Understanding your monthly recurring revenue (MRR) can be difficult for many businesses. Most people either try to grasp the concept of MRR without a true understanding, or don’t try to grasp the concept at all because it seems complex. I’ve broken down the main points in an attempt to clarify Stripe MRR and how it works.

Every day, your monthly recurring revenue (MRR) fluctuates. It’s because of all the underlying dynamics of customers joining, upgrading, canceling, or downgrading.

Understanding and staying on top of all of these MRR fluctuations may be difficult at times. To simplify things, consider your MRR movements to have simply two components:

MRR Added – This is the revenue that your company added within a specific time period.

MRR Lost – This is the revenue that your company lost.

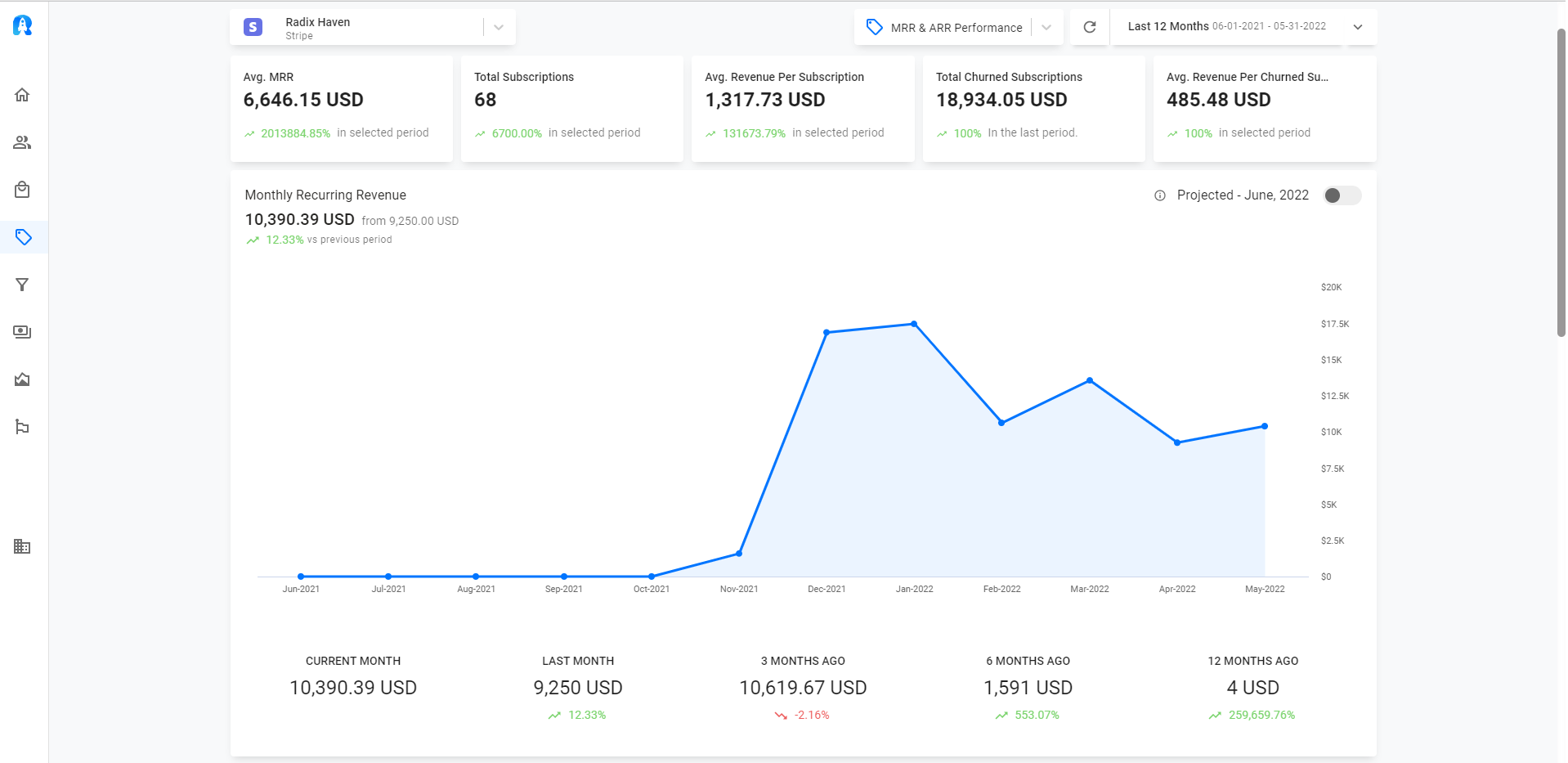

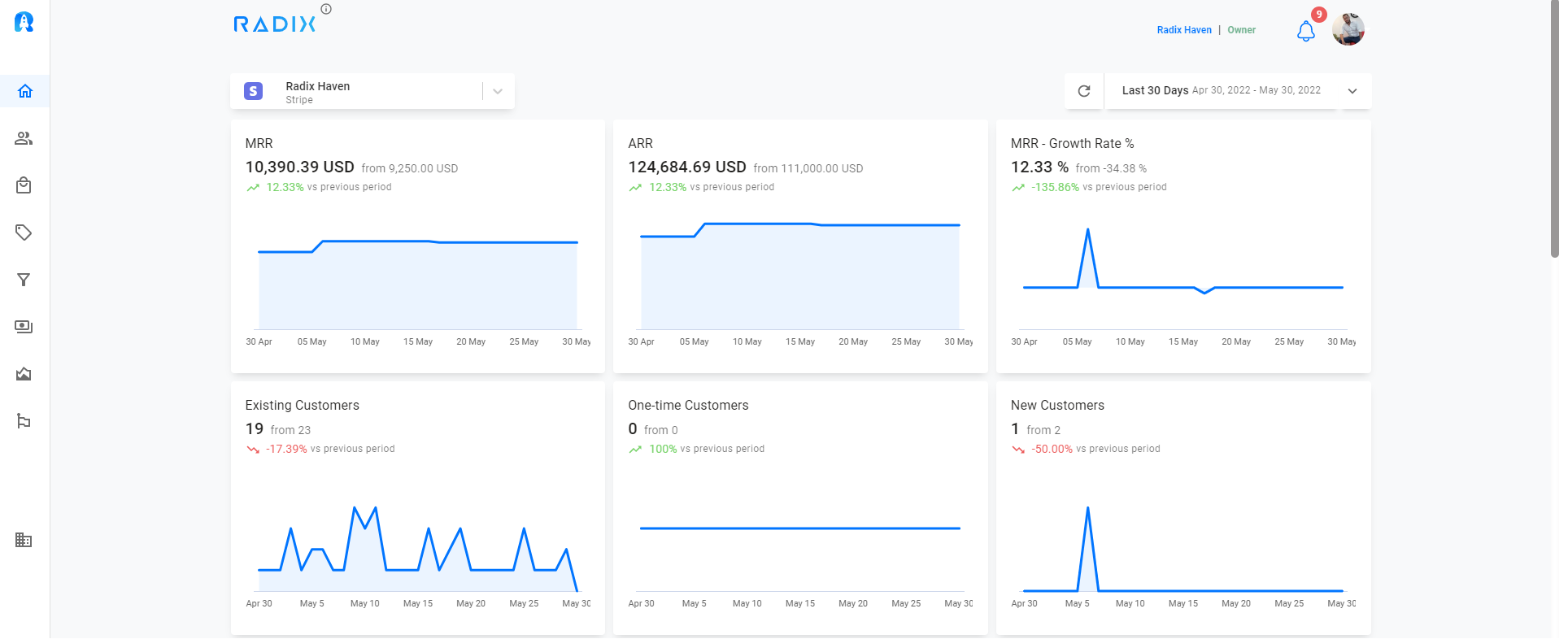

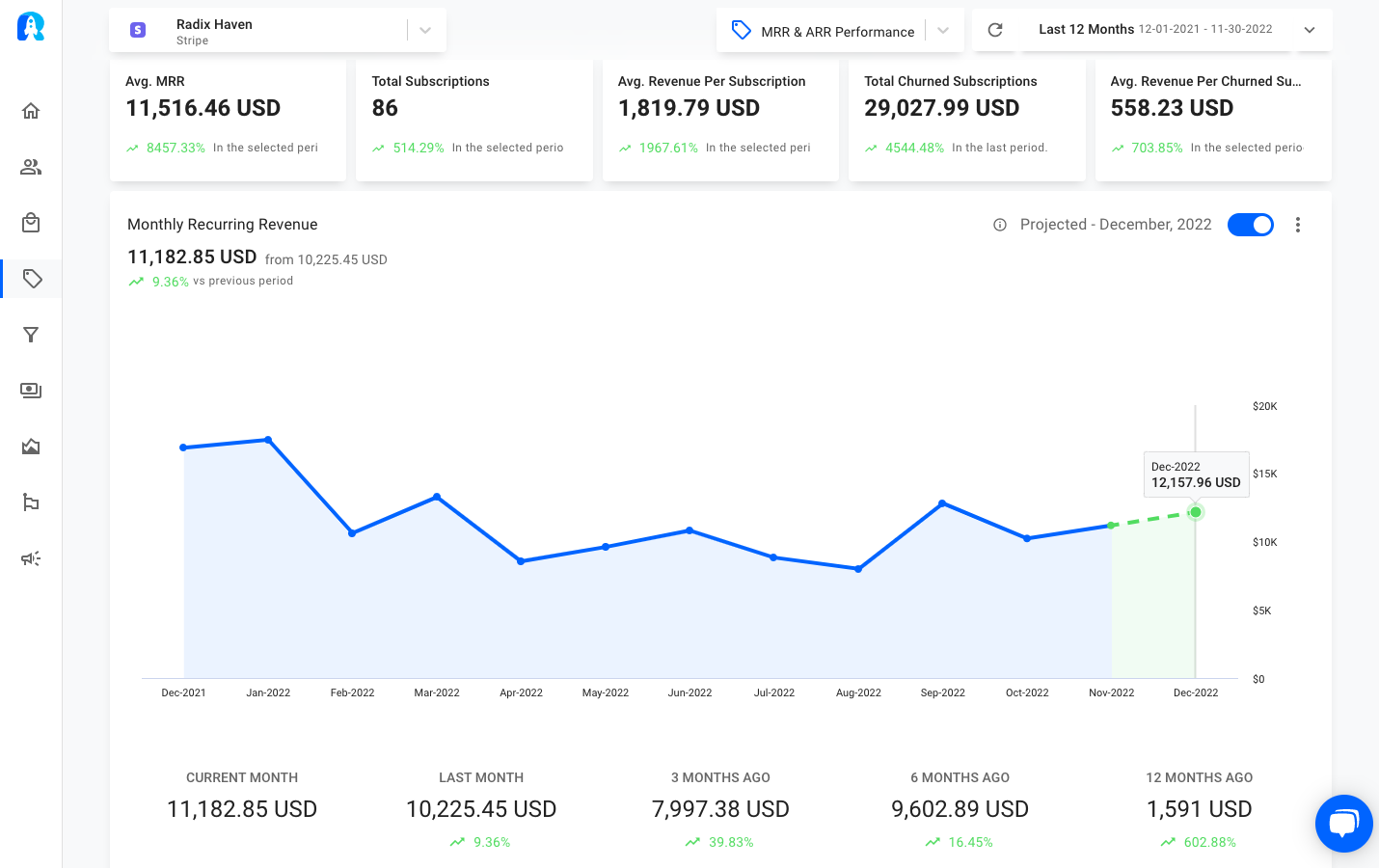

Below is a screenshot of the Stripe MRR chart in Radix. Here you are able to track how your revenue is performing In real-time.

Remember that If you want to grow your company, you must add more MRR than you lose!

Understanding the Movements of Stripe MRR

Let’s go further into how your SaaS company gains or loses MRR. And how those modifications are classified as MRR movements in SaaS.

You may increase your MRR by doing the following:

- Attracting new customers is referred to as a New Business MRR in the SaaS language.

- Expansion MRR occurs when current customers pay more.

- Recovering former customers — Reactivation MRR

You can also lose MRR if:

- Customers cancel — Churn MRR

- Existing customers begin to pay less – Contraction MRR

