Financial forecasting is the process of predicting the performance of a company in the future. Taking previous business performance, current business trends, and other factors into account is one way to accomplish this. It is important to note that based on the type and purpose of the prediction, some elements of financial forecasting may differ.

Why is it important?

In theory, failing to perform regular financial forecasting leaves you flying blind. Traditional forecasting provides several advantages for some of your company’s most important activities, including:

Budgeting during the year:

A budget depicts your company’s cash flow, financial situation, and future goals and expectations for a specific fiscal term. Financial forecasting and planning go hand in hand because forecasting provides insight into your company’s future; these insights assist make budgeting more precise.

Financial risk reduction:

By constructing a budget without financial forecasts, you risk overspending. In reality, without the outcomes of a financial projection, the majority of your financial decisions would be ill-informed.

Setting attainable company objectives:

Accurate forecasting will assist you in predicting whether your company will expand or decrease. As a result, you may set reasonable and attainable goals—as well as control your expectations.

Identifying potential issues:

By reviewing the company’s previous performance, financial forecasting can assist you in identifying current issues. You can also uncover prospective issues by gaining insight into what the future holds.

Attract possible investors:

Investors use a company’s financial projection to estimate its future performance—and the possible returns on investment. Furthermore, consistent forecasting demonstrates to your investors that you are in charge and ready for the future.

There are four major forms of financial forecasting

1) Income Forecasting:

Income forecasting implies estimating future income by studying the company’s previous revenue performance and present growth rate. It is required for cash flow and balance sheet forecasting. Furthermore, the data is used by the company’s investors, suppliers, and other concerned third parties to make critical choices.

2) Sales Forecasting:

Sales forecasting is anticipating how many products/services you intend to sell during a certain fiscal period. There are two methods for forecasting sales: top-down forecasting and bottom-up forecasting.

Sales forecasting provides a wide range of applications and benefits, including budgeting and planning production cycles. It also assists businesses in more efficiently managing and allocating resources.

3) Budget Forecasting:

A budget establishes specific expectations about your company’s performance as a financial roadmap for the future of your organization. Budget forecasting seeks to determine the budget’s ideal outcome, assuming that everything goes as planned. It is based on budget data, which is based on financial forecasting data.

4) Cash flow Forecasting:

Cash flow forecasting entails projecting the movement of cash in and out of the company over a certain fiscal period. It is dependent on things such as income and spending. It has several applications and benefits, including determining immediate cash requirements and budgeting. However, it is worth mentioning that cash flow financial forecasting is more accurate in the short run.

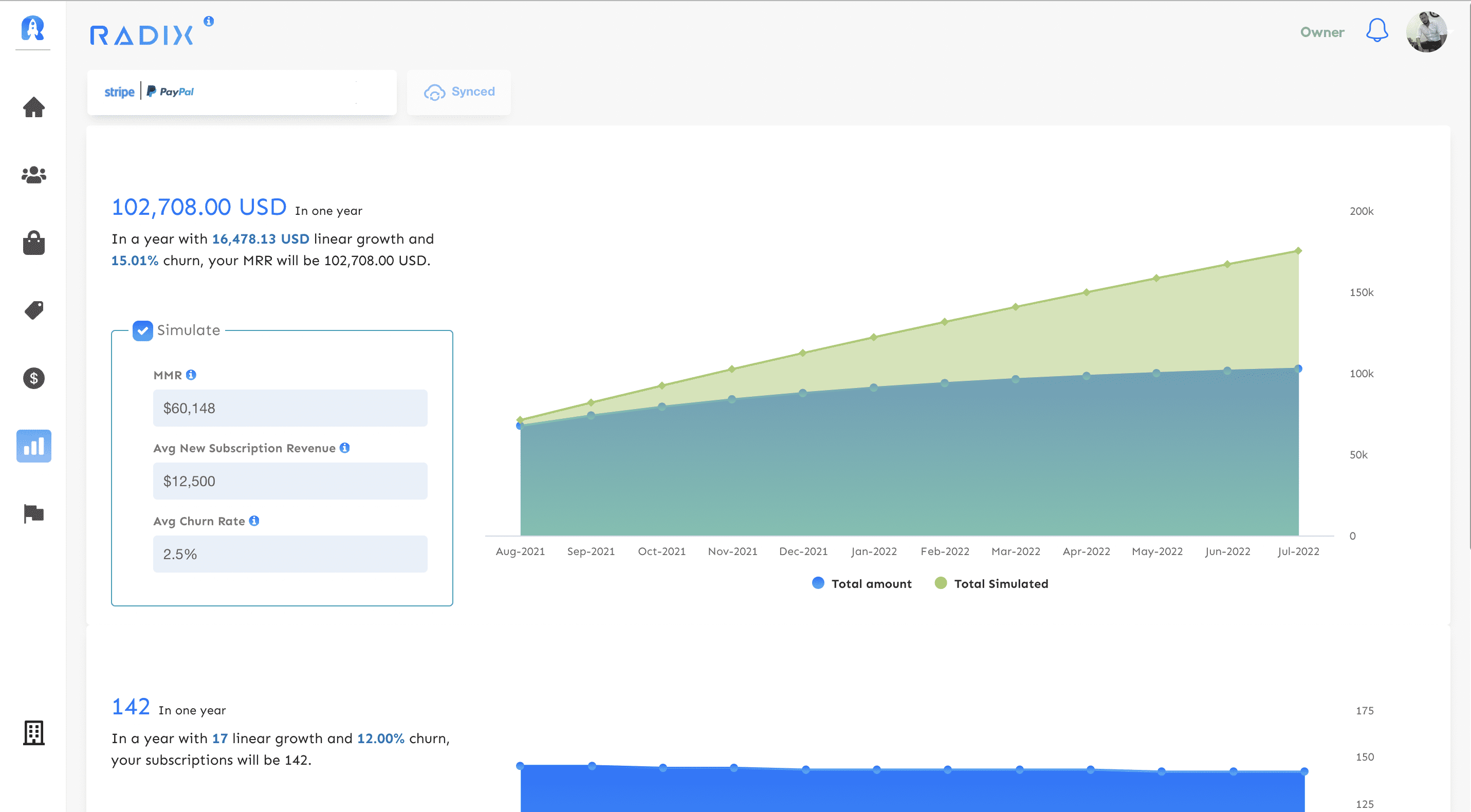

Forecast your Revenue with Radix:

Sign Up Here!

Read More:

How to Forecast MRR: A Super Quick Guide

Forecast & Simulate with Radix For Free (MRR/ARR, Churn, and more)