In the intricate world of accounting, where numbers dance to the tune of precision, understanding concepts like unearned revenue is crucial. Unearned revenue, also known as deferred revenue or deferred income, is a financial term that holds immense significance for businesses, particularly those with subscription-based services.

In this comprehensive guide, we will delve deep into the heart of unearned revenue. We’ll explore its definition, significance, and how to account for it. Additionally, we will discuss Radix, a cutting-edge data revenue platform, to help businesses monitor their subscription revenue in real time.

What Is Unearned Revenue?

Unearned revenue, as the name suggests, is income that a company receives before it has actually earned it. This is commonly found in businesses that offer services on a subscription basis, like software as a service (SaaS), magazine subscriptions, or even annual maintenance contracts. When customers pay for these services upfront, the company receives the money in advance, creating a liability on their balance sheet.

Significance of Unearned Revenue

Understanding unearned revenue is crucial for both financial reporting and planning. Here’s why it matters:

1. Accurate Financial Statements

Unearned revenue plays a vital role in creating accurate financial statements. By recognizing unearned revenue as a liability, a company reflects its obligations to provide services in the future. This ensures that financial statements reflect the true financial position.

2. Revenue Recognition

Companies need to adhere to accounting standards, such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Properly accounting for unearned revenue helps companies adhere to these standards, ensuring that revenue is recognized when it is earned, not when it is received.

3. Cash Flow Management

Unearned revenue can also serve as a valuable source of working capital. While the money is received upfront, it can be used to cover operational expenses or invest in the business before services are provided. This can be especially beneficial for startups and growing businesses.

How to Account for Unearned Revenue

Now, let’s delve into the nitty-gritty of how to account for unearned revenue. Properly accounting for unearned revenue is crucial for maintaining financial transparency and compliance with accounting standards.

1. Identify Unearned Revenue

The first step in accounting for unearned revenue is to identify it on your balance sheet. Unearned revenue is listed as a liability. This means it falls under the ‘liabilities’ section of your balance sheet. It’s crucial to keep a close eye on this figure as it represents your obligations to provide services in the future.

2. Recognize Revenue When Earned

Revenue should only be recognized when the related services or products have been delivered or when the earnings process is substantially complete. For subscription-based businesses, this means recognizing revenue over time, typically on a monthly or annual basis.

3. Adjust Journal Entries

To account for unearned revenue, you need to make journal entries. When you receive payment from a customer for a subscription, you debit the unearned revenue account and credit the revenue account. As you earn the revenue over time, you make adjusting entries to debit the unearned revenue account and credit the revenue account.

Here’s a simplified example:

Let’s say your business receives $12,000 from a customer for a year-long software subscription. Initially, you debit the unearned revenue account with $12,000 and credit the revenue account with the same amount. Over the course of the year, as you provide the service each month, you adjust your journal entries. For instance, after one month, you’d debit the unearned revenue account by $1,000 and credit the revenue account with the same amount.

4. Disclose in Financial Statements

Unearned revenue must be disclosed in your financial statements, typically in the footnotes. This provides transparency and clarity to investors, shareholders, and regulators about the company’s financial position and the extent of unearned revenue.

5. Regular Reconciliation

It’s essential to regularly reconcile your unearned revenue account with actual services provided. Ensure that the amounts are accurate, and make necessary adjustments when needed.