You can forecast your Stripe MRR with Radix

Recurring revenue is the total income from recurrent payments. For effective budgeting and company planning, recurring income forecasting is critical.

To clarify, you can calculate and forecats Recurrent Revenue in two ways. For automated calculations, companies may employ forecasting recurring revenue software or manually compute revenue using spreadsheets.

For both methods, companies need to input key metrics about their subscriber base and subscription prices. The metrics include:

- Number of subscribers at the beginning of the period (month, year)

- Number of new subscribers

- Average revenue per user (ARPU)

- Churned recurring revenue(canceled subscriptions)

- Revenue gained through upgraded subscriptions

- Revenue lost to downgraded subscriptions

Let’s look at how to use these metrics to calculate monthly recurring revenue (MMR) and annual recurring revenue (ARR).

The fundamental formula for calculating MMR is straightforward:

Number of Monthly Subscribers x Monthly Subscription Price per User

Example: 50 monthly subscribers x $10 per user = $500

If your company has more than one subscription tier, calculate the MRR for each one and then sum them all up:

(Number of Tier 1 Monthly Subscribers x Tier 1 Price per User) + (Number of Monthly Tier 2 Subscribers x Tier 2 Price per User)

For Instance: (100 monthly Tier 1 subscribers x $10 per user) + (50 monthly Tier 2 subscribers x $20 per user) = $2000

Add the churned MRR, monthly upgrades, and monthly downgrades to the formula for an exact MRR calculation:

(Number of Monthly Subscribers x ARPU) – Churned Revenue – Downgrades + Upgrades

