There is no more important metric for a SaaS business to monitor than churn: the rate at which customers leave your service and take their subscription dollars away. Churn may be fueled by a variety of factors, and even minor month-to-month changes in churn % can be terrible to planning, so understanding what churn is and how to measure it is critical. Here we are going to explain a little more about stripe churn analysis.

Customer churn is one of the biggest challenges most SaaS businesses face. The SaaS market is extremely lucrative, but it is not easy to reach profitability. This is why stripe churn analysis includes a lot of questions that every company needs to ask itself in order to clarify its strategy and approaches towards retention, customer service and new customer acquisition.

Stripe Churn Analysis: What is it?

Churn Analysis is the measurement of customers who terminate their Saas (Software-as-a-Service) solutions. The process helps business owners understand their existing and prospective customer base in order to gain valuable insights for improvement or adoption of new services. Despite the temptation to look away from those churning customers, churn analysis is something you must absolutely do. It’s a major part of understanding your business model and making adjustments when needed.

Why Churn Analysis is Important?

The importance of Stripe churn analysis on SaaS is to determine at what stage customers are going to churn and why? Churn probability and customer lifetime value play important role in SaaS business, and when these two variables are considered by a company, the overall profit from subscriptions increases tremendously.

In SaaS business, if you have churned customers, you can lose a lot of money. It is because it is really expensive to acquire new customers. So it is really important to reduce the churn rate.

Reasons Why Customer Churn Occur

Customer churn comes in many forms: customers who complain about service and who might or might not leave, customers who leave you for competitors, and customers who simply stop buying from you. It’s the one thing that can destroy your business if you’re not paying attention.

The moment you know customer churn has happened is when it’s too late. Identifying the signs and understanding the contributing factors are crucial to retention and at the same time choosing the most appropriate retention initiatives is essential.

That is why understanding Stripe churn analysis is critical. Understanding the many causes of customer churn is a critical first step in addressing and lowering your rate.

