Before you can ask a venture capital firm to invest in your startup, you must convince them why they should. This involves preparing metrics they can use to compare you with other startups and use as a basis for their decision-making process. In this article, we will be discussing how to prepare your startup metrics to raise capital.

The process of raising a startup often is not easy. While some entrepreneurs might raise capital by throwing a few numbers on the table and smiling, most cannot. Instead, they will have to put in a considerable amount of sweat, tears, and hard work to convince investors that they are worthy of their money.

Here are some tips to have more chances of getting investment in your startup:

Back-Up Everything With Data (full startup metrics)

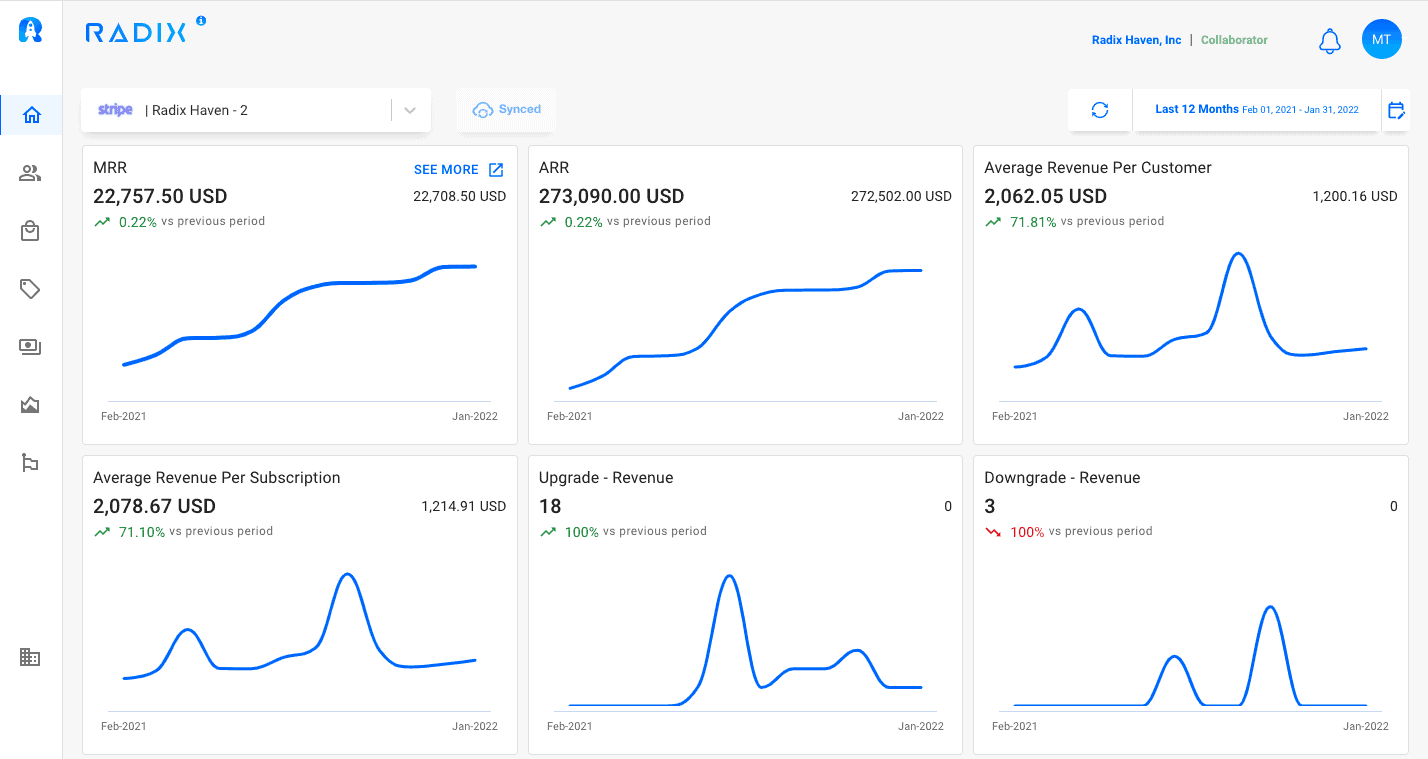

Data should be centered on the two areas of interest to investors: financial and growth metrics. You should be able to list the essential KPIs that serve as the foundation of your company:

- MRR

- ARR

- Growth Rates

- Gross Churn

- Net Churn

- Renewal Rates

- Collection Rates

- CAC

- Life Time Value

- Etc

You will have to offer facts behind each of these start up metrics when speaking with an investor. You should be prepared to discuss the key drivers and explain why the numbers are as they are.

Not only should you comprehend your data, but so should your audience. Make your pitch as clear as possible. Indicate how much money you are needing and why. Share your plans for your next milestone, market, or product.

Note: All These Metrics Can Be Analyzed in Real-Time On Our Data Analytic Platform

Validate Your Story With Your Growth Metrics

Startups must rigorously track and analyze the collected data. With the proper education, you will have confidence when pitching to investors that your product is constantly improving and your company has a solid foundation for growth.

Remember, as a startup, you will always be learning. Have a plan in place for measuring every aspect of your business and adjust based on what you learn. This can be difficult with limited resources, but it is necessary to validate your story with numbers. Believe in your team and product and show potential investors that faith through clean analyses of data.

These are the startup metrics that investors care about:

- Product/Market Fit: Total ARR, New ARR, numbers of customers, Cash Burn, etc.

- Repeatable Sales Process: CAC, LTV, Cash Forecasting, Churn Rates, Retention Rates, Collection Rates.

- Expanding The Business: Churn, Customer Renewal Rates, etc.

Investors want to see your financials:

- Trended Revenue by Customer. Trended Monthly Financials.

- Growth Metrics

- Accounting

- Forecasting

Implement Accounting Best Practices

The type of accounting you use for your SaaS company depends on your specific business model. However, from a technical standpoint, all accounting systems are just a way to record and report your company’s transactions. The best accounting practices will match the needs of your business and the goals you set out to achieve through financial reporting.

Investors are mostly interested in regular, consistent revenue. Accounting’s purpose is to free up your finance team’s time so that they can spend more time developing research and insights from revenue statistics, which can be presented to investors.

Raise Capital by Using Data Benchmarking to Determine Valuation

If you are planning to raise capital for your startup, you should benchmark and use data that validates your startup’s future potential. Data will help you determine the valuation of your startup. If a venture capitalist is betting $10M on your product, it can be difficult to get them to take a different point of view. Benchmarking data allows you to present different scenarios and build a model around the risk involved in each one. It is not about being pessimistic or optimistic. It is about being informed and strategic in the best way possible.

Before you go to fundraise, you should have a great understanding of what you are worth. Startup metrics will be your weapon

Create Your Free Radix Account If You Need Accurate Metrics To Enhance Your Startup Pitch Deck!

Sign Up here !

Read More:

SaaS Metrics: What Are The Top 5 VCs Look At For Series A/B/C?

Analyze Your Unit Economics With Radix

Improve MRR Performance:10 Tips for Improving Your MRR for Better Business Growth