For Example: (100 subscribers x $20 per user) – $50 in churned revenue – $30 in downgrades + $100 in upgrades = $2,020

Radix has a forecast function that enables easy recurring revenue forecasting. You only need to link your Stripe account and magic will happen.

Forget about tedious spreadsheets and create your free account here!

How to Optimize Stripe MRR Metric?

- Increase your subscription price by adding more value to your product/service. Do not charge more without properly researching your customers’ opinion.

- Upgrade current subscriptions by restructuring your product/service features in different pricing plans.

- Win Back churned customers by sending special offers with full access to your product/service at a lower price. Make sure you solve the problem efficiently so you don’t experience a second churn from those customers.

Conclusion

In conclusion, Monthly Recurring Revenue (MRR) is the foundation of any customer-based company. Knowing what you have coming in each month means you can plan for growth and know how to support that growth once it happens.

Understanding how a company grows month after month requires forecasting monthly recurring revenue. The ability to quickly adjust sales, marketing, and customer service activities depending on subscriber behavior is enabled by meticulous monthly revenue tracking.

Use Radix to track, forecast & grow your Stripe MRR to make better financial and budgeting decisions based on your revenue data.

You will be able to:

- Predict your future MRR and Active Subscriptions for the next 3, 6, and 9 months.

- Identify seasonal patterns based on your forecasts.

- Implement real-time action plans in an attempt to be proactive rather than reactive.

Sign Up Here!