If you’ve been following Twitter’s news, then you know that the social media platform has been in a bit of a slump. Its shares are down more than 50% from their peak earlier this year and have lost much of their value over the past 12 months. In particular, Twitter’s ad revenue is shrinking as users turn to other platforms for news and information. But one area where Twitter could be making up for lost ground is in subscriptions—and it appears that some investors are starting to agree.

Subscriptions have never been an important part of the company’s business model; they represent less than 1% of its total revenue today compared with over $3 billion in 2016 (according to data from Second Measure). That number will likely rise if Twitter can successfully monetize its new subscription service offering verification.

Twitter’s core product is free, and it gives away premium data for free

Twitter’s main product is free. It gives away premium data for free, and it has a reputation for being an analytics company.

Twitter has a lot of data about its users and their interests. It knows what they like, how they use Twitter, where they live (and maybe even who they are), what they tweet about most often…the list goes on!

This is valuable information, and Elon could use it in many ways. One of those ways is to sell that data to advertisers. Twitter’s main product right now is free data—so why not start selling it off?

It’s all about the ad revenue

The first thing to understand about Twitter’s business model is that it’s not just about advertising. It’s a free product, and its core users are incentivized to use it because of the engagement—if you don’t want to see ads, you can pay for premium data or go offline.

This may seem like an obvious point, but there are many investors who think otherwise. Some even consider Twitter as an ARR firm worth $1 billion if they were able to monetize some of its other products (e.g., Periscope).

In fact, one recent report predicted that “it could be worth billions within five years” without realizing what kind of role advertising plays in its overall revenue stream right now (and how much more valuable those ad dollars would make). So while we don’t know exactly how much money investors will make from subscriptions over time.

Twitter has an eye on new revenue streams.

Twitter is looking to diversify its revenue streams. The social network has been struggling to make money from advertising, which has become increasingly difficult as consumers’ attention spans shorten and they move on to other platforms.

Twitter also wants to create new revenue streams by charging users for premium data or subscriptions. If you watch more than one video per day on Twitter, you might be interested in this option if it’s offered by the company; otherwise, it’s not something that will affect your experience much at all (unless there are some videos that are particularly relevant).

How big is the subscription opportunity for Twitter?

Twitter is one of the most popular social networks in the world, with more than 320 million users generating billions of impressions per day. The company has built a reputation for innovation and experimentation, but it’s also faced some challenges along the way.

In 2015, Twitter began testing new features like Moments and Discover; designed to make browsing through tweets more engaging. This year, it launched its own news app called “Twitter Lite” for Android-based devices (and iOS later). It also announced plans to move away from SMS text messages in favor of using WhatsApp as a platform for communication between users and businesses—a change that will impact people who rely on SMS as their primary means of communication with friends or family members outside their immediate circle.

What are the potential implications for investors?

What are the potential implications for investors?

- The stock price has climbed more than 30% in the past six months, and the company’s ARR is up to $6 billion. This could mean that Twitter’s revenue growth rate will be higher than analysts predict, which would benefit investors’ returns.

- Its operating margins—the percentage of net income after tax (NIPT) that goes to shareholders—are higher than its peers. In other words, Twitter can afford to spend more on research and development or advertising because it already makes money from its products and services as well as from selling shares of stock at a large premium over their market price. This means that if you’re looking for an investment in social media companies today where there is high risk but potentially high reward (like Facebook), Google or Apple might not be your best option yet since their valuations have already reached lofty heights due to their dominance within this industry.”

Twitter’s new subscriptions may add $1 billion in revenue by creating less churn.

Twitter has been looking for ways to make money off of its user base for some time now, and one way it has chosen to do so is through an $8 dollar verification.

Twitter has long been a free service, and many users have been upset by the idea of paying for something that they feel should be free. By requiring an $8 dollar verification, Twitter may be able to convince more people to sign up for the service in order to avoid having their accounts marked as fake or spam.

The company may also be trying to make a statement about its commitment to fighting fake accounts. In order for a user’s account to be verified, they must submit a photo of their passport or driver’s license and enter their credit card information in order for the verification process to begin. Such requirements could help cut down on people using fake accounts as well as prevent bots from signing up for Twitter in order to spread propaganda.

