Monthly Recurring Revenue (MRR) is a key metric for businesses that are monetized through subscriptions. When forecasting MRR, your main goal is to avoid booking too little revenue or too much of it. This article will explain how to forecast MRR for SaaS businesses and provide tips on how to test your predictions and avoid four common mistakes that are often made.

Recurring revenue is vital to subscription businesses. SaaS Businesses track a key indicator known as monthly recurring revenue to evaluate their progress (MRR). It’s the monthly revenue generated by subscriptions for the company. New subscriptions, cancellations, upgrades, and downgrades all affect this statistic.

Let’s look at what elements to consider and what to avoid when forecasting monthly recurring revenue.

How to Forecast MRR (Monthly Recurrent Revenue)?

Recurring revenue is the total income from recurrent payments. For effective budgeting and company planning, recurring income forecasting is critical.

To clarify, You can calculate and forecats Recurrent Revenue in two ways. For automated calculations, companies may employ forecasting recurring revenue software or manually compute revenue using spreadsheets.

For both methods, companies need to input key metrics about their subscriber base and subscription prices. The metrics include:

- Number of subscribers at the beginning of the period (month, year)

- Number of new subscribers

- Average revenue per user (ARPU)

- Churned recurring revenue (canceled subscriptions)

- Revenue gained through upgraded subscriptions

- Revenue lost to downgraded subscriptions

Let’s look at how to use these metrics to calculate monthly recurring revenue (MMR) and annual recurring revenue (ARR).

The fundamental formula for calculating MMR is straightforward:

Number of Monthly Subscribers x Monthly Subscription Price per User

Example: 50 monthly subscribers x $10 per user = $500

If your company has more than one subscription tier, calculate the MRR for each one and then sum them all up:

(Number of Tier 1 Monthly Subscribers x Tier 1 Price per User) + (Number of Monthly Tier 2 Subscribers x Tier 2 Price per User)

For Instance: (100 monthly Tier 1 subscribers x $10 per user) + (50 monthly Tier 2 subscribers x $20 per user) = $2000

Add the churned MRR, monthly upgrades, and monthly downgrades to the formula for an exact MRR calculation:

(Number of Monthly Subscribers x ARPU) – Churned Revenue – Downgrades + Upgrades

For Example: (100 subscribers x $20 per user) – $50 in churned revenue – $30 in downgrades + $100 in upgrades = $2,020

