CAC is a metric that company use to determine the amount of money it costs to acquire a customer using paid advertising.

This is an essential metric in determining whether your company will be profitable in the future and should be considered when determining how much to spend on paid advertising campaigns, as well as other marketing tactics.

Customer Acquisition Cost (CAC) is simply the average amount of money your company spends to acquire a new customer.

What is the Importance of CAC?

CAC is one of the key metrics startups use to assess how effective their marketing efforts are.

Understanding CAC is critical for determining how cash efficient your SaaS company is.

To develop a profitable business, the basic math is to make sure you generate more money from clients throughout their lifetime than you spent acquiring them.

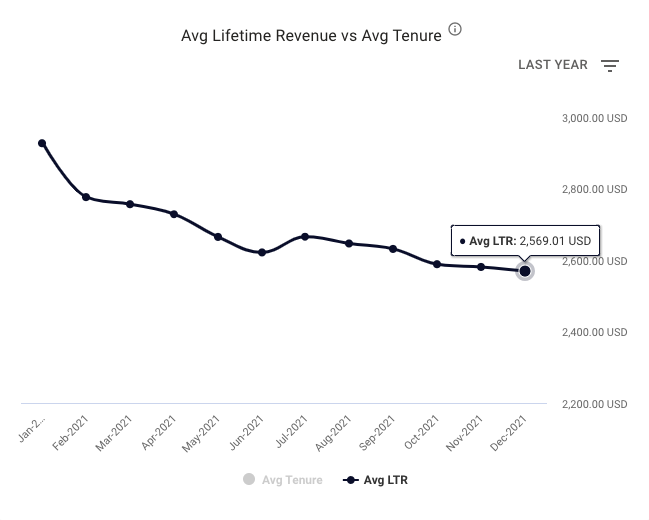

The average number of years (months/weeks) that customers utilize your product is Lifetime Value.

CAC is an important indicator that frequently affects a company’s marketing budget. A comprehensive image of your this metric provides you with a better perspective, allowing you to better balance your spending and move closer to profitability.

What Is The Most Appropriate Time Period For Calculating CAC?

It takes a significant length of time after the initial discovery for someone to identify your product and return to make a purchase.

It is best to evaluate it over a period of time, say 3 months.

If you calculate it for a single month, it may not be the best indicator of what occurred that month. If you spent $10,000 in January but only made $5,000, it’s not necessarily from this month. And the money you spend today might help you get consumers the following month.

Remember that each customer’s path to discovering your product will be different. Here’s an example of a typical discovery procedure:

- Prospect reads your blog.

- Visits your website.

- Analyzes your product.

- Returns later to make a purchase.

There Are 2 Ways to Look at It

The standard approach to Customer Acquisition Cost is to divide it into two categories: blended & paid.

- Blended CAC: occurs when you account for all sorts of marketing channels, even those that you do not directly pay for, such as content marketing. It is the overall cost of acquisition for a period/customers gained during that time.

- Paid CAC: refers to the total acquisition cost/customers obtained through paid channels.

While blended CAC provides a holistic picture of your company, Paid CAC can assist you to identify which channels require attention and whether your paid channels are successful.

It is critical to break down your acquisition costs and separate what is important. There may have been buried expenses that did not result in any revenue. Simply take up the costs that are directly related to your revenues.

Radix Will Help You…

You can connect your Stripe and PayPal accounts to calculate your Customers’ Lifetime Revenue to determine whether your CAC is positive or negative.

Sign Up Here!

Read More:

MRR: What is Monthly Recurring Revenue?

ARR: What is Annual Recurring Revenue?

Churn Analysis in SaaS Business

Revenue Churn: Definition, How to Calculate, Ways to Track & Improve