Radix: Monitoring Subscription Revenue in Real Time

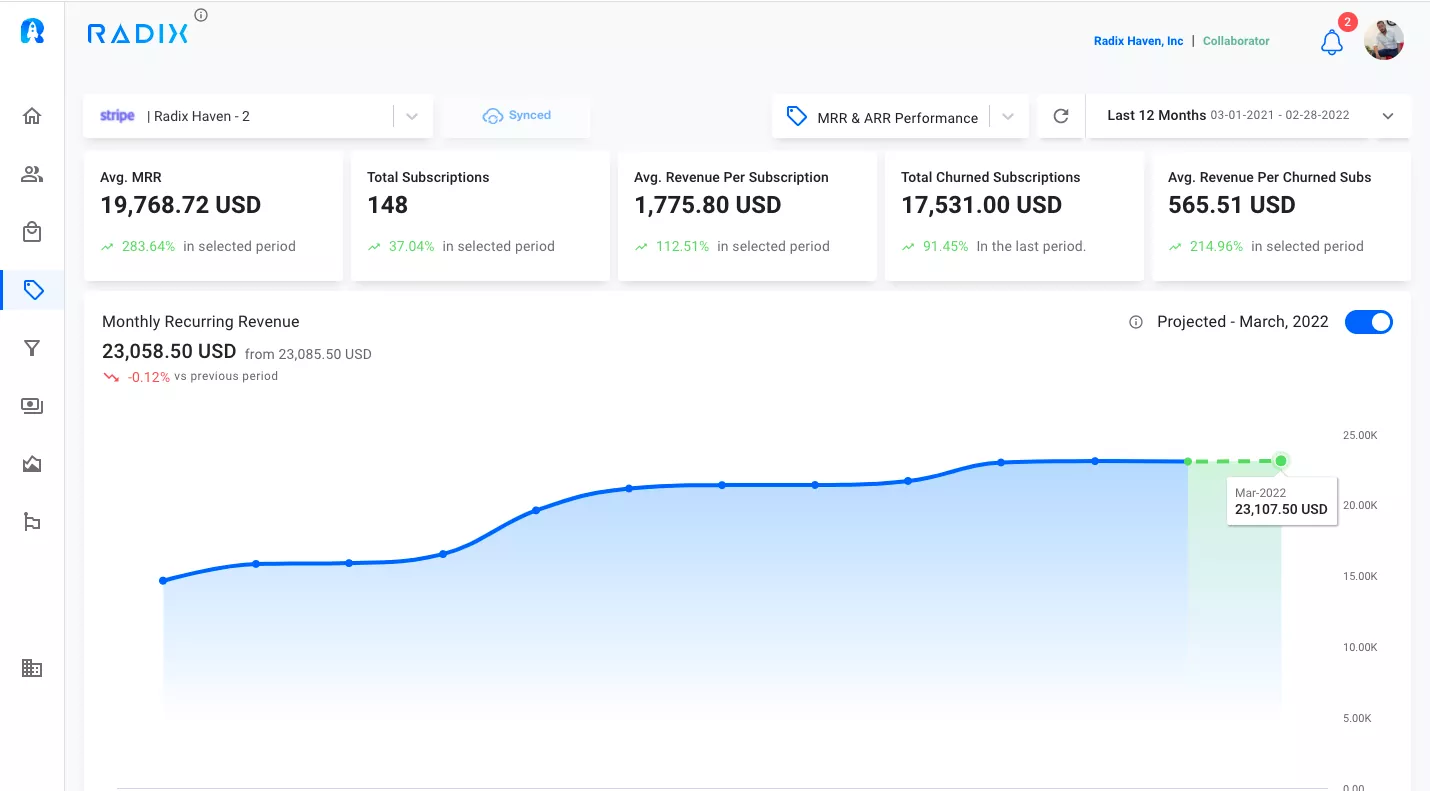

In today’s fast-paced business world, monitoring subscription revenue in real time is critical. It allows businesses to make informed decisions, adapt to changing market conditions, and ensure the sustainability of their subscription-based services. Radix, the best data revenue platform, is designed to do just that.

What Is Radix?

Radix is a cutting-edge data revenue platform that empowers businesses to monitor their subscription revenue in real time. This innovative solution provides a comprehensive set of tools to track, analyze, and optimize subscription revenue, ensuring your business operates at its full potential.

Key Features of Radix

Radix offers a plethora of features that make it an indispensable tool for businesses relying on subscription revenue:

1. Real-Time Revenue Tracking

Radix provides up-to-the-minute insights into your subscription revenue. With real-time tracking, you can quickly identify trends and make immediate adjustments to your business strategy.

2. Advanced Analytics

The platform offers advanced analytics that help you understand customer behavior, subscription churn rates, and revenue growth patterns. These insights are crucial for making data-driven decisions.

4. Subscription Lifecycle Management

Managing subscriptions effectively is key to optimizing revenue. Radix streamlines subscription lifecycle management, making it easier to acquire, retain, and upsell customers. Start your free trial here

5. Integration Capabilities

Radix is designed to integrate seamlessly with PayPal and Stripe in less than 10 minutes.

6. Automated Alerts

Stay ahead of potential issues with Radix’s automated alerts. Receive notifications about subscription renewals, payment failures, or other critical events that require your attention.

7. Forecasting and Budgeting

Radix helps you make informed financial decisions with its forecasting and budgeting tools. Plan your revenue and expenses with confidence based on historical data and market trends.

How Radix Helps with Unearned Revenue

One of the most critical aspects of managing subscription-based revenue is tracking unearned revenue accurately. Radix streamlines this process by automating the accounting entries related to unearned revenue and recognizing it as services are provided. This ensures your financial statements are always up to date and accurate.

Furthermore, Radix provides valuable insights into unearned revenue trends, allowing you to predict future cash flows, assess the impact of subscription changes, and make informed decisions about resource allocation.

In summary, Radix is a game-changer for businesses seeking to maximize their subscription revenue. It not only ensures that unearned revenue is accounted for accurately but also provides the tools to optimize your subscription business and drive sustainable growth.

Conclusion

Unearned revenue is a fundamental concept in the world of accounting, particularly for businesses with subscription-based services. It plays a crucial role in maintaining financial transparency, adhering to accounting standards, and optimizing cash flow. Properly accounting for unearned revenue ensures that businesses can accurately represent their financial position and make informed decisions.

Additionally, the emergence of innovative solutions like Radix has revolutionized the way businesses monitor subscription revenue. With real-time tracking, advanced analytics, Unearned revenue is more than just an accounting concept; it’s a reflection of a business’s commitment to delivering value over time. By accurately accounting for unearned revenue and using tools like Radix, companies can build strong, lasting relationships with their subscribers and ensure the long-term success of their subscription-based services.

Track your revenue numbers accurately today