Conclusion

Twitter’s new subscription business model could be a big win for the company. It will help the company generate more revenue and build a sustainable platform, while also giving users more value for their money. We believe that Twitter has a massive opportunity ahead of them, which will likely lead to continued growth in revenue over time.

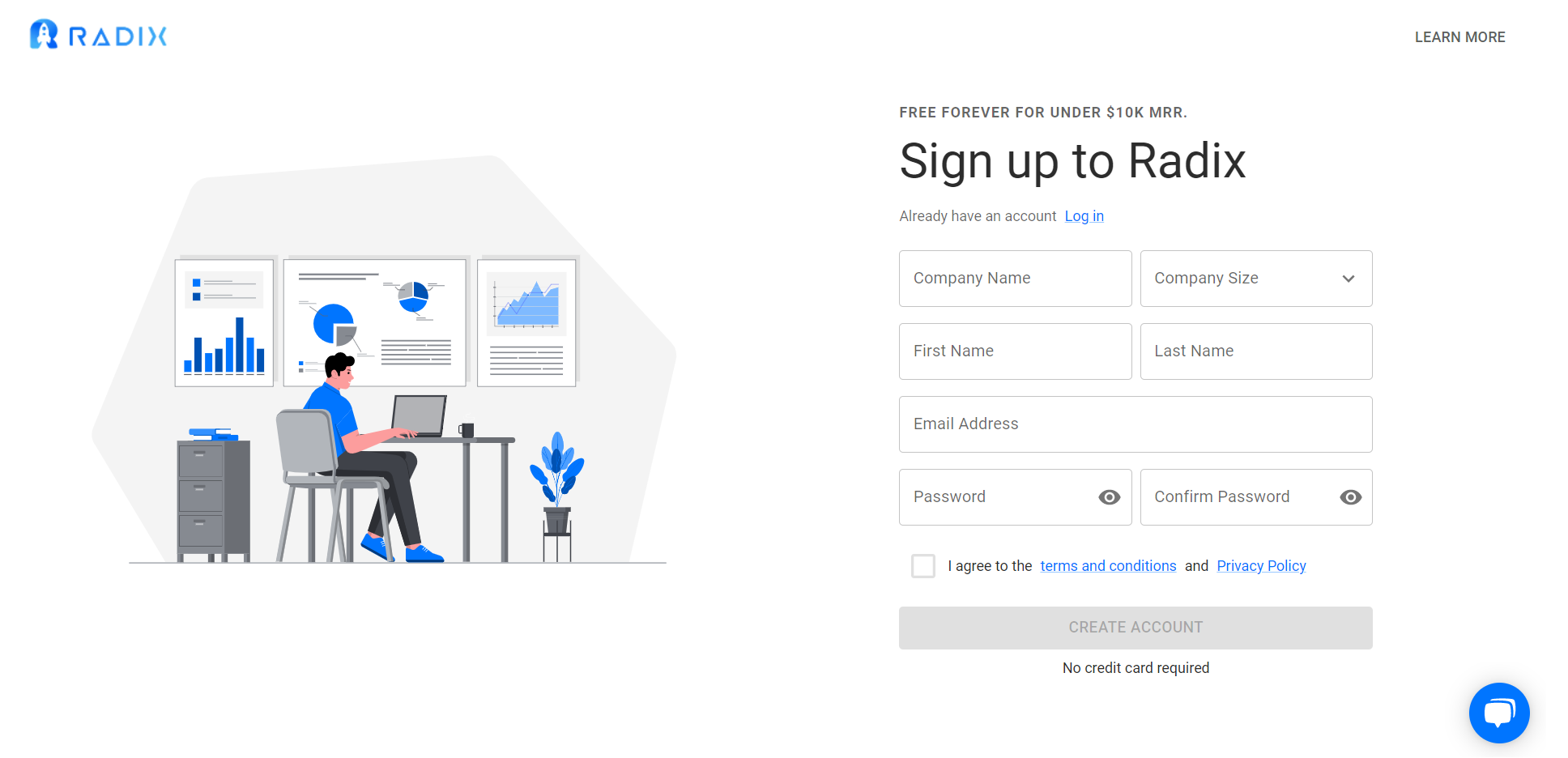

Remember that Radix can track and analyzeyour revenue data!

Learn more with our blogs