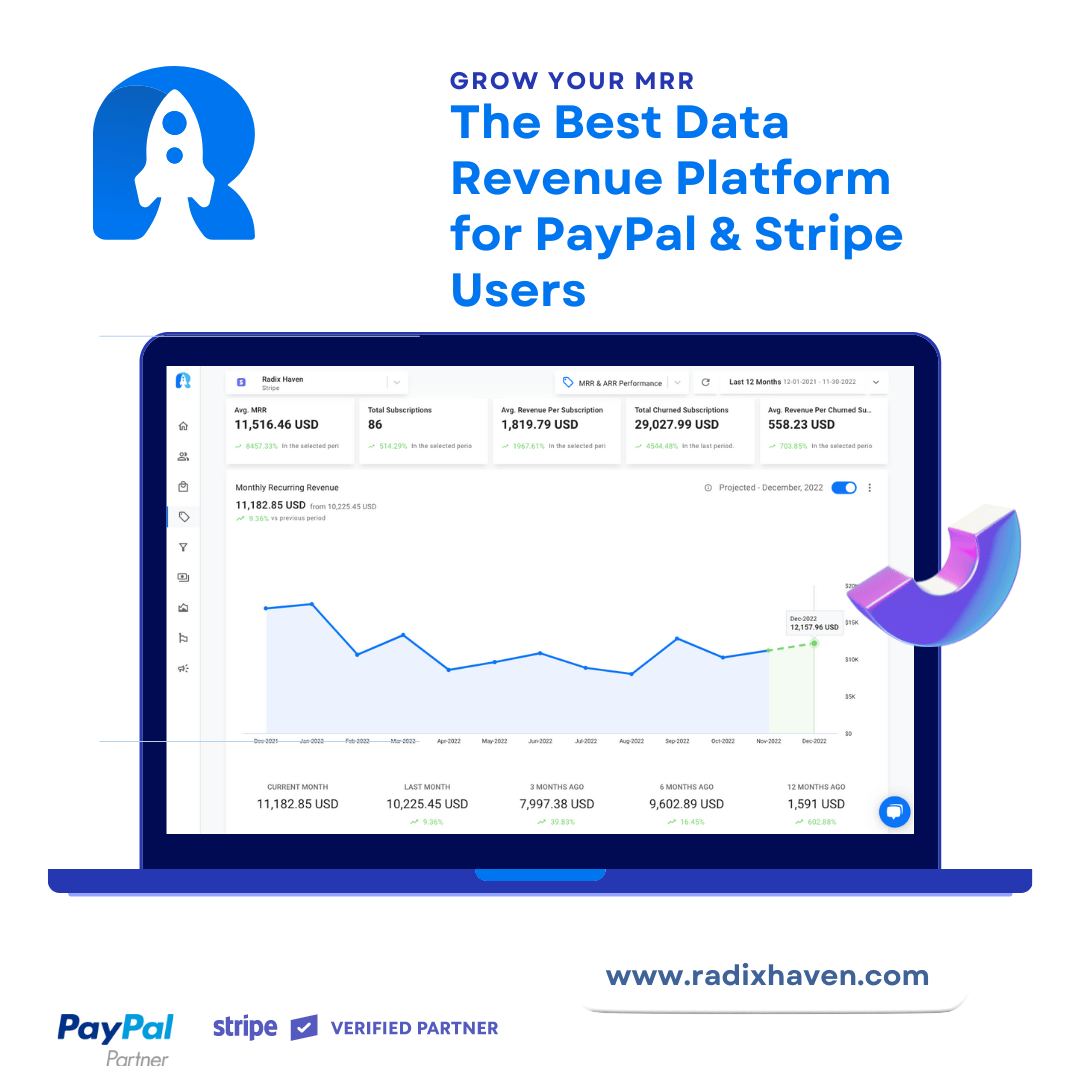

For businesses seeking to make the most of their SaaS financial model and gain a competitive edge, tools like Radix can be invaluable. Radix enables real-time monitoring of your revenue, expenses, and profitability, allowing you to make informed decisions and stay at the forefront of your financial health. Sign up for Radix today to supercharge your SaaS financial management and secure the financial future of your business.