-

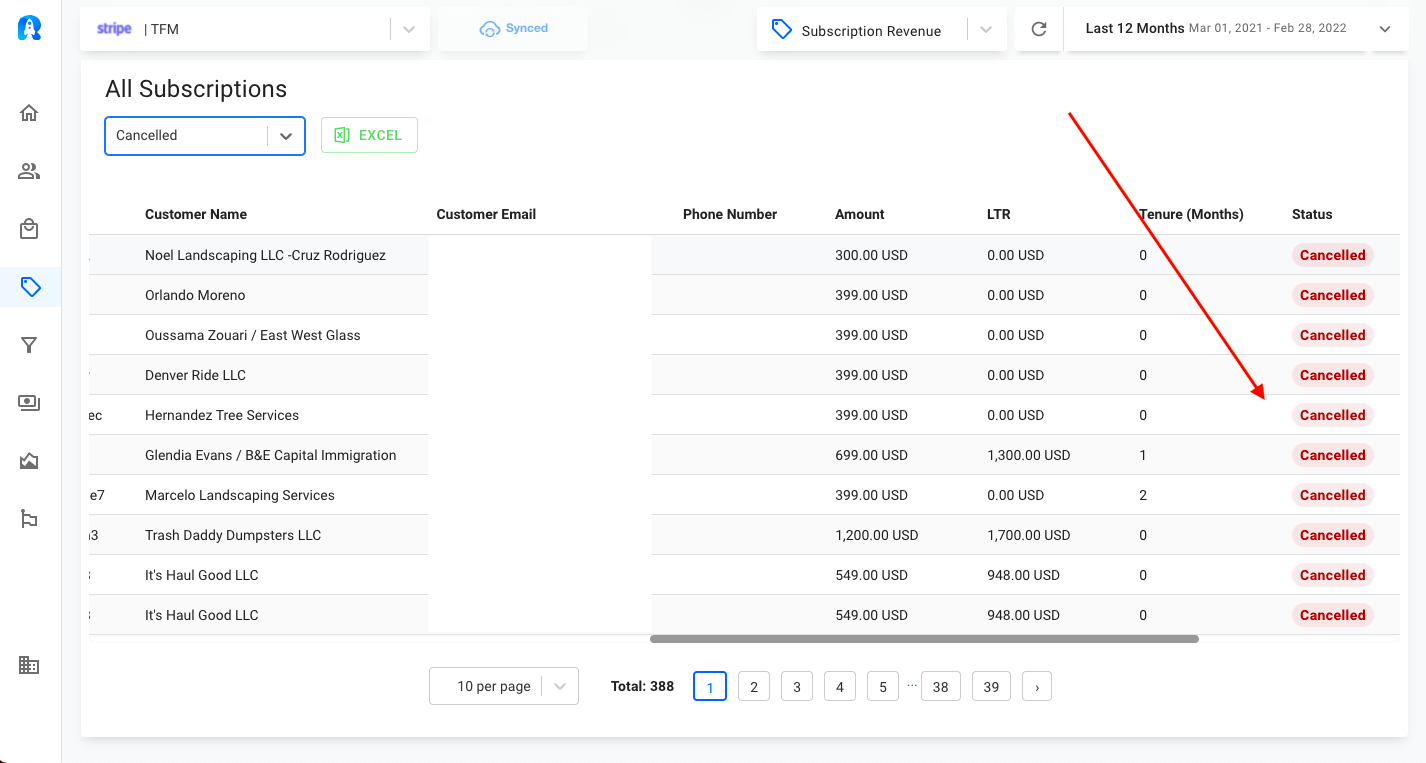

Canceled Subscriptions

Canceled subscriptions are generally the first type of churn that comes to mind, and they might be prompted by a variety of factors.

Poor Customer Fit

Selling your product to the incorrect kind of customer might result in them churning soon after signing up, therefore invalidating the cost of the resources spent to acquire them.

Lacking Functionalities

Customers may request additional features for your product as their needs change.

Poor Onboarding

Customers that do not obtain what they need from your product will almost surely churn. If the client could have obtained what they wanted from your offering but didn’t, this type of churn reflects a particularly awful loss of opportunity. Poor onboarding or a poorly designed setup procedure is often to cause.

-

Change to a Competitor

Your company is especially vulnerable to this type of churn if it is not adequately tuned in to your customers’ changing expectations and support requirements. More dynamic competitors will be more likely to win business from your customer base.

-

Account Closure

Even if your customer is leaving your business happy with the service you’ve provided and their requirements met, it’s still churn.

You may have done a good job, but a customer lost in this manner is still a missed opportunity and a cost that must be addressed. You’ll lose the MRR you get from them, and you’ll have to pay to replace them. Furthermore, a consumer departing after getting what they want signals that, while you’re doing a good job of providing your essential service, your product doesn’t offer a lot of repeat-use value.

You may reduce churn by growing your product line or enhancing the repeat-use value of your solutions.

