The Collection Rate is one of the statistics that businesses pay close attention to because it directly affects the sales and profits of a company.

Collection Rate, sometimes referred to as A/R or accounts receivable, is the number that tells how often your customers make payments for what they have purchased from you. One of the best things you can do for your business is improving collection rates by consistently communicating with customers who are behind on their payments and doing what you can to get them paid.

If you run a SaaS company, the collection rate is one of the biggest issues, especially because most customers have problems with their payment methods. If your customers do not have some reminder to pay for their service each month, it is most likely that they will forget about it, and not pay you at all.

HERE ARE 5 METHODS TO IMPROVE YOUR COLLECTION RATE BY INCREASING EFFICIENCY – ALL WHILE PUTTING CUSTOMER EXPERIENCE AT THE CENTER OF YOUR STRATEGY:

-

Use a Data Science Platform to Improve Collection Rate

Data is essential for an efficient, customer-focused debt collection operation. The more information you have about each client, the more you can use automation to increase productivity and personalize your approach (improving CX).

How do you go about doing this?

By establishing a centralized customer information center. This enables all employees to examine accounts in the same database. It reminds collectors to review accounts and sends warnings when issues develop. When correctly configured and maintained, the system has all of the information on every receivable available – easily readable and searchable by the management. This reduces both expenditures and the amount of time spent on accounts.

Feel free to use Radix

-

Offer Flexible Payment Options

A great technique is to offer flexible payment options, such as allowing clients to pay on a day that is most convenient for them. As a result, customers may be able to avoid debt in the first place. With a centralized data hub in place, it’s simple to keep track of these different preferences and incorporate them into your data collection process.

-

Determine the most effective communication methods — and then automate them

Communicating with your client is the first step in efficient debt collection. Furthermore, like with any consumer communication, it is critical to personalize, selecting the channel that works best for each individual. Because customers with long-term debt are frequently leery of unknown numbers, SMS or email may be preferable to phone calls for many people.

After determining the optimal channels (not all clients will have the same preferences), the next step is to automate as much of the process as possible. Automating payment reminders, for example, improves collection efficiency, allowing personnel to focus on more difficult responsibilities. Furthermore, by using automation throughout the payment communication cycle, you can boost the probability of consumers paying on time.

-

Adopt a Multi-Channel Payment Strategy to Boost Convertion Rate

People can pay more easily using a multi-channel strategy. Customers should be able to pay directly from their phone via an online portal or app if you SMS or email them a payment reminder. They are less likely to follow through if they have to log on to another device or call your call center.

Customize the channel offering for each person depending on what you know about their preferences. Some people prefer digital self-service alternatives, while others prefer to mail or speak with an adviser to set up a payment plan.

-

Make payment options simple

Making every payment option available to your customers might sound good on paper, but how easy is it to manage? As a business owner, you have to make sure that your customers can pay using the service they want. So you integrate Stripe and PayPal (Read more of our partnership with PayPal Here) into your app, which means you now have an infinite amount of options for payments. The problem with this approach is that the result can look poorly organized and create confusion among customers. If we take a simple example of an e-commerce website, it is possible to offer a wide variety of payment options at the checkout.

Create An Integrated Debt Collection Strategy

Finally, by developing a debt collection strategy that considers consumers and their payment cycles holistically, you can enhance debt collection rates while providing a frictionless and personalized CX.