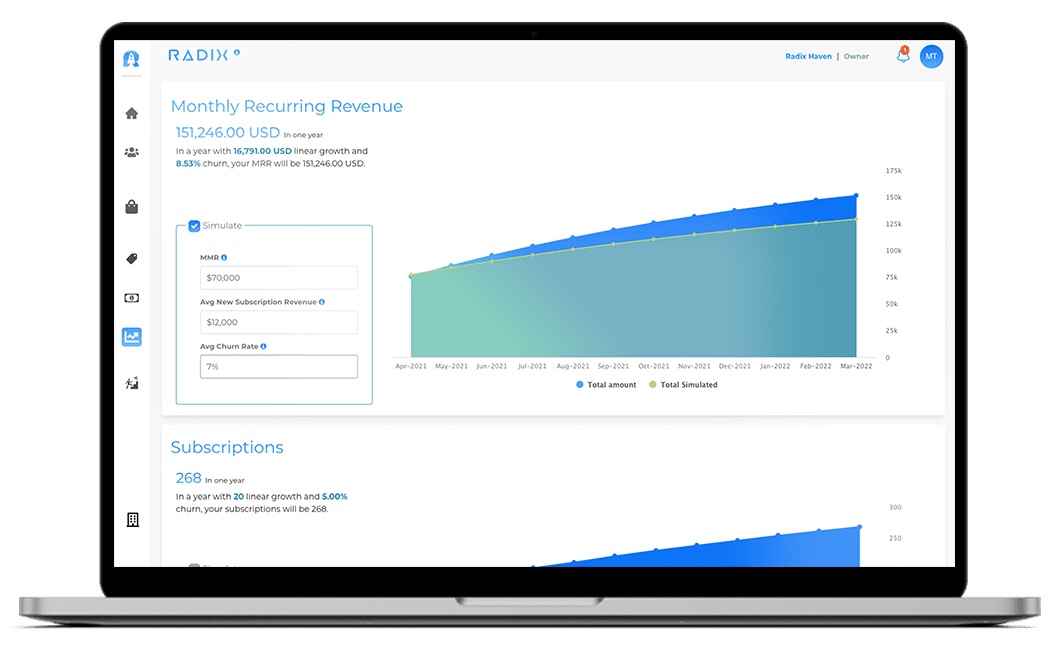

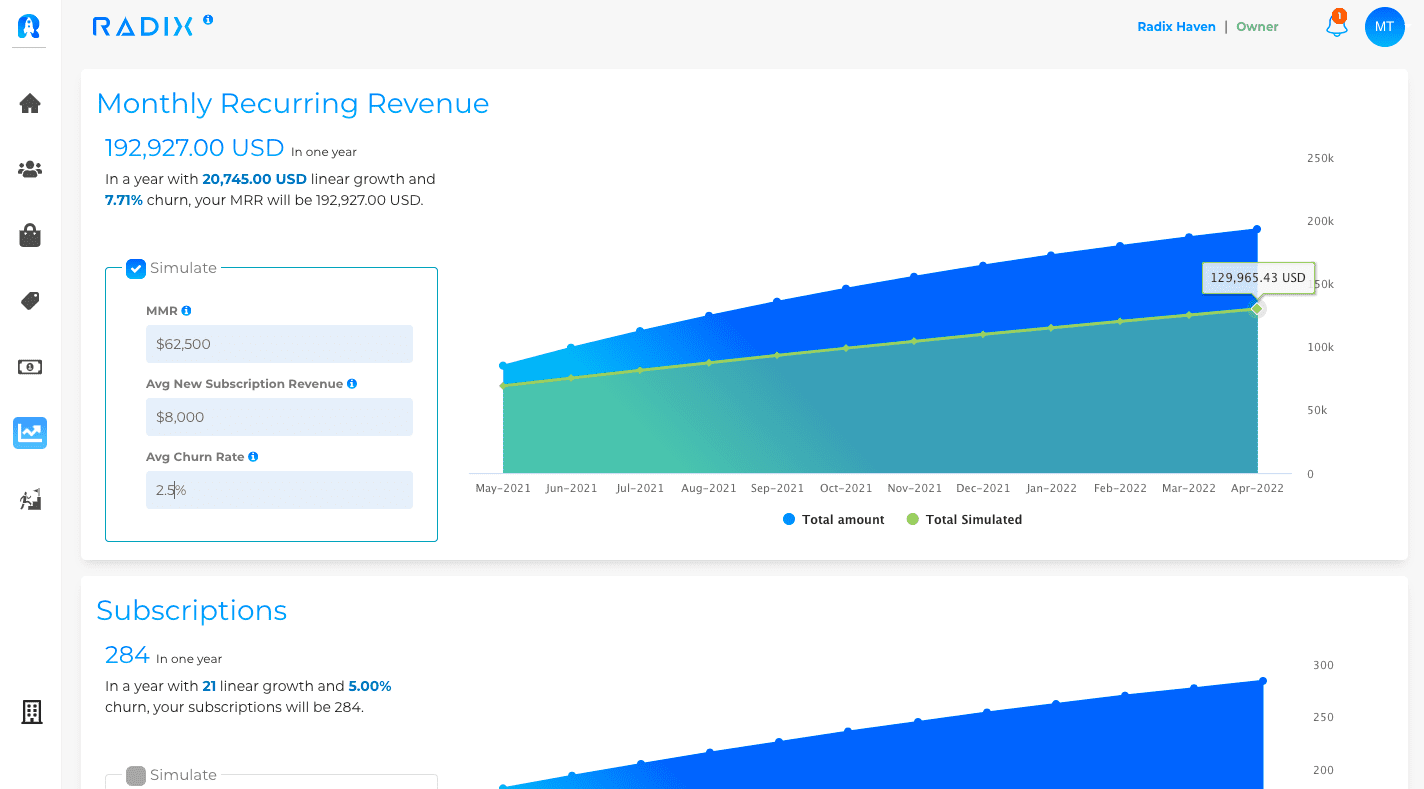

Radix has a forecast function that enables easy recurring revenue forecasting. You only need to link your PayPal or Stripe accounts and then magic will happen.

Forget about tedious spreadsheets and create your free account here!

What about ARR?

However, Annual recurring revenue (ARR) is the year-round equivalent of monthly recurring revenue. It uses the same fundamental formula as the MRR formula:

(Number of Subscribers During the Calendar Year x ARPU) – Revenue churned – Downgrades + Upgrades

In other words, You can calculate more easily ARR by multiplying MRR by 12. If memberships change a lot each month, this calculation may be inaccurate.

What Not to Do When Forecasting Recurring Revenue

When you forecast MRR or ARR, avoid the following mistakes (if you do it manually; with Radix you will not have to worry)

- Taking into account one-time payments. When you include one-time purchases into recurring revenue estimates, the outcome is an erroneous estimate of recurring revenue.

- Adding annual subscriptions to MRR. Annual subscription amounts must be divided by 12 for correct MRR calculations.

- Adding trial period subscriptions. In the e-commerce/SaaS space, adding trial periods is common. However, it’s something you should avoid when forecasting your recurring revenue. Trial periods are the devil in disguise when forecasting your recurring revenue.

- Neglecting discounts. Subtract processed discounts from the recurring revenue calculation.

Conclusion

In conclusion, Monthly Recurring Revenue (MRR) is the foundation of any customer-based company. Knowing what you have coming in each month means you can plan for growth and know how to support that growth once it happens.

Understanding how a company grows month after month requires forecasting monthly recurring revenue. The ability to quickly adjust sales, marketing, and customer service activities depending on subscriber behavior is enabled by meticulous monthly revenue tracking.

Use Radix to Forecast & Simulate your MRR to maake better financial and budgeting decisions based on your revenue data.

You will be able to:

- Predict your future MRR and Active Subscriptions for the next 3, 6, and 9 months.

- Secondly, Identify seasonal patterns based on your forecasts.

- Finally, Implement real-time action plans in an attempt to be proactive rather than reactive.

Sign Up Here!

Read More:

Forecast & Simulate with Radix For Free (MRR/ARR, Churn, and more)