-

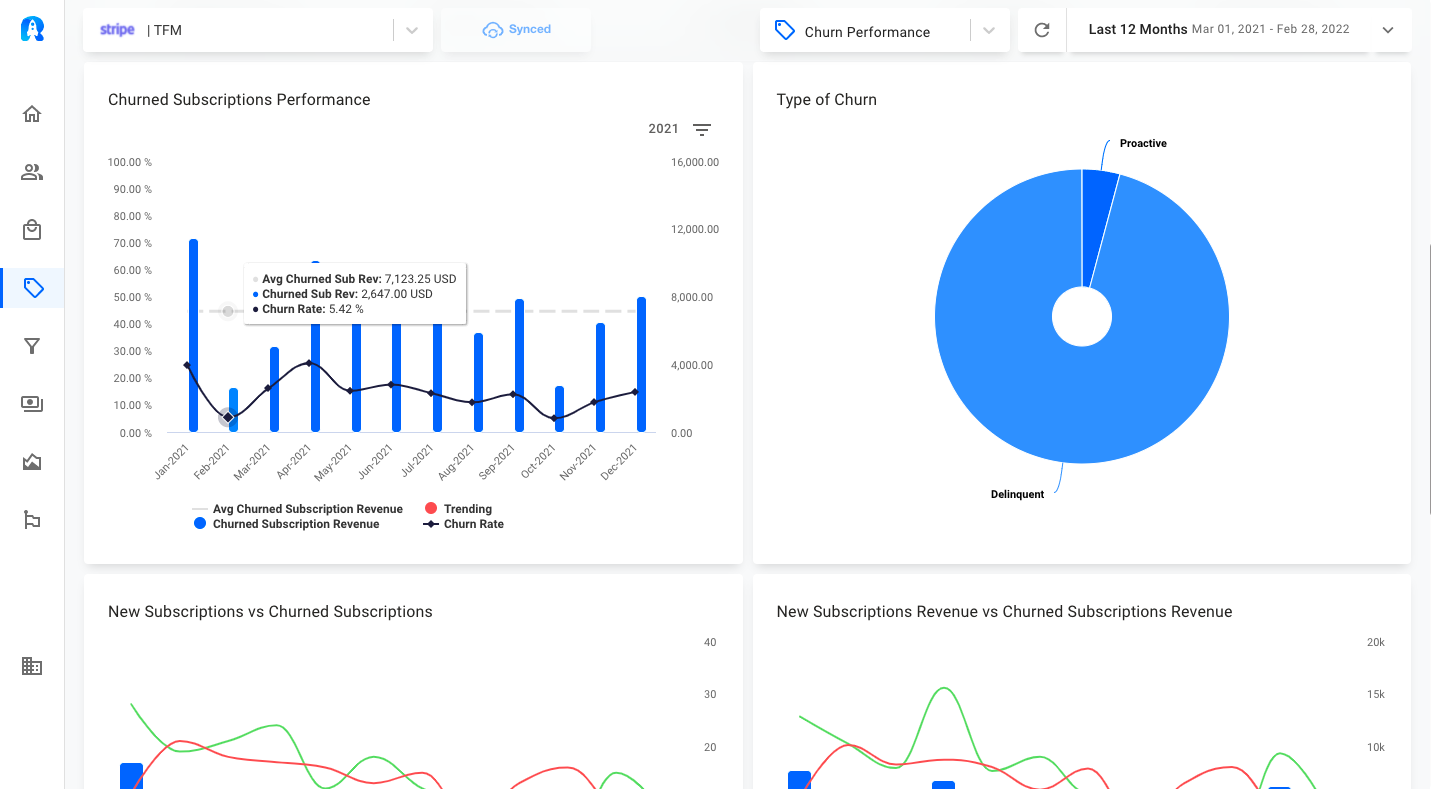

Delinquent Churn

Customers whose credit cards were canceled because they were maxed out, canceled because they were no longer valid (probably because they were stolen), or frozen when used overseas.

Why you need to Track and Analyze Churn

Churn is a tremendously relevant metric in the SaaS industry. It is the criteria by which all companies, new and old, live or die. Permitting your churn rate to rising might lead to several other complications.

- Churn Results In A Higher CAC And Lower Revenue

Churn results in a higher CAC and lower revenue. That’s right, churn is more expensive than acquiring a new customer.

- Churn may be reduced by analyzing it

Although you may try to outrun churn by focusing on acquiring new customers, you can only actively minimize churn by focusing on the areas where you are losing customers.

Use Radix to do this!