TRACK COLLECTION RATE IN REAL-TIME WITH RADIX

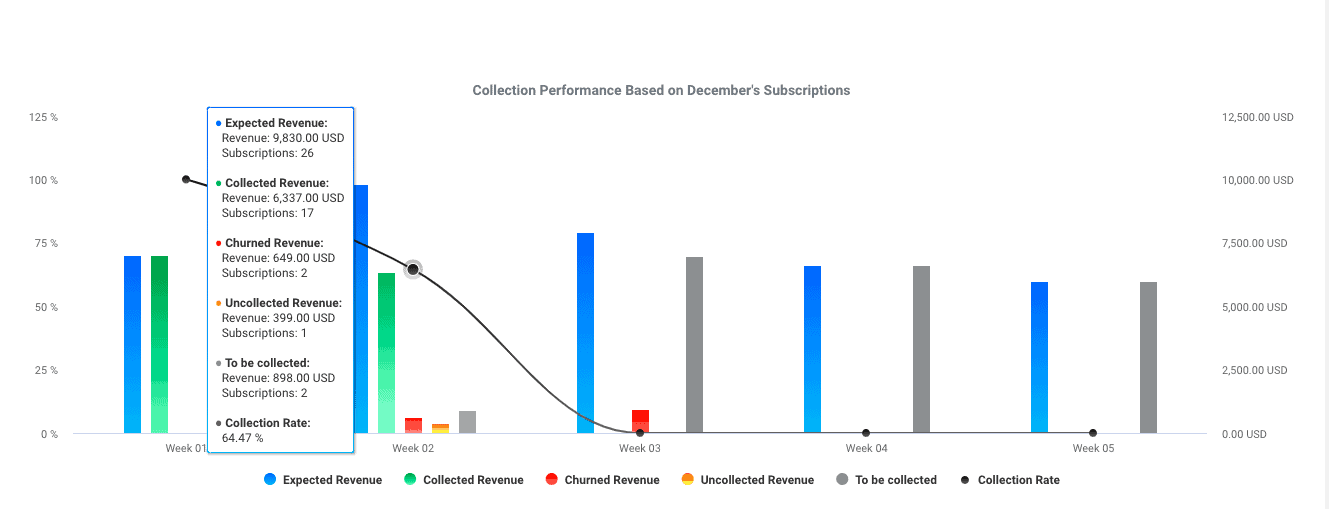

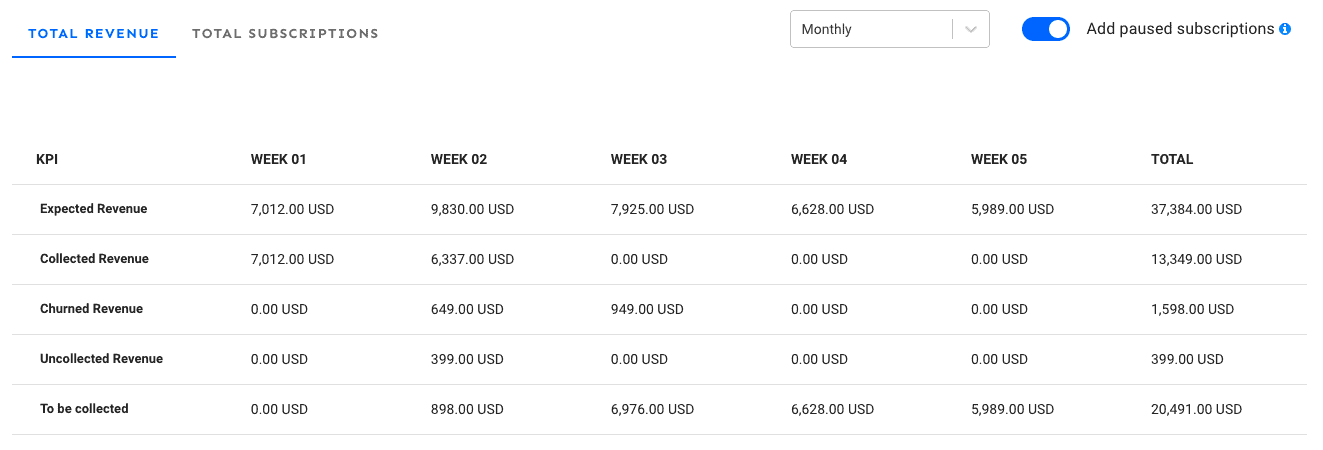

With Radix you will have at your disposal dashboards that will allow you to see in real-time the performance of your Collection Rate. Also, you can forecast how much revenue you will have the following month, the number of churned revenue, uncollected revenue, and which are those customers that need to be contacted and collected.

