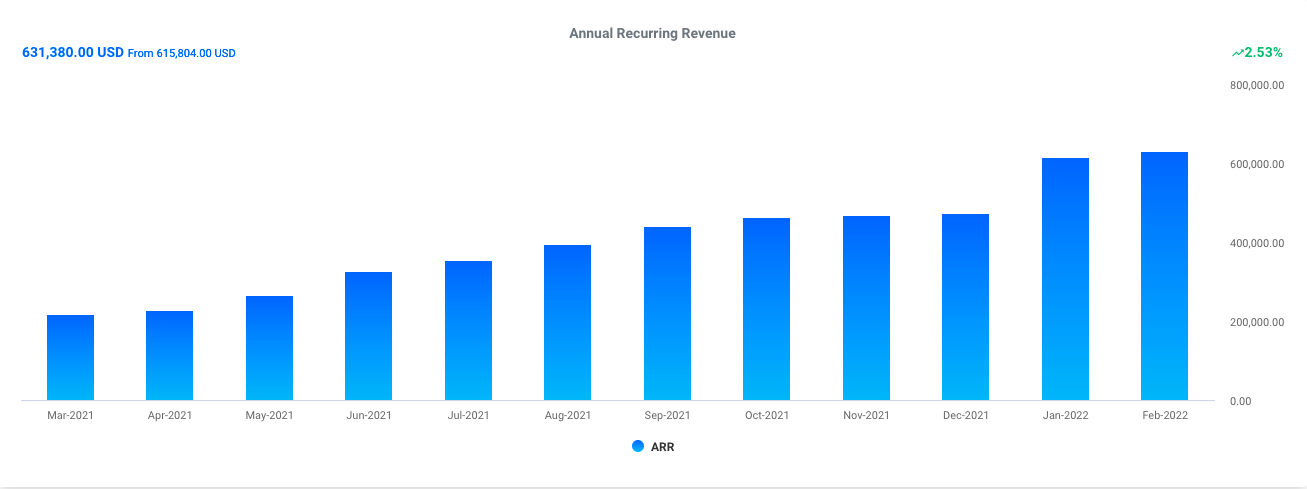

Annual Recurring Revenue or ARR is a metric that allows companies to determine their recurring revenue. Annual recurring revenue is derived from dividing your annual revenue received by customers who agreed to make automatic payments for your services. The metric allows companies to analyze their ability to grow through subscription-based businesses ensuring a stable income.

Annual Recurring Revenue is a key metric that tells SaaS or subscription companies how much revenue they can expect from their customers each year.

Why is ARR Important?

The importance of Annual Recurring Revenue for software companies is the fact that it is the only metric that measures profitability, and companies’ bottom line. It helps the organization to focus on revenue and not just the number of units sold. In simple terms, ARR shows how much money a company is making per customer, in other words: ” Annual revenue per paying customer” or how much it costs to maintain one customer.

Annual Recurring Revenue is a useful metric for understanding two elements of a SaaS company’s revenue:

- Gained Revenue: as a result of new sales and upgrades (expansion revenue)

- Lost Revenue: as a result of customer churn and downgrades.

When calculated correctly, ARR is a solid measure of your company’s health and a good predictor of future revenue.

It also provides important context for other indicators. For example, suppose you have a churn rate of 6%. Is this cause for concern? Is it acceptable, or not? But, when you consider the churn in the context of the Annual Recurring Revenue, you can determine whether it is cause for concern or not.

Furthermore, rising SaaS businesses with a consistent flow of ARR have a higher chance of attracting more investors and keeping board members happy.

How to Calculate ARR

The calculation of ARR is easy. Here is the formula, as well as all you need to know about it. The following equation may be used to do it:

ARR = Total (Yearly Recurring Charge of all paying customers)

If you bill your clients on a monthly basis, you may calculate ARR as follows:

ARR = (Subscription Price) x (12/ Duration of subscription in months)

For example, if a client signs a two-year (24-month) contract for $50,000 that is invoiced monthly, your calculation is:

ARR = $50,000 multiplied by (12/24) = $25,000.

If you bill your clients on a yearly basis, you may calculate it as follows:

MRR = (Contract Price) / ARR (Duration of contract in years)

For example, if a client signs a four-year contract for $40,000, your Annual Recurring Revenue calculation is:

ARR = $40,000/4 = $10,000.

What to Consider When Calculating Annual Recurring Revenue

Because Annual Recurring Revenue is a calculation of all recurring subscription charges over a specified time, you must include the following elements:

Downgrade revenue: When a client switches from a higher value plan to a lower value plan, MRR Churn occurs. It is critical to include it in ARR calculations since it decreases the customer’s recurrent revenue.

Upgrade revenue: When a client changes from a lower value plan to a higher value plan, usually as a result of an upsell, the customer’s recurring revenue increases. As a result, you must include upgrade revenue in your ARR calculation.

Recurring invoices: It includes all recurring subscription income.

*Do not include:

- One-time fees

- Set-up fees

- Non-recurring add-ons

The Distinction Between ARR & MRR

Monthly Recurring Revenue (MRR) is the consistent recurring revenue generated by subscribers in a given month. MRR is classified into numerous categories, including new MRR, upgrade MRR, expansion MRR, and contraction MRR. On a monthly basis, this degree of information and division provides helpful insights. Tracking ARR makes more sense for organizations that offer yearly subscription contracts.

With that in mind, ARR and MRR are never mutually exclusive, as the former provides a long-term picture while the latter provides short-term insights.

Common Errors to Avoid When Interpreting Annual Recurring Revenue

- ARR is not cash

Cash is not the same as ARR.

When ARR is confused with cash, it can provide a distorted picture of how much money a company has.

- It is not a backward-looking metric

Another typical error is for companies to calculate it by summing up total revenue over the previous 12 months. Remember that it considers how much revenue you may expect in the future, not how much money you produced last year.

- Discounts are not taken into account

If you have provided your clients discounts or coupons, it indicates they are not paying the entire subscription amount. When calculating Annual Recurring Revenue, it is critical to account for discounts. For example, if the yearly subscription value is $20,000 and the client receives a 15% discount, the customer is only paying $17,000, and only that amount should be used for ARR computation.

- Not including late payments

Every company has late-paying clients. You can keep late payments in control by introducing a dunning procedure, but remember to include late dollar amounts in your Annual Recurring Revenue calculations.

Track & Analyze Your Saas or eCommerce ARR With Radix

The best thing about Radix is you do not need to be a high-powered mathematician to derive figures from your most important metrics. Just as long as you know your way around a dashboards, you can track and analyze your SaaS or Ecommerce ARR.

Sing Up Here!

Read More:

MRR: What is Monthly Recurring Revenue?

Improve MRR Performance:10 Tips for Improving Your MRR for Better Business Growth