Stripe Churn Analysis with Radix

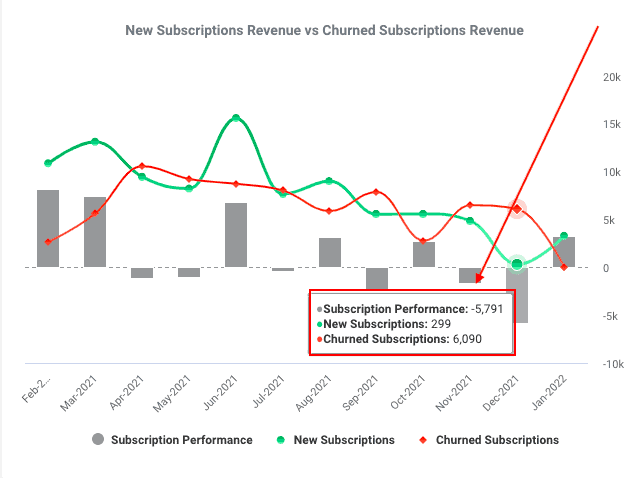

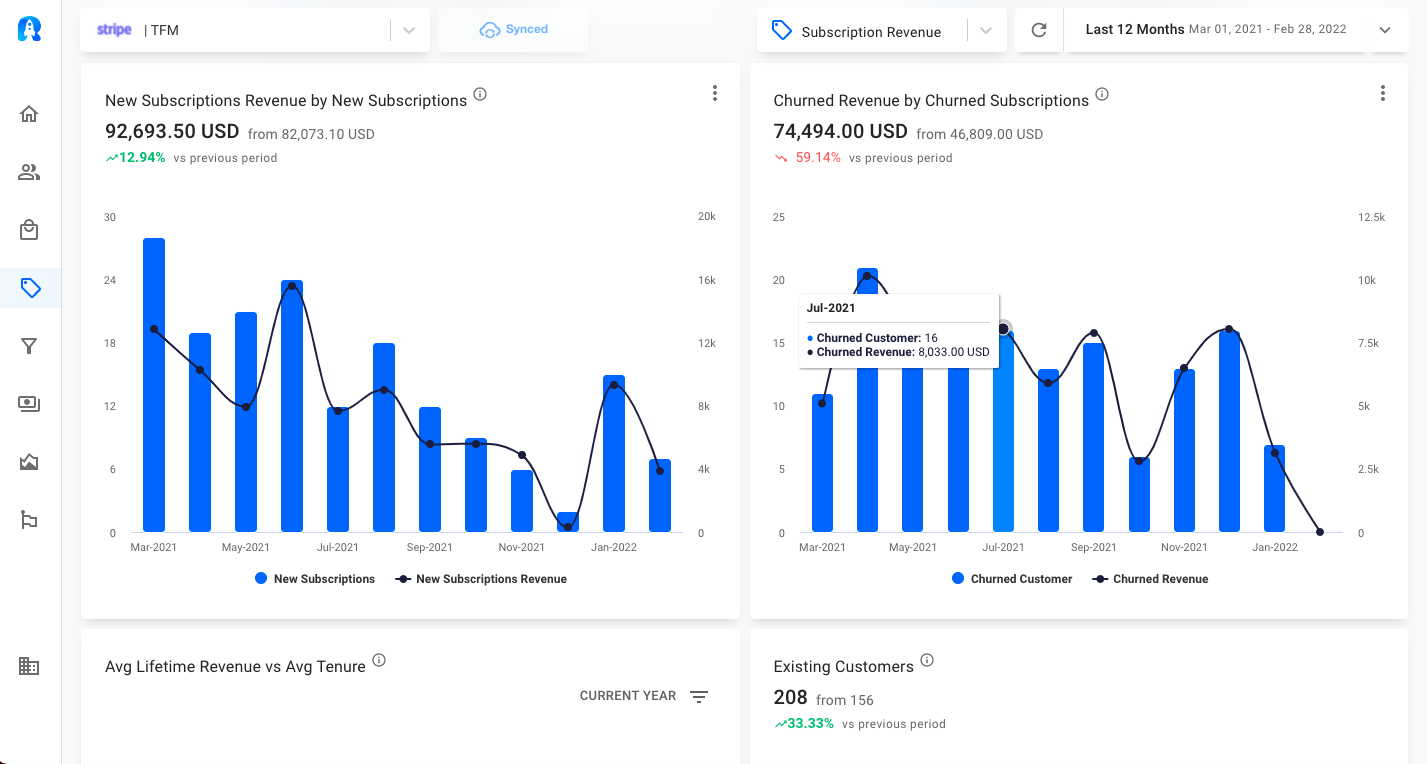

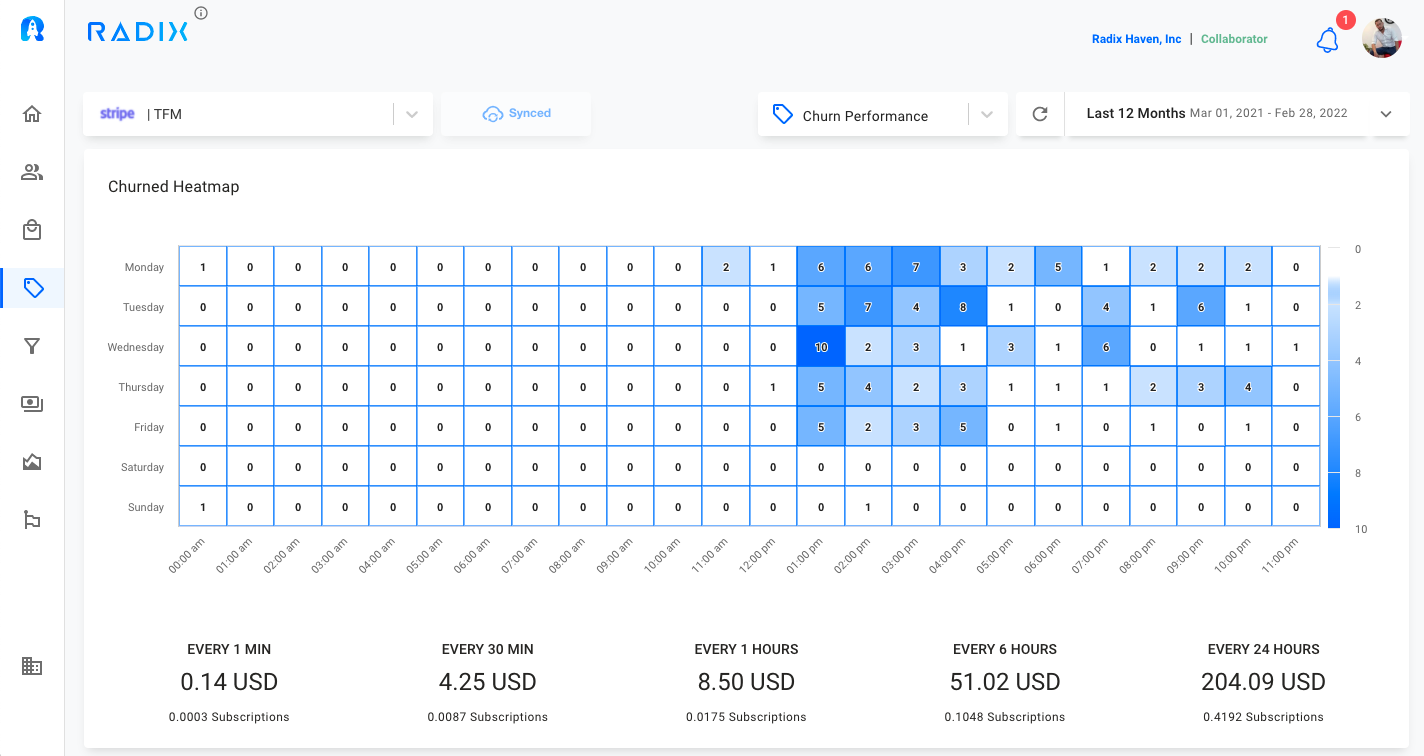

Radix is a new way to understand churn data. Radix breaks down churn data into different dimensions, allowing you to segment and visualize your customers with clarity you never had before.

With our platform you will be able to:

- Analyze Customer behavioral patterns

It’s unusual that your business will just serve one kind of customer. Diverse customers have different needs, which translate into different behavioral patterns. Here is when churned heat map analysis comes into play. Radix tracks client cohorts over time as follows:

- Segment Customers

Have you ever wished that you could identify and categorize your customers easily? You know, put them in clear boxes so that you can understand them on a deeper level. If yes, then it’s time to look at the power of Radix.

- Predict your business churn

A good solution will be able to forecast the most likely causes of churn and alert any customers who are at danger.

You are the CEO of your company. It’s up to you to keep track of your business’s health. But there are a lot of big numbers flying around, and it can be hard to make sense of them. Understanding things like Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), and Average Revenue per User (ARPU) will help you put everything in perspective and make smart financial decisions. Choosing a solution like Radix is the best decision you will ever make.

Sign Up Here !

Read More:

Churn Prevention: How to Identify & Prevent Churn with Radix

15 Ways to Reduce Churn: Radix Edition

Types of Churn: Delinquent vs Proactive

Revenue Churn: Definition, How to Calculate, Ways to Track & Improve