Above in the image we have a breakdown by:

1) Expected Revenue

2) Collected Revenue

3) Churned Revenue

4) Uncollected Revenue

5) To be Collected

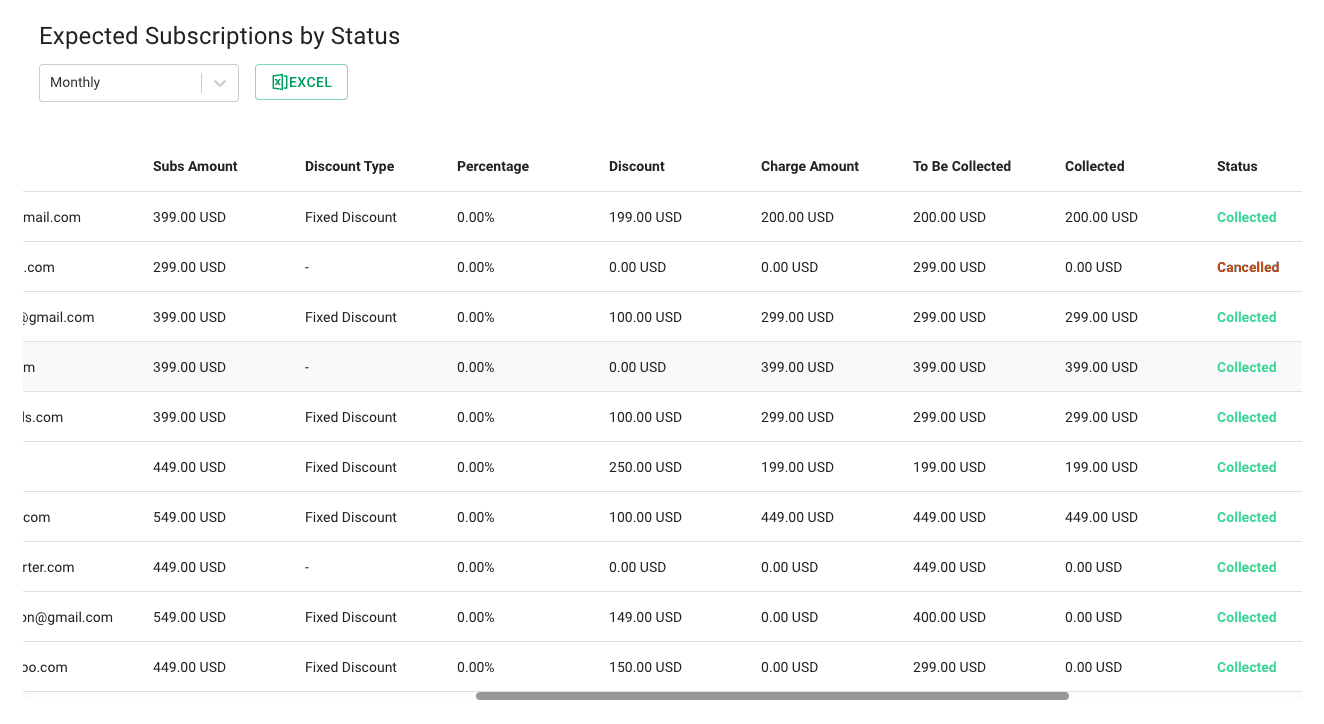

…and we can also go much more specific with each of our customers:

Improve your SaaS or eCommerce Collection Rate with Radix. Start Your Free Trial Here

Read More:

15 Ways to Reduce Churn: Radix Edition

Best Practices to Improve SaaS Onboarding

How to Grow a Cool SaaS Business